Mexico's Sheinbaum Weighs Legal Action After Musk Alleges Cartel Ties

Authored by Tom Ozimek via The Epoch Times,

Mexican President Claudia Sheinbaum said she is considering legal action after tech billionaire Elon Musk alleged on social media that she was taking orders from drug cartels.

Speaking at a Feb. 24 news conference in Mexico City, Sheinbaum said government lawyers were reviewing the matter.

“We’re considering whether to take some legal action,” she said.

“The lawyers are looking into it, but what matters to me is what the people say, honestly.”

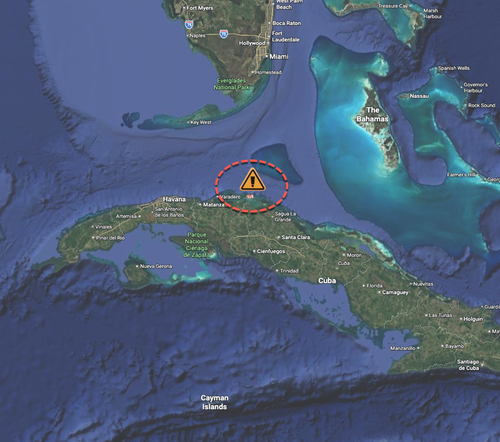

Musk’s allegation of Sheinbaum’s cartel subservience followed the capture and killing of Jalisco New Generation Cartel (JNGC) leader Nemesio Oseguera, known as “El Mencho,” by Mexican security forces.

In his post on X, Musk responded to a 2025 video of Sheinbaum discussing cartel violence and saying that returning to a war against the cartels is “not an option” because it would mean extrajudicial killings that are “outside the framework of the law.” She added that military force against the cartels would also be counterproductive because it would trigger retaliatory violence that would only “increase homicides in Mexico.”

Responding to those remarks, Musk alleged that she was “saying what her cartel bosses tell her to say.”

“Let’s just say that their punishment for disobedience is a little worse than a ‘performance improvement plan,’” Musk wrote.

He did not provide evidence to support his claims.

Sheinbaum could face difficulty suing Musk for defamation in the United States because of strong legal protections for free speech. To prevail, she would need to show that Musk knowingly made a false statement or acted with reckless disregard for the truth.

Tesla, Musk’s auto company, did not immediately respond to a request for comment.

Violence After El Mencho’s Killing

Musk’s comments came amid heightened tensions in Mexico following Oseguera’s death.

An uneasy calm appeared to be returning to parts of the country on Wednesday after the killing of the cartel leader triggered widespread reprisals. The violence paralyzed highways, grounded flights, and forced residents and tourists to shelter in place, particularly in Jalisco state.

Aerial view of burned vehicles over the La Desembocada bridge in Puerto Vallarta, Jalisco State, Mexico, on Feb. 24, 2026. Alfredo Estrella/AFP via Getty Images

Sheinbaum said at the Feb. 24 briefing that authorities were working to restore order after Sunday’s military operation in Tapalpa, Jalisco, left Oseguera dead following a shootout.

“Today there was no school, but tomorrow activities are expected to return to normal,” she said.

“In the Guadalajara airport, practically all flights have already resumed, and in Puerto Vallarta, little by little, things are returning to normal.”

Sheinbaum added that there were still “some” burned vehicles on the side of the road on Tuesday that would be removed later in the day.

Mexican President Claudia Sheinbaum pays tribute during the celebration of Flag Day in Mexico City on Feb. 24, 2026. Yuri Cortez/AFP via Getty Images

Mexico’s Security Cabinet said in a Feb. 24 post on X that affected states were experiencing “a gradual reopening of economic and educational activities, with progressive normalization of mobility and strategic operations,” according to a translation.

More than 50 people were reported killed in the operation and its aftermath, including members of Mexico’s National Guard. The White House said the United States provided intelligence support for the raid.

The CJNG, one of Mexico’s most powerful criminal organizations and a major trafficker of fentanyl and methamphetamine into the United States, responded to Oseguera’s death with coordinated attacks, including vehicle burnings and armed confrontations with security forces.

Sheinbaum also sought to reassure international visitors ahead of the 2026 FIFA World Cup, saying there was no risk to fans traveling to Mexico and that “all the guarantees” for safety were in place.

Trump’s Escalating Pressure

Musk’s criticism mirrors that of U.S. President Donald Trump, who has sharply escalated rhetoric against Mexican cartels and criticized Sheinbaum’s approach.

“The cartels are running Mexico. It’s very sad to watch and see what’s happened to that country,” Trump told Fox News’ Sean Hannity in a Jan. 8 interview.

“They’re killing 250,000, 300,000 in our country every single year.

“We knocked out 97 percent of the drugs coming in by water, and we are going to start now hitting land with regard with the cartels.”

Trump also warned that Mexico needs to “get its act together.”

“You have to do something with Mexico,” Trump told reporters in January. “We’re going to have to do something. We’d love Mexico to do it; they’re capable of doing it, but unfortunately, the cartels are very strong in Mexico.”

He has described Sheinbaum as “afraid” of the cartels and has suggested the United States could conduct military strikes on Mexican soil. His administration has intensified anti-cartel measures, including designating certain Mexican syndicates as terrorist organizations.

“Much more remains to be done by Mexico’s government to target cartel leadership, along with their clandestine drug labs, precursor chemical supply chains, and illicit finances,” Trump said in a presidential determination published by the U.S. State Department in September 2025. “Over the next year, the United States will expect to see additional, aggressive efforts by Mexico to hold cartel leaders accountable and disrupt the illicit networks engaged in drug production and trafficking.”

Sheinbaum has repeatedly rejected the prospect of unilateral U.S. intervention, saying it would violate Mexican sovereignty.

“We categorically reject intervention in the internal affairs of other countries,” Sheinbaum said during a news conference in early January. “The history of Latin America is clear and compelling: Intervention has never brought democracy, never generated well-being, nor lasting stability.”

White House press secretary Karoline Leavitt speaks during a press briefing at the White House in Washington on Feb. 10, 2026. Madalina Kilroy/The Epoch Times

The White House confirmed that the United States provided intelligence support for the operation to capture El Mencho and applauded Mexico’s army for taking down a man who was one of the most wanted criminals in both countries.

“The United States provided intelligence support to the Mexican government in order to assist with an operation in Talpalpa, Jalisco, Mexico, in which Nemesio ‘El Mencho’ Oseguera Cervantes, an infamous drug lord and leader within the Jalisco New Generation Cartel, was eliminated,” White House press secretary Karoline Leavitt said in a Feb 22 post on X.

Sheinbaum told reporters on Feb. 24 that she expects security to continue to normalize in Mexico following coordinated roadblocks and arson attacks by cartel members after the operation against Oseguera.

Tyler Durden

Wed, 02/25/2026 - 20:05

Presidents Putin and Cyril Ramaphosa, via TASS.

Presidents Putin and Cyril Ramaphosa, via TASS.

Getty Images

Getty Images

Recent comments