Deporting Censorship: US Targets UK Government Ally Over Free Speech

Authored by Paul D. Thacker via RealClearInvestigations,

As ICE sweeps in Minneapolis have drawn wide attention, a little-noticed immigration case playing out in a New York federal court has significant implications for America’s relationship with Britain and the ongoing debate over global censorship.

In late December, the State Department announced its intention to revoke the visas of five foreign individuals who have allegedly censored Americans. The most consequential member of this group is Imran Ahmed, a British Labour Party political operative now living in the U.S., who is the CEO of an influential nonprofit, the Center for Countering Digital Hate.

In documents released Feb. 6 in federal court, the State Department claims Ahmed and the Center have been key players in efforts to censor Americans. A memo written by State Department Undersecretary Sarah Rogers asserts that “Ahmed was a key collaborator with the Biden administration on weaponizing the national security bureaucracy to censor U.S. citizens and pressure U.S. companies into censoring, and his group advocates for foreign regulatory action that extraterritorially impacts American citizens and companies.”

In a follow-up memo, Secretary Marco Rubio wrote that Ahmed had led efforts to censor Americans and harm U.S. media outlets, including ZeroHedge and The Federalist. “I have determined that Ahmed’s activities and presence in the United States have potentially serious adverse foreign policy consequences and comprise a compelling U.S. foreign policy interest.” Rubio asserted. While the Center casts itself as a disinterested nonprofit trying to stop online hate, Rubio noted that documents leaked from inside the group outline ambitious plans to “kill Musk’s Twitter” and “trigger EU and UK regulatory action.”

Ahmed has a small army of lawyers working to halt his deportation proceedings, which are now being litigated. Ahmed’s lead attorney is Roberta Kaplan - a former advisor to New York Gov. Andrew Cuomo - who sued President Trump on behalf of his niece, Mary Trump. Ahmed is also represented by Norm Eisen, a Democratic Party fundraiser and former advisor to Obama. Last Thursday, they filed an updated court complaint against the U.S. government to keep Ahmed in the United States.

International Implications

The effort to deport Ahmed has broader political implications because of the close ties he and his associates have to the highest reaches of the British government. Morgan McSweeney, who co-founded the Center with Ahmed, is widely seen as the architect of Prime Minister Keir Starmer’s Labour Party victory in 2024. McSweeney served as Starmer’s chief of staff until earlier this month, when he resigned because of a separate scandal connected to Jeffrey Epstein.

Imran Ahmed

Imran Ahmed

U.K. government documents reviewed by RCI show that the organization’s influence extends throughout Starmer’s government. The Trump administration’s pushback on Ahmed’s weaponization of speech against U.S. citizens and companies suggests a deep concern about foreign intervention and censorship stemming from one of America’s closest allies.

In a recent interview with Undersecretary Rogers, RCI noted that the State Department appeared to be “knocking on the door of the Prime Minister’s office.” Rogers demurred, declining to detail her discussion with Starmer officials. “We have a very special relationship with the British government,” she responded. “The issue has been communicated.”

Senior Labour Minister Chi Onwurah accused the Trump administration of attacking free speech after Rubio announced shortly before Christmas that the administration was seeking Ahmed’s deportation. “Banning people because you disagree with what they say undermines the free speech the administration claims to seek,” Onwurah said, adding that Ahmed was an articulate advocate for greater regulation of online speech.

However, internal British government documents show that Onwurah is one of Starmer’s many advisors who have been working with Ahmed on activities many consider censorship. Ahmed and Onwurah did respond to requests for comment.

Weaponizing Censorship

The Center for Countering Digital Hate grew out of the efforts of Labour Together, a think tank founded in 2015 to undermine Jeremy Corbyn, a far-left member of Parliament who led the Labour Party at the time. McSweeney, a leading figure in the organization, founded the Center around 2018 with Ahmed as a potent weapon to attack political enemies and advance narratives in the British media.

In a tactic also deployed by progressives in the U.S., the Center worked to silence voices it opposed by creating advertising blacklists to deprive disfavored media outlets of revenue. One successful campaign involved constant claims of “misinformation” and antisemitism lodged against the influential leftist news site Canary to drive away advertisers and tank their funding. “Bye birdie! Hyper-partisan fake news website The Canary is on its last legs!” tweeted British TV host and Center campaigner, Rachel Riley, celebrating a 2019 crash in The Canary’s advertising.

In 2021, Ahmed opened an office in Washington, D.C., and began working with American journalists to censor dissent and enforce political narratives friendly to Democrats and the Biden administration. The Center’s chairman is Simon Clark, a former senior fellow at the Center for American Progress, a think tank founded by John Podesta, who ran Hillary Clinton’s campaign against Donald Trump in the 2016 election.

In 2021, the Center for Countering Digital Hate released a report targeting a “disinformation dozen” of critics complaining about the Biden administration’s COVID vaccine policies. This report, released by an organization founded only months earlier in the United States, received a warm reception at the White House.

At a July 2021 press briefing, White House Press Secretary Jen Psaki quoted from the report while claiming that Facebook was undermining federal vaccine policies. “There’s about 12 people who are producing 65% of anti-vaccine misinformation on social media platforms,” Psaki stated. Facebook criticized the Center’s report for being free of evidence and failing to explain how they arrived at their numbers and conclusions.

One of the people included in the “disinformation dozen” was Robert Kennedy Jr., who was considering a run against President Biden in the Democrats’ 2024 primaries. The Center’s “infamous ‘disinformation dozen’ report specifically called for deplatforming Secretary Robert F. Kennedy and others,” wrote Secretary Rubio in his memo calling for Ahmed’s deportation.

Targeting Musk’s X

In the summer of 2023, the Center hosted a private conference in Washington for liberal groups allied with the Biden administration for the purpose of neutralizing the influence of X owner Elon Musk, who was helping to fund Trump’s presidential campaign. The list of attendees included Biden White House and State Department officials, Democratic Party congressional staffers, union leaders, the heads of several progressive foundations, and employees of the hyper-partisan website Media Matters for America. While no Republicans or conservatives appear on the roster, at least one member of the British foreign service is listed as an invited guest. Annabel Graham is a diplomat and national security professional based at the British Embassy in Washington. She previously handled the Home Office’s engagement with the U.S. and Five Eyes partners.

Working in parallel with Media Matters, the Center took aim at X’s advertisers, just as it had the British Canary. After the Center and Media Matters released reports claiming that Musk’s social media site was promoting “hate,” companies such as Disney announced they were pulling their advertising from X, triggering a crash in Musk’s profits. Disney’s CEO at the time, Bob Iger, was also a major donor to the Biden administration.

Ahmed has also worked in Brussels to influence EU censorship laws. When European regulators first began targeting X for alleged disinformation in late 2023, Ahmed celebrated on social media, implying that his organization was behind the move. “The @CCDHate has been briefing EU officials since October 7,” he wrote, “using our research on the tidal wave of hate and disinformation coming from social media.”

“X has surged to become the leading news app in every EU country, serving tens of millions of Europeans who use the platform daily to access uncensored information,” the State Department noted in its filings to deport Ahmed.

Friends in High Places

The Center’s involvement in U.S. politics is especially fraught because of its close connections with Britain’s leaders.

Ahmed began working hard to lobby the Labour government even before its landslide victory in July 2024. Weeks before the election, Ahmed emailed his staffers, looping them in with Josh Simons on his private Gmail to set up a meeting. “Josh is head of Labour Together and is a key person in policy for the next Labour government,” Ahmed wrote. Simons soon left the think tank to become a member of Parliament, where he is a close ally of Starmer.

The Guardian recently reported that before his election to Parliament, Simons “commissioned and reviewed a report in 2023 on journalists investigating the thinktank [Labour Together] that would help propel Keir Starmer to power.”

The Center even has its own members now operating in Parliament. One of the newly elected MPs, Kirsty McNeill, sat on the organization’s board from late 2019 until her 2024 election to Parliament. McNeill was listed in the Center’s staff handbook as a lead trustee, and the group’s mental well-being plan provided McNeill’s personal cell phone for their Mental Welfare Hotline. “Please feel free to contact Kirsty if you have any concerns about your Mental Wellbeing that is not being addressed by CCDH and/or your Line Manager.”

Ahmed has also been working quite closely with the Department for Science, Innovation and Technology, which is responsible for regulating speech in the U.K., including implementing the Online Safety Act. Passed in 2023, the Act put a “range of new duties on social media companies and search services, giving them legal duties to protect their users from illegal content and content harmful to children.” The Starmer government has taken pains to hide Ahmed’s work with the department. When a British reporter asked the department to detail their relationship and work with Ahmed and the Center, it told him to file a freedom of information request.

Newly uncovered documents show that weeks after Labour won the 2024 election, Ahmed wrote to Baroness Jones of Whitchurch, whom Starmer appointed as a leading Minister of the department. Ahmed introduced Jones to his work to “outline the policy areas CCDH believes are critical to delivering your forthcoming agenda.”

Ahmed highlighted that the Center had “championed the Online Safety Act since its inception,” and bragged that he was the “first witness before the draft bill committee” that had reviewed the Act. He also promised that the Center would “continue to be a critical partner to OFCOM,” the U.K. regulator charged with enforcing the censorship act.

“We welcome the opportunity to work with your office as the UK leads the charge in online safety,” Ahmed wrote.

Ahmed stepped up his lobbying in August 2024, writing once again to Jones that, “Social media platforms cannot be a haven for those looking to sow division in our communities. … Please contact for further information or to arrange a briefing with CCDH.”

Closed-Door Meeting

Heavily redacted documents show that Ahmed met personally with senior department officials in early November 2024. This meeting led to a previously unreported closed-door roundtable with Baroness Jones and other prominent politicians. Documents show that Baroness Jones personally addressed the roundtable in her role as Minister for Online Safety. Jones emailed CCDH organizers and recommended that the meeting “focus on how best we can collectively monitor the impact the [Online Safety Act] is having and identify areas – based on evidence – of where further targeted interventions are needed.”

Last July, the department published a report which argued that the Act “does not go far enough to address the spread of harmful misinformation.”

Baroness Jones left the department to join the House of Lords in September, and the department did not respond to RCI’s request for comment.

Senior directors at OFCOM, which is assessing and enforcing the Online Safety Act, were slated to attend this meeting, as was Simons and four other Labour MPs. Simons was appointed Parliamentary Under-Secretary to the department last month. He did not return request for comment sent to his government and private email.

Another guest expected to attend the private roundtable was Chi Onwurah, the MP who defended Ahmed when Secretary Rubio announced deportation proceedings. Onwurah chairs the Science and Technology Select Committee, which has oversight of the Department for Science, Innovation and Technology.

Onwurah seems determined to obfuscate and mislead the media about her work with the Center. During a December BBC interview, she giggled when asked if the Center was a Labour Party front group that pushed through the Online Safety Act.

“The Online Safety Act was brought forward under the Conservatives and by the Conservative Party,” Onwurah told the BBC. Onwurah’s claim is a poor attempt to recast recent history.

Ahmed had, in fact, recruited at least one member of the Conservative Party. Damian Collins joined the Center in July 2020, and the British government later published a decision allowing his membership with Ahmed’s organization.

A Conservative Party MP, Collins is the original sponsor of the Online Safety Act. And the first person Collins had testify in favor of the act was Imran Ahmed, his colleague at the Center.

After Parliament passed the Online Safety Act, which Collins and Ahmed campaigned for, Collins celebrated on X. Collins later left Parliament to join Geradin Partners in London to run the public policy practice at one of the leading law firms for digital regulation in Europe. Collins is also a director at Orbis, a firm co-founded by former British intelligence officer Christopher Steele. Steele’s now-debunked dossier, alleging ties between Trump’s 2016 campaign and Russia, helped spark years of investigation that plagued Trump's first term.

The Trump White House has complained several times to the Starmer government about the Online Safety Act. Vice President JD Vance has said the law infringes on individual rights. When Vance accompanied an American delegationto London last August, he said the Online Safety Act is taking the Starmer government down a “very dark path” of online censorship.

Tyler Durden

Sat, 02/21/2026 - 08:10

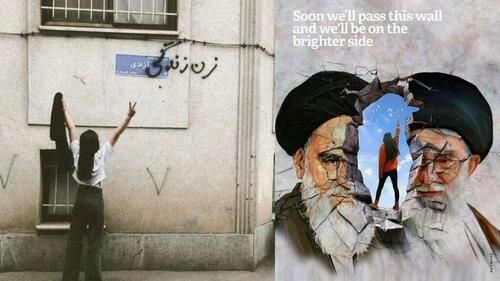

via Iranian state media

via Iranian state media

Source: qantara.de

Source: qantara.de

The IRS in Washington. Madalina Kilroy/The Epoch Times

The IRS in Washington. Madalina Kilroy/The Epoch Times OpenAI employees were sufficiently alarmed by future mass murderer Jesse Van Rootselaar's interactions with ChatGPT that they urged managers to call the police

OpenAI employees were sufficiently alarmed by future mass murderer Jesse Van Rootselaar's interactions with ChatGPT that they urged managers to call the police Van Rootselaar at a gun range: He captioned this social media post "I blew up their desert eagle!"

Van Rootselaar at a gun range: He captioned this social media post "I blew up their desert eagle!"  Six days after Van Rootselaar's (left) mass murder-suicide, another man-in-a-dress, Robert Dorgan,

Six days after Van Rootselaar's (left) mass murder-suicide, another man-in-a-dress, Robert Dorgan,

Imran Ahmed

Imran Ahmed

Recent comments