Leftist Media Outraged After USA Olympic Hockey Team Goes Pro-MAGA

Perhaps it's destiny - The last time the USA Men's Olympic Hockey Team won the gold in 1980 they had to first defeat the communist Soviet Union. It was not the final game of the Olympics, it was the second to final game, but it was the only game that was treated as an epic battle of cultural and political ideals and not just a sports competition. In 2026, the Team USA finally won again, this time against the increasingly communistic country of Canada.

Maybe this time around the global audience was not as aware of the political nature of the event, but the woke left was certainly spellbound, poised to exploit the outcome as symbolic of an ideological victory over American conservative principles. In other words, they expected the Canadians to win, and they planned to gloat about the downfall of the US image at the feet of a far-left country. Obviously, it didn't work out that way.

To pour salt on their wounded progressive egos, the men's team is largely pro-MAGA and says they are excited to attend Trump's State of the Union Address. Leftist activists have been pressuring American athletes throughout the Olympics to denounce the Trump Administration. Particularly, they have called on American representatives to speak against ICE and the mass deportation of illegal immigrants.

The USA Women's Hockey team capitulated and chose to snub Trump's invitation after their gold medal win. Leftists expected the men to do the same. Instead, they invited FBI Director Kash Patel and partied with him after the win. Patel is an avid hockey player and was already present in Milan to oversee security for the proceedings. Donald Trump also made a locker room call to the team to congratulate them.

You can hear the genuine pride in Donald Trumps voice when he called the Team USA Hockey Team pic.twitter.com/ch6GbXShwh

— Harrison Krank (@HarrisonKrank) February 23, 2026

It all seems like good, clean American patriotism, but that's the problem. Now, the establishment media is running a blitz against the men's team, attacking them in a series of hit pieces and denouncing their support of the President.

The Nation calls it the "Ugly Underbelly Of The US Men's Hockey Victory", asserting that:

"Trump holds incredible nostalgia for the “Miracle on Ice” Olympic hockey team of 1980. This was the squad that, in one of the great Olympic upsets of all time, defeated the USSR in the semifinals before winning the gold. Pundits turned the victory into a right-wing symbol. It showed that the country had moved away from the social struggles of the 1960s and ’70s and embraced the crypto-fascist variant of patriotism best exemplified in the 1980 election of Ronald Reagan..."

In other words, leftists despair over the loss of the communists and their eventual downfall. They see the victory of capitalism as "crypto-fascist". The Nation attacks the men's team as if they work for Trump. This is what leftists do when people don't submit to their demands and refuse to virtue signal for the woke agenda.

"Unlike other US Olympians speaking out against this regime, men’s hockey players chose to be lickspittles..."

"...The real Olympic heroes were the athletes who stood up for each other - and against Trump."

They go on to list the handful of Olympic athletes who decided to pull a "Kaepernick" and politicize their sport with activism instead of simply competing and representing their country.

Slate raged over Kash Patel's celebration with the team, suggesting he had no reason or right to be at the event (even though he was invited to be there). The cope and seethe was readily apparent in SBNation's screeching diatribe in which they argued that:

"Instead of trying to carve off football and basketball viewers, the NHL has been marketing itself to non-sports fans, emphasizing women, supporting the LGBTQ+ community with Pride Nights, and making substantial inroads with Gen Z as a result..."

Yes, and this is a detrimental error because hockey fans generally do not like woke nonsense and mentally ill, sexually degenerate activists. The LGBT agenda has been forced on hockey fans, they never asked for it. And, just because Gen Z is more inclined to watch hockey does not mean those particular viewers are more inclined to be gay or woke. They continue:

"We’re left with a sport that’s at odds with itself, during a time of momentous change. A new generation of young, diverse fans running headfirst into a sport that has often held a reputation for being insular, tribal, exclusionary, and prejudiced. Team USA’s celebration was everything the NHL has been trying to push against, now it’s on full display..."

The Guardian played to the deportation angle and the idea that players might receive "backlash" (backlash that the leftist media often generates and fabricates) if they attend Trump's State of the Union, suggesting that they avoid political entanglements.

"Some players will face pressure to be “team players” and go along with the propaganda-driven Capitol Hill invitation. But perhaps some will recognize that they are being asked to give tacit approval to an administration that is denying many US residents and citizens a chance to be a part of Team USA writ large..."

No legal American citizens are being denied their citizenship. Around 10 anchor babies have been deported along with their illegal parents, but this is not necessarily a denial of their citizen's status. Regardless, no foreigner is entitled to access the US for any reason.

Open immigration is a fabrication of the political left, even the "melting pot" narrative was a creation of early socialists. It is not an integral part of the American tradition. Migrants have to earn the right to come to the US. They are not owed anything.

At bottom, hockey has been targeted for co-option by the political left since the early 2020s and they thought they had taken full control of the platform. This is why they are outraged by the behavior of the men's Olympic team. The leftists assumed that they owned these guys.

Beyond that, the media was hoping for a Canadian win as a springboard to bag on the US and Trump. Instead, they lost, and now journalists are accusing Trump and the men's hockey team of politicizing the victory that leftists were planning to politicize. Their hypocrisy knows no bounds.

Tyler Durden Tue, 02/24/2026 - 18:50

Work progresses on a new migrant detention facility dubbed "Alligator Alcatraz" at Dade-Collier Training and Transition facility in the Florida Everglades on July 4, 2025. Rebecca Blackwell/AP Photo

Work progresses on a new migrant detention facility dubbed "Alligator Alcatraz" at Dade-Collier Training and Transition facility in the Florida Everglades on July 4, 2025. Rebecca Blackwell/AP Photo

via Reuters

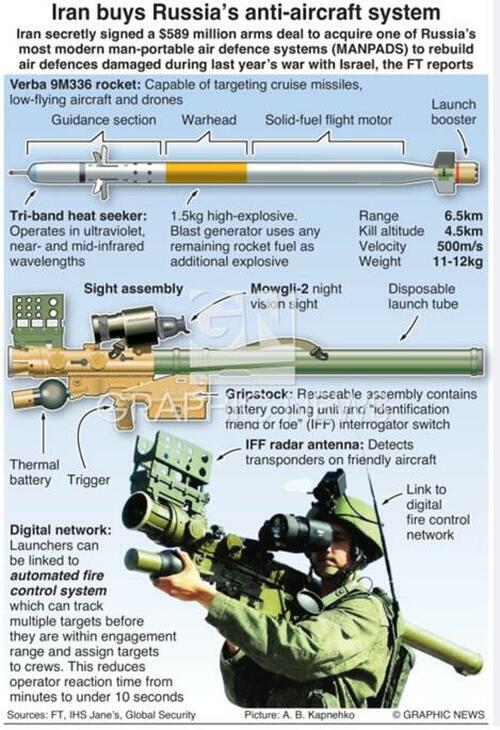

via Reuters Graphic News: the Verba 9K336 MANPADS

Graphic News: the Verba 9K336 MANPADS

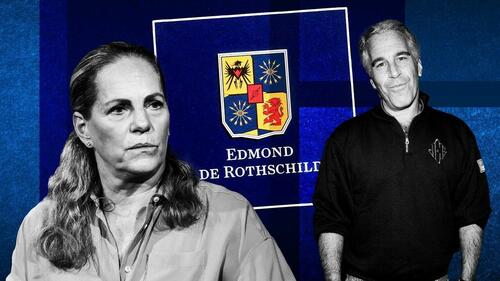

Jeffrey Epstein, right, became a personal confidant and key business adviser to Ariane de Rothschild, left, for six years from 2013 © FT montage/Bloomberg/Alamy/Getty Images

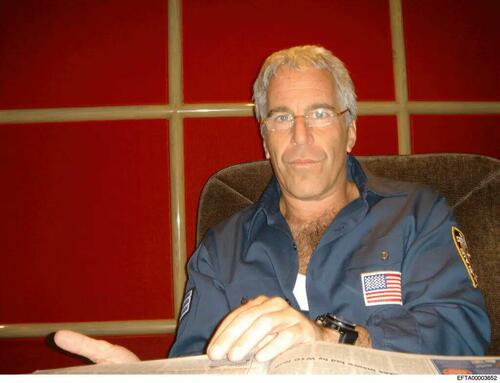

Jeffrey Epstein, right, became a personal confidant and key business adviser to Ariane de Rothschild, left, for six years from 2013 © FT montage/Bloomberg/Alamy/Getty Images Epstein with Sheikh Jabor Bin Yousef Bin Jassim Bin Jabor al Thani. Pic: @OversightDems

Epstein with Sheikh Jabor Bin Yousef Bin Jassim Bin Jabor al Thani. Pic: @OversightDems

Source: AFP

Source: AFP via ABC News

via ABC News via AFP

via AFP

Zelensky awarding a medal to a Ukrainian soldier on February 23, 2026 Source: Office of the President of Ukraine.

Zelensky awarding a medal to a Ukrainian soldier on February 23, 2026 Source: Office of the President of Ukraine.

Recent comments