Nancy Mace And Ilhan Omar Go Full Jerry Springer Over Iran

Authored by Steve Watson via Modernity.news,

Rep. Nancy Mace obliterated Ilhan Omar on X after the Somali-born Democrat raged about U.S. strikes on Iran during Ramadan, escalating calls to expose Omar’s alleged immigration fraud and boot her back to Somalia.

The feud erupted over the weekend when Mace trolled Omar and fellow Squad member Rashida Tlaib, sending them “thoughts and prayers” over the confirmed death of Iran’s Ayatollah in the U.S. strikes.

My heart goes out to Ilhan Omar and Rashida Tlaib tonight. Sending them thoughts and prayers. pic.twitter.com/8CLlk18Q7D

— Rep. Nancy Mace (@RepNancyMace) March 1, 2026

Omar fired back, accusing Mace of being drunk: “I hope you aren’t drunk and took your staff’s advice, Rashida and I don’t know this man and feel confident he didn’t care about us. Please restrain from drinking too much as you have been warned from your staff and stay off social media when you are drunk. I pray in his holy month you find peace and respect for your self.”

I hope you aren’t drunk and took your staff’s advice, Rashida and I don’t know this man and feel confident he didn’t care about us. Please restrain from drinking too much as you have been warned from your staff and stay off social media when you are drunk. I pray in his holy… https://t.co/s4kpye5QVg

— Ilhan Omar (@IlhanMN) March 1, 2026

Mace then hit Omar with a direct reference to long-standing allegations of marrying her brother for immigration fraud.

So tell me, what was it like being married to your brother? https://t.co/N9pYmHEiAa

— Rep. Nancy Mace (@RepNancyMace) March 1, 2026

Mace doubled down Sunday on NewsMax with Ed Henry, dismissing Omar’s complaints about the timing of the strikes. “I don’t give a damn if it’s Ramadan. I don’t care if Muslims are fasting right now,” Mace said, adding “This was the right time with the right Intel, the right President, to go in there and do this.”

She then called for action: “I’m ready to denaturalize and deport her to Somalia.”

Rep. Nancy Mace (R-SC) says of Ilhan Omar, “I’m ready to denaturalize her and deport her to Somalia.”

— Paul A. Szypula ?? (@Bubblebathgirl) March 2, 2026

Mace said this after lambasting Omar for marrying her own brother and whining about Iran being attacked during Ramadan.

Mace is ruthless and I love it.pic.twitter.com/wctfoVr8HY

This isn’t the first time Mace has targeted Omar over immigration fraud claims. Just last week, Mace pushed the House Oversight Committee to subpoena records related to Omar, her former spouses, and family, aiming to prove allegations of marriage fraud to evade U.S. immigration laws. Federal marriage fraud carries penalties including prison, fines, denaturalization, and deportation.

The two have sparred since last year when Mace attempted to censure Omar over vile comments she made following the assassination of Charlie Kirk.

? BREAKING: Ilhan Omar is officially in DANGER of being kicked off her committees and CENSURED for justifying Charlie Kirk's assassination

— Nick Sortor (@nicksortor) September 16, 2025

Rep. Nancy Mace just filed filed the resolution to make it happen.

ALL REPUBLICANS SHOULD SUPPORT THIS!

Somali Rep. Omar has ZERO… pic.twitter.com/DZOFv0zrqM

The push follows a Justice Department probe into Omar’s finances and foreign ties that stalled under Biden but has been revived by Trump, who accused Omar of amassing up to $30 million in family wealth after arriving from Somalia with little.

Adding fuel, an investigation revealed Omar’s husband’s winery as a fake shell for alleged money laundering, with no license or operations despite revenue jumping to $5 million.

As Rashida Tlaib was caught chanting “KKK” during Republican “USA!” chants at Trump’s State of the Union, Omar also heckled Trump during the address, refusing to apologise and then bizarrely invoking racial slurs.

Your support is crucial in helping us defeat mass censorship. Please consider donating via Locals or check out our unique merch. Follow us on X @ModernityNews.

Tyler Durden Tue, 03/03/2026 - 20:55

The F.B.I. raided the home of Alberto M. Carvalho, superintendent of the Los Angeles Unified School District, and the district offices on Wednesday. Credit...Philip Cheung for The New York Times

The F.B.I. raided the home of Alberto M. Carvalho, superintendent of the Los Angeles Unified School District, and the district offices on Wednesday. Credit...Philip Cheung for The New York Times

The manufacturing facilities of the Independent Can Company in Belcamp, Md., on June 25, 2025. Ryan Collerd/AFP via Getty Images

The manufacturing facilities of the Independent Can Company in Belcamp, Md., on June 25, 2025. Ryan Collerd/AFP via Getty Images Traders work on the floor of the New York Stock Exchange during morning trading in New York City on Feb. 24, 2026. Strong corporate earnings, technological innovation, and a positive economic outlook have contributed to the US stock market’s appeal. Michael M. Santiago/Getty Images

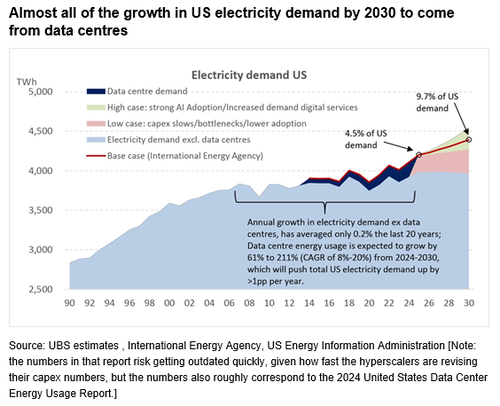

Traders work on the floor of the New York Stock Exchange during morning trading in New York City on Feb. 24, 2026. Strong corporate earnings, technological innovation, and a positive economic outlook have contributed to the US stock market’s appeal. Michael M. Santiago/Getty Images A technician works at an Amazon Web Services AI data center in New Carlisle, Ind., on Oct. 2, 2025. The United States has outpaced many advanced economies in growth and productivity over the past year, with some analysts describing the momentum as the start of a new industrial revolution. Noah Berger/Getty Images via Amazon Web Services

A technician works at an Amazon Web Services AI data center in New Carlisle, Ind., on Oct. 2, 2025. The United States has outpaced many advanced economies in growth and productivity over the past year, with some analysts describing the momentum as the start of a new industrial revolution. Noah Berger/Getty Images via Amazon Web Services European leaders take part in a meeting as they attend the Informal EU Leaders’ Retreat in Alden Biesen, Belgium, on Feb. 12, 2026. While US productivity has increased rapidly since 2019, productivity growth in the UK and eurozone has remained mostly stagnant, recent data shows. Ludovic Marin/AFP via Getty Images

European leaders take part in a meeting as they attend the Informal EU Leaders’ Retreat in Alden Biesen, Belgium, on Feb. 12, 2026. While US productivity has increased rapidly since 2019, productivity growth in the UK and eurozone has remained mostly stagnant, recent data shows. Ludovic Marin/AFP via Getty Images US Vice President JD Vance (3rd L) tours Hatch Stamping in Howell, Mich., on Sept. 17, 2025. US manufacturing activity expanded in January for the first time in 12 months. Jeff Kowalsky/AFP via Getty Images

US Vice President JD Vance (3rd L) tours Hatch Stamping in Howell, Mich., on Sept. 17, 2025. US manufacturing activity expanded in January for the first time in 12 months. Jeff Kowalsky/AFP via Getty Images

Cue death squads. Illustrative Fallujah fighting, via EPA

Cue death squads. Illustrative Fallujah fighting, via EPA

via Reuters

via Reuters

Recent comments