"Modern Money Only Works By Cheating": If You're Long Bitcoin (Or Not Long Bitcoin), Read This...

Tl;dr: Bitcoin exists not to replace fiat money but as a provocative "hard object" in an elastic monetary world. Modern fiat succeeds by cheating - deferring pain, socializing losses, and bending rules to absorb crises (Weimar rigidity led to hyperinflation; 1929 rigidity was abandoned for elasticity in the 1930s; 2008 and COVID responses bent rules to survive). Fiat buys time during trauma but creates ratcheting inflation that disproportionately burdens the asset-poor, while rewarding mobile capital.

Bitcoin recreates gold's key elusive trait: non-discretionary, issuer-risk-free scarcity in digital form. Unlike gold (which responds to price via new supply), Bitcoin's 21-million cap is mechanically enforced by code and time, refusing incentives. This makes it an potential anchor beneath fiat - collateral for credit expansion - if it scales to gold-like market value (~$45T vs. Bitcoin's ~$1T).

Yet the real risk lies not in math (256-bit cryptography remains robust against classical attacks) but in human coordination: governance, quantum threats requiring consensus upgrades, and holder temperament during violent drawdowns. Markets price Bitcoin's gap to gold not from doubts about scarcity, but from uncertainty about whether humans can endure its rigid, psychologically demanding process without capitulating. Bitcoin tests endurance more than code - its value hinges on who holds it, and for how long.

* * *

For the OG ZeroHedgers, Hugh Hendry's name will be well known and well respected.

For others, the infamous Scot made his bones being the ultimate contrarian to the world's order and making a killing through the great financial crisis for himself and his hedge fund partners.

Google is your friend to find the many times we posted on Hendry's musings in the late 2000s, early 2010s.

On the nature of panics and capital destruction (from Eclectica Fund commentary, August 2007): "Panics do not destroy capital; they merely reveal the extent to which it has been previously destroyed by its betrayal into unproductive works."

On speculation ending (August 2008 interview, amid the crisis escalation): "There is no role for speculation or speculators today. This is kaput. If we were Second World War generals, we've exposed our flanks and the enemy is advancing."

Hendry frequently emphasized contrarianism, asymmetry in bets (e.g., tail-risk protection with high upside in disasters), and skepticism of consensus. He drew inspiration from existentialist ideas, once saying principles like "God is dead, life is absurd, and there are no rules" guided his investing - fitting for someone willing to bet aggressively against the crowd pre-crisis.

His was the best performing macro hedge fund in 2010.

During Trump 1.0 he warned about the decline of Europe: "In Europe we anticipate further duress in the political commitment to the European project as the success of Trump’s economic stimulus plan keeps US growth humming along leaving the continent badly exposed as a politically fractured economy without the resolve to implement successful growth strategies."

This was him in 2020 before the inflation crisis: "Chaos is coming... The mood of the nation is what unleashes the inflationary genie...it is not a monetary phenomenon."

A few years after apparently retiring to St.Barts, the former Eclectica asset management co-founder is living his best life and sharing his thoughts via substack.

Hendry recently opined on "Bitcoin & The Human Problem", explaining why certainty breaks us before price does.

bitcoin is down more than fifty percent from its high, and that fact alone is not even the bad news. historically, it usually gets worse. seventy percent drawdowns. eighty percent. this is not an anomaly, it is the pattern. the real question however is not why bitcoin does this, but why we keep pretending that this time will be different for us.

every cycle, people search for external explanations. leverage. regulation. china. quantum computing. the excuse does not matter. what matters is that the moment price falls hard enough, belief collapses. not because the thesis changed, but because the human brain cannot tolerate certainty paired with delayed reward under stress. when the future is clear but distant, and the present is painful, we choose relief now over reward later. always.

this is where monetary ideology dies and psychology takes over. under threat, we rewrite reality to avoid pain. we call it cognitive dissonance if we want to sound clever, but it is really just survival instinct. beliefs are luxuries. when belief becomes dangerous, it is abandoned instantly. peter denies jesus the moment belief threatens his safety. bitcoin does the same thing to its disciples. the king of hard money is worshipped right up until holding him becomes intolerable.

bitcoin’s fatal flaw, if it has one, is not technological. it is revelatory. it shows you the future too early and too clearly. a million dollars per coin is not a vague hope, it is a vivid image. our brains are not designed to hold that vision steady through violent volatility. we are not wired to lose money while knowing, with unbearable clarity, that patience would eventually make us rich. that contradiction fries the nervous system.

so the price falls, the new money panics, and belief evaporates on contact with stress. bitcoin is not failing. we are. gullible, imaginative, hysterical creatures who can glimpse the future but cannot emotionally survive the path to get there. the asset does not break. the holder does.

this is also why we will be replaced by machines. not because they are smarter, though they are, but because they can tolerate certainty without emotion. they do not flinch at drawdowns. they do not seek relief. they simply execute.

the bitter punchline is that nothing has changed. the future remains intact. the path remains unbearable. accumulation only becomes possible when holding becomes intolerable. below fifty thousand. really below forty. that is the ritual. that is the prayer. bitcoin does not need faith. humans do, and we keep losing it at precisely the wrong moment.

But, his latest note "Bitcoin & The Problem Of Hardness" is a masterpiece in seeing the big picture as he wends his way from the old world to the present day, explaining why mathematics, trauma, and human temperament matter more than ideology in modern money...

[ZH: Hendry writes in a unique style, without using capitals, we have chosen to preserve that style, though we have bolded a few sections of particular interest.]

For years, i treated bitcoin as something i understood well enough to have an opinion on, but not well enough to take apart properly.

that wasn’t laziness. it wasn’t lack of curiosity. it was the quiet assumption that whatever bitcoin was trying to solve, modern finance had already found a workaround.

this fourth, violent drawdown forced me to reconsider that assumption.

not as a trade, not as a belief system, but as a monetary object with consequences. at this point in its life, repeated collapses are no longer a curiosity. they are a feature that demands explanation.

this piece is my attempt to finally map the terrain i’d been circling for years: bitcoin’s hardness, its fragility, its human governance, and its uneasy relationship with a world that increasingly runs on elastic money and digital abundance. it’s not a defence. it’s not an indictment. it’s an audit.

writing it surprised me. i came away less certain about price, more certain about structure, and far more interested in the question of whether bitcoin’s biggest risk has ever been the mathematics at all.

if you’ve felt confident dismissing bitcoin, or confident believing in it, this is written for you. it left me sharper. i hope it does the same for you.

hugh.

a hard object in an elastic world.

bitcoin is not here to save the world. its here because the world learned the hard way that modern money only works by cheating. cheating time. cheating pain. cheating death. we built systems that survive by bending, by socialising loss, by pretending tomorrow can always carry what today can’t. and it mostly worked. worked well enough that america never failed, markets never cleared, and catastrophe was deferred again and again.

but in doing so, we quietly erased something that used to matter. the idea that there should exist at least one asset that doesn’t bend. one thing that refuses discretion. one thing that doesn’t care who’s in power, who’s desperate, or who’s about to break. bitcoin is not an improvement on the system. it is a provocation aimed at it.

a hard object thrown into an elastic world to see what happens.

that provocation only makes sense once you recognise what elastic money left behind. as societies embraced fiat, the global pool of savings did not become defenceless. inflation arrived, but it was hedgeable. equities, property, credit, productive ownership. capital learned how to run. what didn’t reappear was another asset that hedged inflation without introducing credit risk.

gold has of course played that role for centuries. scarce, apolitical, jurisdictionless, created without leverage, owing nothing to anyone. an inflation hedge that was simultaneously riskless. when gold was demoted as a monetary standard, that role was tolerated, not replaced when gold was ransacked between the long years of 1980 and 2011. curious minds looked for an alternative.

bitcoin emerged inside that gap. not as a rejection of fiat, and not as a tool for managing economic cycles, but as an attempt to recreate gold’s most elusive property in digital form. not merely scarcity, but scarcity without issuer risk. not just protection against dilution, but insulation from discretion. this is why bitcoin’s design is so severe. if the objective were simply to hedge inflation, the world already has dozens of ways to do that. the harder ambition is to build an asset that can sit beneath the monetary system as collateral rather than inside it.

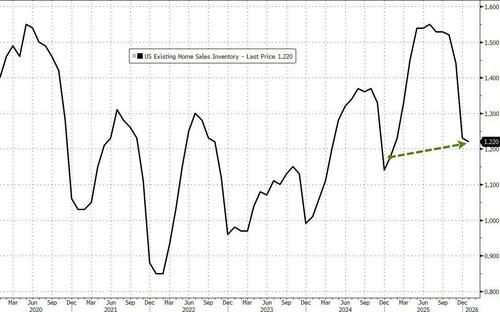

that ambition now collides with modern finance. credit expands not on trust, but on what can be pledged. this is why stablecoins matter. they fuse the credit-risklessness of us treasuries with hard constraints elsewhere in the system. they are the clearest signal yet that the future of fiat will be built on better collateral, not moral restraint. bitcoin has a seat at that table only if it can scale into a recognised, liquid, riskless anchor. and that requires market value. not sentiment. not belief. but a market value deep enough to support global credit creation without fragility.

this is why the comparison with gold is unavoidable. gold is roughly forty-five trillion dollars. bitcoin remains under one. the gap is not philosophical. it is functional. geology has already earned its role. mathematics is still auditioning.

the question is not whether bitcoin is scarce enough, portable enough, or clever enough.

the question is whether an asset enforced by code and human coordination can ever be trusted, at scale, in the way an asteroid once was.

this is what this paper is about.

not whether bitcoin replaces fiat. it will not.

not whether elasticity is immoral. it is not.

fiat in an age of abundance.

the defining monetary lesson of the twentieth century was not ideological. it was traumatic. it emerged not from debates about socialism versus capitalism, or keynes versus hayek, but from the lived experience of what happens when economic systems impose rigidity on societies already under extreme stress.

after the first world war, germany was not a failed society. it was bruised, diminished, politically unstable, and deeply resentful, but it remained functional. industry existed. labour existed. institutions existed. the system was strained, not yet broken. the collapse came later, and it was not inevitable.

versailles changed that.

the treaty was not merely punitive. it was vindictive and economically illiterate. reparations were demanded in hard terms, payable in gold, at precisely the moment germany’s productive capacity was being constrained. forgiveness was absent. flexibility was absent. economic reality was ignored.

when germany struggled to meet those obligations, the response was not renegotiation but enforcement. in 1923, french and belgian forces occupied the ruhr valley, seizing control of germany’s industrial heartland, its coal, its steel, its metal production, while still demanding gold payments to the allied victors. output was taken. gold was still required. rigidity was imposed from both ends.

this was the breaking point.

what followed was not ideological radicalisation in the abstract, but economic paralysis in practice. unemployment surged. production collapsed. a growing share of the adult population became economically useless. not inefficient. not underpaid. useless. idle. watching. waiting. that condition does not produce reflection or moderation. it produces rage. and hyper-inflation.

hard money did not cause the collapse of weimar germany. but it failed catastrophically to absorb the trauma. and when institutions fracture under mass unemployment, money fractures with them. hyperinflation wasn’t softness. it was panic. it was the monetary expression of legitimacy evaporating in real time.

that sequence mattered. and it was remembered.

a decade later, the world faced another shock that threatened to replay the same pattern at a far larger scale. the crash of 1929 produced mass unemployment, collapsing demand, and the genuine possibility that the american system would follow germany down the same path. the ingredients were familiar: idle men, shuttered factories, political stress, and a rigid monetary framework that transmitted pressure rather than absorbing it.

this time, the response changed.

gold was abandoned as the governing constraint, not because it was immoral or discredited, but because it was brittle. too rigid to cope with systemic trauma. under gold, pressure concentrates until something snaps. under fiat, pressure disperses. elasticity replaced purity. monetary doctrine abandoned to keep the system intact.

the response was ugly. it was unfair. it produced deserved anger. but it worked.

the united states survived intact. unemployment was brutal, but the political centre held. extremism remained marginal. fiat didn’t heal the trauma, but it prevented it from metastasising. that became the lesson: in moments of economic shock, hardness accelerates entropy, while monetary elasticity buys time. and time, in stressed societies, is the difference between repair and collapse.

this was not an argument against scarcity. it was an argument against rigidity in the wrong place, at the wrong time. fiat emerged not as an ideological triumph, but as an adaptive response to the catastrophic failure of hard constraints under conditions of mass unemployment.

that distinction matters, because bitcoin did not arrive to overturn this lesson. it arrived long after, in its aftermath.

fiat’s ugly success.

over the subsequent century, that logic has been tested repeatedly, and each time it has been reaffirmed under pressure.

the global financial crisis of 2008 was not a scare or a stress test. it was a system-wide cardiac arrest. the banking system was insolvent in any meaningful sense. the only open question was whether circulation could be restarted before institutional damage became permanent. the response was not elegant. rules were bent. balance sheets were expanded. losses were socialised. hard constraints were suspended to keep the system alive. it was ugly, unfair, and morally nauseating to me and many others. it also worked.

the same pattern repeated during the pandemic. supply chains froze. borders closed. hospitals filled. the phrase “human extinction” escaped the laboratory and entered the bloodstream of culture. belief alone was enough to threaten collapse. once again, fiat leaned in. too much some say. money expanded. credit expanded. time was frozen. people were paid to stay home while the system was held upright. once again, rigidity was rejected in favour of elasticity. once again, the worst tail events were avoided.

this is what fiat does well.

it absorbs shocks that hard systems transmit. it disperses pressure instead of concentrating it. it allows societies to survive periods of mass dislocation without forcing immediate liquidation of people, institutions, or legitimacy. in a world repeatedly exposed to financial crises, pandemics, and geopolitical shocks, this has proven to be a feature, not a bug.

elasticity, however, is not free.

the cost shows up as inflation. not as a temporary inconvenience, but as a ratchet. prices spike, settle, and then remain elevated. grocery bills do not return to their old levels. this is the mechanical consequence of pushing risk forward in time. fiat smooths the present by borrowing from the future.

this matters most for those without assets. for the disenfranchised, inflation is not a macroeconomic abstraction or a debate about models. it is a daily budgetary pressure. rent before wages. food before leisure. energy before dignity. when prices ratchet higher, there is no portfolio adjustment, no rebalancing, no clever hedge. there is only less room to breathe.

modern financial systems are exceptionally effective at protecting those who already participate in them. the franchise holders. equities rise with nominal growth. property absorbs inflation and then some. credit, leverage, index-linked instruments, real assets, productive ownership. the menu is broad, liquid, and proven. elasticity doesn’t destroy capital for insiders. it often enriches them. asset prices inflate faster than wages precisely because the system is designed to keep capital mobile and solvent.

the burden falls elsewhere.

what inflation punishes is not thrift in some moral sense, but exclusion. money left idle because it must be. capital that cannot move because it does not exist. patience without agency. this is not a judgment about behaviour. it is a structural outcome. fiat rewards participation and mobility, not fairness. and over long periods of sustained monetary elasticity, that distinction compounds into something corrosive. something unfair.

this is where bitcoin enters the story, not as a solution to inequality, and not as a replacement for fiat, but as a strange and uncomfortable experiment. a mathematical object offered to the world without permission, leverage, or jurisdiction. a bearer asset in digital form. one that could, in principle, be owned by anyone with access to a phone and an internet connection. no bank account required. no credit history. no gatekeeper.

for the disenfranchised, that possibility mattered. not because bitcoin guaranteed protection, but because it offered asymmetry. if the experiment failed, little was lost. if it succeeded, if a provably scarce, apolitical, non-discretionary asset could be recognised at scale, the upside was transformative. not charity. social escape velocity. that truth remains.

but the promise remains unresolved. and it brings us back to the central tension of this paper. bitcoin’s relevance, credibility, and ultimate utility depend not on ideology, but on scale. to function as an anchor inside a fiat system. to serve as collateral, to support credit, to matter. the market capitalisation of bitcoin must approach that of gold. anything smaller remains a speculation. anything larger becomes infrastructure.

this is why the question is no longer academic. after fifteen years, bitcoin is no longer a curiosity. it is a lab rat running in real time, being tested as to whether mathematical scarcity can earn the trust, liquidity, and legitimacy that geological scarcity acquired over centuries. and whether doing so can widen access to riskless inflation protection, rather than merely creating a new priesthood.

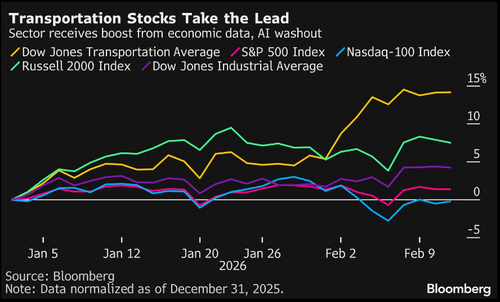

this distinction sharpens as economies approach a shock larger than weimar or 1929: the displacement of labour by machines. automation and artificial intelligence are not just productivity stories. they are redundancy events. entire categories of work will vanish faster than societies can reassign income, purpose, or dignity. in that world, the fragile variable is not capital. it is employment.

fiat will almost certainly be called upon again. not as ideology, but as necessity. universal credit, fiscal transfers, monetary elasticity. these are the tools required to cushion employment shock and prevent social fracture when labour is displaced at scale. this is not conjecture. it is the only mechanism modern states possess to manage such transitions.

and importantly, this world does not lack inflation hedges. what is missing is something narrower and more structural: non-discretionary scarcity at industrial scale. assets that can sit at the base of the monetary system as collateral, not because they promise growth, but because they promise constraint.

gold once played that role. perhaps it will again. bitcoin is an attempt to recreate it digitally. not as salvation, and not as an alternative to elasticity, but as a potential anchor beneath it. the unresolved question is whether bitcoin can grow large enough, liquid enough, and trusted enough to serve that role when the singularity arrives.

how gold actually works.

gold has long been understood as money that sits outside politics. it is trusted precisely because it is not governed by decree, not issued by states, and not altered by committees. its neutrality is earned through distance. it is dug from the ground, refined at cost, and accumulated slowly. for centuries, that physical constraint has made it a reliable anchor when confidence in human institutions has failed.

but gold’s scarcity is often misunderstood.

when gold traded at roughly three hundred dollars an ounce in the early 2000s, global proven and probable reserves were estimated at around forty-five to fifty thousand tonnes. exploration budgets were thin. lower-grade ore was uneconomic. entire jurisdictions were ignored. supply looked finite because, at that price, it effectively was.

that picture changes when price changes.

today, with gold trading around five thousand dollars an ounce, estimated proven and probable reserves are closer to sixty-five to seventy-two thousand tonnes, despite decades of continuous mining. higher prices reclassify rock into ore. tailings into assets. deposits once dismissed as marginal suddenly become viable. jurisdictions previously considered uneconomic re-enter the map.

this is not debasement. it is response.

gold does not dilute itself politically. it expands itself industrially. when price rises, supply responds. not instantly. not recklessly. but structurally. historically, global gold supply has grown at roughly three percent per year. that rate is slow enough to preserve trust, but persistent enough to matter over long horizons.

by the end of this century, if history is any guide, the total stock of gold mined plus proven and probable reserves will have roughly doubled. no votes will be taken. no rules will be changed. physics will simply do what physics allows.

this is both gold’s strength and its limitation.

gold’s hardness is governed by geology. it obeys natural law, not human coordination. that makes it politically neutral and socially legible. but it also means that gold cannot refuse incentives. when the reward is high enough, more effort is applied. more technology is deployed. more supply eventually emerges.

gold responds to price.

that property does not make gold inferior. it makes it comprehensible. markets understand geological scarcity instinctively. they know how it behaves under stress. they know how it leaks. slowly. predictably. impersonally.

this is the benchmark against which bitcoin is inevitably measured. not because bitcoin is trying to replace gold, but because gold represents the oldest and most trusted expression of non-sovereign scarcity.

bitcoin enters this landscape not as a moral challenger to gold, but as a mechanical one. its claim is not that gold is weak, but that there exists another form of hardness, governed not by physics, but by time and rule.

that distinction is where the argument begins.

a different kind of hardness.

bitcoin’s claim is not philosophical. it is mechanical.

unlike gold, bitcoin does not respond to price. it does not expand when demand rises, and it does not contract when demand falls. its supply is governed entirely by time, according to a schedule fixed at inception and enforced by the network itself. that schedule does not care about recessions, wars, elections, panics, or the bitcoin price.

bitcoin was capped at birth. twenty-one million units. not an estimate. not a reserve calculation. not a probabilistic assessment signed off by a committee. a hard ceiling, defined in code and indifferent to circumstance. roughly ninety-four percent of that supply has already been issued. the remainder will be released slowly, on a predetermined path, with issuance effectively exhausted by around 2040. after that, the supply does not grow.

this is what makes bitcoin unusual. gold’s scarcity is governed by geology and incentives. bitcoin’s scarcity is governed by rules and time. when the gold price rises, supply eventually responds. when the bitcoin price rises, supply does not. instead, issuance tightens mechanically through the halving process, which reduces the flow of new coins roughly every four years regardless of demand.

this is not a moral hierarchy. it is a structural asymmetry.

gold is scarce because it is hard to extract. bitcoin is scarce because it is hard to change. gold’s constraint is physical. bitcoin’s constraint is social and procedural. one obeys physics. the other obeys consensus. both are forms of hardness, but they behave differently under stress.

by the end of this century the total stock of bitcoin will be unchanged. there will be no technological breakthrough that unlocks new bitcoin deposits. no reclassification of marginal code into viable supply. no price signal that induces expansion. scarcity is enforced by design, not discovered over time.

this is why bitcoin is often described as algorithmically scarce. not because it is digital, but because its supply dynamics are explicitly non-responsive. it is a system constructed to refuse incentives. where gold yields, bitcoin remains inert.

that inertness is the feature. it is also the source of discomfort.

markets are comfortable with scarcity that leaks slowly and impersonally. they are less comfortable with scarcity that depends on rule adherence and human coordination. geological systems do not argue back. social systems do. and the harder the rule, the more attention is paid to whether it can be broken.

bitcoin’s hardness, therefore, is not just a question of numbers. it is a question of credibility. not whether the rules are strict, but whether they can remain strict under pressure. not whether scarcity is defined, but whether it can survive stress without being renegotiated.

this is where bitcoin stops looking like a commodity and starts looking like a monetary regime. a red flag perhaps. its scarcity doesn’t rest on trust in institutions or authority, but it does rest on the collective willingness of participants to enforce rules that cannot be appealed, amended, or suspended for convenience.

that is a powerful design choice. it is also a demanding one. and its why bitcoin cannot be evaluated solely on the basis of its supply curve. the market is not just pricing scarcity. it is pricing the process required to maintain it.

that process is where the real uncertainty begins.

abundance and the exception.

what happens to scarcity in a world where almost everything else becomes abundant.

over the long arc of technological progress, the dominant trend is collapse in marginal cost. compute becomes cheaper. energy becomes more efficient. bandwidth expands. manufacturing scales. even intelligence and creativity, once thought irreducibly human, begin to look reproducible. the direction of travel is clear. more output, less input. more capability, less cost.

this abundance is not evenly distributed, but it is relentless.

the consequence is that scarcity erodes almost everywhere. goods that were once expensive become cheap. processes that once required labour become automated. advantages that once persisted collapse under replication. for capital, this creates opportunity. for labour, it creates displacement. entire categories of work can disappear faster than societies can reassign income, status, or purpose.

this is not a policy failure. it is a feature of technological speed.

but abundance sharpens the value of what does not scale. as more assets become reproducible, the appeal of assets that are deliberately constrained increases. not as replacements for fiat, and not as solutions to inequality, but as anchors. reference points. stores of value whose scarcity is not a function of demand, innovation, or political discretion.

gold has played this role for centuries. its scarcity leaks, but slowly enough to remain legible. bitcoin proposes a different anchor. one whose scarcity is not discovered over time, but enforced from the outset. in a world where almost everything responds to incentive, bitcoin is constructed to refuse it.

this is the context in which bitcoin should be understood. not as a bet against fiat, and not as a utopian alternative to modern states, but as an engineered exception in an environment of accelerating abundance. its relevance increases not because fiat is failing, but because fiat is succeeding in a world where the primary challenge is managing transition rather than enforcing discipline.

scarcity is collapsing across the economic landscape. where it persists, it does so either because physics enforces it, as with gold, or because rules do, as with bitcoin.

that distinction sets the stage for the central question the market is still wrestling with. not whether scarcity matters, but whether scarcity enforced by human process can command the same confidence as scarcity enforced by nature. the risk is not mathematical.

at the heart of this paper is not the price of bitcoin, not the narrative, but the thing that actually makes it scarce in practice. the lock.

bitcoin’s supply is only as hard as the mechanism that enforces ownership. that mechanism is encryption. not trust. not reputation. not authority. mathematics. ownership is defined by the ability to produce a valid cryptographic proof. if you can produce it, the network recognises you as the owner. if you can’t, the coins don’t move. there is no appeal, no administrator, no override, no discretion. the rule is absolute.

this is what gives bitcoin its hardness. not belief, but enforcement.

the lock itself is built on a key space so large that ordinary intuition fails. bitcoin’s current security rests on 256-bit cryptography. that number sounds abstract, but its meaning is concrete. it implies a universe of possible keys so vast that guessing the correct one is not merely unlikely, but physically meaningless. the standard analogy holds because it is accurate: it is equivalent to predicting the outcome of 256 perfectly fair coin tosses, correctly, in a single attempt. the number of possible outcomes dwarfs the number of atoms in the observable universe. not by a margin, but by orders of magnitude.

this is why bitcoin’s scarcity feels real. not asserted. not agreed upon. enforced by a wall that cannot be climbed with any conceivable amount of classical computing power. brute force does not fail slowly here. it fails categorically.

but no wall built from mathematics is eternal.

this is not heresy inside cryptography. it is orthodoxy. cryptographic systems are not laws of nature. they are assumptions about what is computationally infeasible given the machines we can build. quantum computing, if it matures to sufficient scale and reliability, does not gradually erode those assumptions. it invalidates them. in principle, certain mathematical problems that are intractable today become solvable. locks that once looked cosmological become penetrable.

this does not mean bitcoin is vulnerable today. it does mean that its hardness is not geological. it is conditional.

this is where discussion usually collapses into nonsense. critics speak as if bitcoin is on a ticking clock, moments from cryptographic collapse. advocates respond with hand-waving, invoking “bigger keys” or future upgrades as if the problem dissolves on contact. both positions miss the point.

the reality is more disciplined. cryptography is not out of tools. alternative ways of securing digital ownership already exist. increasing security parameters does not linearly increase difficulty; it explodes it. problem spaces expand faster than attackers can realistically pursue. even under aggressive assumptions about future machines, there are known constructions that push feasible attacks back beyond plausible horizons.

the constraint is not mathematics. it is coordination.

engineering disciplines do not harden systems today against threats that are distant, speculative, and underspecified. doing so imposes costs now for dangers that may arrive differently, or not at all. but good engineering does preserve optionality. it builds systems that can migrate. it avoids dead ends. it leaves room to move without tearing the structure apart.

conservative choices. minimal complexity. maximum headroom.

the lock wasn’t chosen because it was eternal, but because it was overwhelmingly strong relative to any foreseeable attack, while leaving open a path to adaptation if the world changes. the mathematics are formidable. probably sufficient for decades. perhaps longer. the real uncertainty does not live inside the encryption itself. it lives in whether a system that enforces absolute rules can coordinate calmly when those rules eventually need to change.

this distinction matters, because it reveals where the real risk lies.

coordination without a conductor.

bitcoin’s greatest vulnerability is not that mathematics will suddenly fail. it is that adaptation requires agreement.

cryptography can be upgraded. rules can be amended. but only through a slow, voluntary process that depends on human coordination.

software can change. can people?

the market understands this intuitively. it doesn’t price bitcoin as if its code were fragile. it prices bitcoin as if its governance were untested under existential pressure. not because the tools are missing, but because the process has never been forced to prove itself in extremis.

power in bitcoin is negative, not positive. the ability to say “no” matters more than the ability to say “yes.” control is distributed through indifference rather than command. participants who care deeply must persuade participants who often do not. that asymmetry is intentional. it makes capture difficult, but it also makes change slow.

there is an old joke, best told by monty python, about revolutionary movements. everyone agrees on the enemy. everyone agrees on the objective. and yet the room is full of factions who despise one another far more than they fear the empire they claim to oppose. the people’s front, the popular front, the other front that split off last year after a disagreement about principles. the comedy works because it is painfully familiar. shared goals are easy. shared coordination is not.

bitcoin’s existential risk looks uncomfortably similar.

the empire, in this case, is not a political power but a technological one: quantum computing. the objective is clear and universally agreed. protect the lock. preserve the scarcity. keep ownership unforgeable. nobody disputes that. and yet, beneath that agreement sits a familiar fragmentation. different camps, different thresholds, different definitions of danger. some insist the empire is decades away and not worth acknowledging. others want to mobilise immediately. some fear that any coordination is betrayal. others fear that delay is suicide.

bitcoin will not be tested by whether quantum computing arrives tomorrow or in thirty years. it will be tested by whether a system built to resist authority can still recognise an empire when it appears, and act together without collapsing into its own people’s front of judea. rome, in the sketch above, barely needs to intervene. the factions do the work themselves. bitcoin’s challenge is to prove that it can do the opposite. that a system built on voluntary consensus can still recognise a real threat, act deliberately, and preserve its core rules without fragmenting into rival truths.

that is the real hardness test. not whether the locks are strong enough, but whether the people guarding them can tell the difference between principle and paralysis when it finally matters.

quantum as a social stress test.

if quantum computing ever becomes relevant to bitcoin, it will not arrive as a cinematic rupture. there will be no single moment when the system is “broken.” instead, it would surface as a gradual erosion of a specific assumption: that only the holder of a key can authorise the movement of coins. the threat is not to the ledger itself, but to the exclusivity of ownership.

this distinction matters. bitcoin does not depend on secrecy in the abstract. it depends on the idea that control cannot be impersonated. if a new class of machines were ever able to reconstruct ownership credentials from publicly visible information, the system would not collapse overnight. but ownership would become contestable. and contestable ownership is where scarcity begins to blur.

such a threat would not arrive evenly. bitcoin ownership is not a single, uniform thing. some forms of ownership already expose more information than others, simply by how they were created or how they have been used. coins held in older address formats, coins that have reused addresses repeatedly, coins that have moved through transparent scripts, or coins sitting on exchanges necessarily reveal more public data about the conditions under which they can be spent.

other coins are quieter. coins held in newer formats, coins that have never moved, coins protected by more conservative spending conditions disclose far less information to the outside world. they would remain safer for longer, not because their owners are more virtuous, but because there is less surface area to attack.

the result is that pressure would build asymmetrically. some coins would become attractive targets earlier, while others would remain effectively untouched. the system would not fail all at once. it would experience localized stress, visible theft attempts, and contested ownership at the margins. that asymmetry matters. it is precisely what would force the system to confront change before catastrophe, rather than after it.

at that point, bitcoin’s challenge would no longer be mathematical. it would be procedural.

the first step would be agreement on the threat itself. not philosophically, but operationally. what does “quantum capable” mean in practice? how powerful would such machines need to be? how reliable? how accessible? how much warning time would exist between theoretical vulnerability and real-world exploitation? without consensus on the threat model, there can be no consensus on the response.

the second step would be the introduction of new ownership rules. a new kind of lock. bitcoin does not replace its rules abruptly. it adds them cautiously. new rules are typically introduced in ways that allow voluntary adoption before anything old is disabled. this bias toward gradualism is deliberate. it reduces the risk of fragmentation, but it also stretches timelines.

the third step, and the one that dominates everything else, would be migration.

bitcoin cannot move coins on behalf of their owners. there is no administrator. no emergency authority. no recovery desk. holders would need to upgrade wallets, generate new addresses, and move their coins deliberately. exchanges would need to adapt. custodians would need to adapt. hardware manufacturers would need to adapt. this would be a multi-year process under the best of circumstances.

and then comes the question bitcoin has spent most of its existence trying to avoid.

what to do about the old rules.

leaving old ownership rules valid forever preserves neutrality. it ensures that coins valid under the rules at the time remain valid indefinitely. but in a world where those rules are compromised, it also leaves a permanent attack surface. disabling old rules protects the system more aggressively, but it strands anyone who is slow, offline, confused, or dead.

there is no solution here that is clean.

this is where the existence of lost coins becomes unavoidable. it is widely believed that satoshi nakamoto mined roughly one million coins in bitcoin’s earliest days and never moved them. beyond that, several million more coins are thought to be lost owing to forgotten keys, destroyed hardware, or owners who have died. estimates vary, but something like fifteen to twenty percent of the total supply may already be permanently inaccessible.

those coins cannot migrate. they do not upgrade. they do not respond. they simply sit.

in purely economic terms, this creates a tempting argument. disabling old rules would freeze a large share of supply. the remaining coins would instantly become more valuable. incumbents would benefit. attentiveness would be rewarded. scarcity would tighten mechanically. from a price perspective, it looks clean.

but bitcoin is not priced like a system that optimises for incumbent profit. it is priced like a system that optimises for rule legitimacy.

retroactively invalidating ownership that was valid under the rules at the time crosses a line bitcoin has been extraordinarily careful to avoid. not because it is sentimental, but because once a system demonstrates a willingness to forgo legitimate ownership for convenience, every remaining holder must price the risk of being next. the question shifts from “how scarce is this” to “what future behaviour might disqualify me.”

that uncertainty does not announce itself as outrage. it shows up as a higher risk premium. as hesitation. as capital demanding optionality rather than commitment.

history offers guidance here, but only if the analogies are used carefully. the gold confiscation of 1933 is often cited in these debates. it is relevant, but frequently misunderstood. gold did not lose its status as a politically neutral store of value. globally and over time, it retained it. what changed was the monetary regime attempting to bind itself to gold, not gold itself.

the united states abandoned gold because the standard had become too rigid to absorb trauma. deflation was crushing the economy. unemployment was mass. legitimacy was failing. the choice was not between fairness and enrichment. it was between preserving individual claims and preserving the system itself. that was a regime change, not an opportunistic confiscation.

bitcoin’s quantum problem, if it ever becomes real, belongs in that category. not discretionary loss within a stable framework, but a question of whether the framework itself can survive without resetting its assumptions. that does not remove the legitimacy cost. it explains when such a cost might be tolerated.

the bar, however, is extremely high.

any decision to disable old rules would create visible losers. estates. early participants. long-term cold storage. institutions with slow governance. people who played by the rules as they understood them at the time. history shows that such losses can be judged necessary, but only under existential justification, never economic optimisation.

this is why bitcoin has been so resistant to discretionary change. it will tolerate loss. it will tolerate dead keys. it will tolerate entropy. what it resists, almost to the point of paralysis, is retroactive punishment by rule change.

this is the real stress test quantum computing represents. not whether new cryptographic tools exist. they do. not whether mathematics can scale. it can. the question is whether a system built on voluntary consensus can coordinate early enough, calmly enough, and at sufficient scale to protect its own scarcity without tearing its legitimacy apart.

that answer will not be found in code. it will be found in human behaviour.

and that, more than any algorithm, is what markets are still trying to price.

drawdowns and temperament.

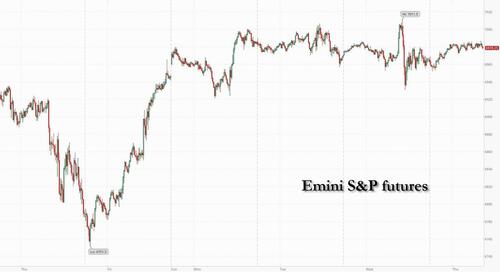

bitcoin is down roughly fifty percent. this is not unprecedented. it has happened before, roughly four times, and in several instances the drawdown extended to seventy or even eighty percent. these episodes are often described as failures. they are better understood as stress tests of temperament.

when major assets halve in value, the correct response is not moralisation. it is allocation. this is true of equities, bonds, property, and commodities. when the s&p falls sixty percent, long-term investors do not debate its legitimacy. they buy it. when long-dated treasuries lose half their value, the instruction is the same. systemic assets occasionally experience violent repricing and then persist. bitcoin, if it is to be treated seriously, cannot be exempt from that logic.

this does not mean bitcoin is risk-free. it is not. it carries idiosyncratic risks that traditional assets do not. protocol risk. governance risk. technological risk. those risks are real, and they are reflected in price. they don’t nullify the asset. they explain its volatility.

the mistake is to confuse volatility with fragility.

bitcoin is not protected from pain. it is protected from dilution. supply does not respond to price. losses cannot be offset by issuance. drawdowns, therefore, must be absorbed entirely through repricing. that makes them feel extreme. but it also means that recovery, when it occurs, is not undermined by structural expansion.

this is where temperament replaces ideology. and what is unusual is the emotional intensity attached to these moves.

bitcoin doesn’t behave like an asset that allows gradual accommodation. it confronts holders with repeated tests of conviction. sharp losses followed by long stretches of waiting. certainty about the long-term supply combined with uncertainty about near-term price. that combination is psychologically demanding in a way most assets are not.

this is not a bug. it is the consequence of a system that refuses to smooth outcomes through discretion. volatility is the price of rule rigidity. markets understand this intellectually. individuals struggle with it emotionally.

this is the point at which ideology tends to collapse. narratives fail. communities fracture. people who articulated the thesis most clearly are often the first to abandon it under pressure. not because the thesis changed, but because holding it became economically intolerable.

bitcoin’s drawdowns, then, are not evidence that the system is broken. they are evidence that it is still being held by humans.

that distinction matters as the argument turns to psychology, belief, and the limits of human endurance in the face of certainty combined with delay.

believe, mispricing, and the human discount.

if bitcoin were only a mathematical object, its pricing would be straightforward. fixed supply. known issuance path. no discretion. no response to price. scarcity enforced mechanically rather than culturally. in that world, valuation would be an exercise in discounting time and adoption, not temperament.

but bitcoin is not held by mathematics. it is held by people.

this is the gap the market continues to price. not uncertainty about the code, but uncertainty about human behavior under stress. not whether the rules will hold, but whether holders will.

from inception, bitcoin was framed as revelation rather than instrument. the hardest money. the chosen alternative. the end state. this framing attracted capital, but it also attracted devotion. and devotion is not a stable pricing mechanism. it produces extremes. euphoric bids followed by violent repudiation. certainty on the way up, disgust on the way down.

markets are comfortable pricing scarcity created by geology. they have centuries of experience doing so. gold does not ask holders to believe anything. it does not demand patience under explicit stress. it does not confront its owners with countdowns, halvings, or visible issuance cliffs. its supply leaks quietly over centuries. impersonally. nobody has to watch it happen.

bitcoin is different. its scarcity is pristine, but it is also theatrical. the issuance schedule is known. the halving dates are calendared. the future is visible. and humans do not handle visible certainty well, especially when the reward is delayed and the price path is violent.

behavioral finance has names for this. temporal discounting. loss aversion. cognitive dissonance. but labels are beside the point. the practical outcome is simple. people sell not when the thesis breaks, but when holding becomes psychologically intolerable.

this is why drawdowns cluster around moments of structural clarity rather than structural failure. the halving does not damage bitcoin. it clarifies it. supply tightens. expectations rise. volatility follows. and under that pressure, the weakest element in the system is exposed.

the weakest element is not the cryptography.

it is not the supply rule.

it is not the network.

it is the holder.

this is not a moral judgment. it is a structural observation. bitcoin asks humans to do something they are historically bad at: tolerate long periods of stagnation and drawdown in exchange for a future that feels intellectually certain but emotionally distant.

gold went through this process over decades. from 1980 to 2011, it failed to make a real high. the thesis did not change. the environment did. but those who were right too early experienced thirty years of indistinguishable wrongness. many abandoned the asset not because it stopped being scarce, but because waiting became unbearable.

bitcoin is compressing that experience into years rather than decades. its adolescence has been marked by repeated, brutal repricing. each one framed as terminal. each one survivable. the speed intensifies the stress. the transparency magnifies it.

this is why the valuation gap between bitcoin and gold remains so wide. gold’s scarcity is enforced by physics and tolerated by human indifference. bitcoin’s scarcity is enforced by code and tested by human psychology. markets price that difference.

to say bitcoin may be mispriced is not to claim inevitability. it is to observe that the discount applied to it appears to be dominated less by doubts about mathematics and more by doubts about the human process required to endure it.

whether that discount narrows over time is not a question of code.

it is a question of who ends up holding the asset.

and for how long.

the transition from narrative-driven ownership to process-driven ownership is slow, but it is not hypothetical. it has happened before. equity markets in the early 20th century were dominated by individuals reacting emotionally to price. today they are shaped by institutions, mandates, and machines that do not care how a drawdown feels, only how it fits within a distribution.

bitcoin appears to be moving through a similar maturation, compressed in time and amplified in volatility. early ownership was ideological. then speculative. what comes next is procedural. assets that survive long enough tend to shed believers and acquire custodians.

this shift does not eliminate volatility. it changes its character. drawdowns become less about loss of faith and more about rebalancing flows. price discovery becomes less theatrical and more mechanical. the asset stops asking to be believed in and starts being held because it fits.

hardness, elasticity, and what the market is still pricing.

it is worth returning, briefly and soberly, to first principles.

this is not an argument against fiat. nor is it a plea for monetary purity. fiat is not a mistake. it was a response. it emerged from the wreckage of the twentieth century, shaped by mass death, political collapse, and the recognition that rigid systems amplify trauma rather than absorb it. elastic money was not designed to be virtuous. it was designed to prevent societies from tearing themselves apart under economic stress.

by that standard, it has largely succeeded. again and again, in 1929, the 1970s, in 2000, 2008 and in 2020, fiat absorbed shocks that would otherwise have produced mass unemployment, institutional collapse, and political extremism. the cost has been inflation, moral hazard, and periodic outrage. but the alternative was worse. history makes that clear.

bitcoin does not exist to replace this system. it exists alongside it, asking a narrower and more uncomfortable question.

how much hardness can a monetary asset sustain without breaking its holders.

gold answers that question geologically.

supply responds to price. scarcity leaks slowly. nobody has to endure explicit tests of faith.

bitcoin answers it mathematically.

supply is fixed. issuance is known. scarcity is absolute. and the burden of adjustment falls entirely on price and psychology.

this difference matters for valuation.

gold’s total market value is roughly forty five trillion dollars. bitcoin’s is under one. geology is not forty five times more convincing than mathematics. but geology is indifferent to belief, while bitcoin requires humans to live inside its rules. markets price that difference aggressively.

bitcoin’s challenge has never been proving its hardness. it has been surviving the consequences of it. repeated drawdowns are not evidence that the system is flawed. they are evidence that its constraints are real. scarcity enforced without discretion produces volatility. volatility tests holders. most fail. a few persist. over time, ownership concentrates in hands that can tolerate the process.

this is why the asset still looks mispriced to some observers including myself. not because the mathematics are uncertain, but because the market continues to apply a heavy discount to the human process required to hold it. that discount may persist for years. it may narrow slowly. it may never fully disappear. none of those outcomes invalidate the structure.

bitcoin was framed early as revelation rather than instrument. that framing attracted devotion, and devotion made the journey harder than it needed to be. gold’s history offers a cautionary parallel. being right too early feels exactly like being wrong. conviction held without relief curdles into capitulation.

what matters now is not belief, but endurance.

bitcoin does not promise comfort. it does not promise justice. it does not promise to save anyone. it offers one thing only: a set of rules that do not bend to price, politics, or persuasion. whether that is valuable depends entirely on who is holding it and why.

the mathematics will almost certainly hold long enough. the question has always been whether we will.

and that, more than code or cryptography, is what the market continues to price.

hugh.

Read much more from Hugh at his 'The ACID Capitalist' substack here...

Tyler Durden

Thu, 02/12/2026 - 09:20

Reuters: Erik Prince, founder of Blackwater, attends a police and military presentation, in Guayaquil, Ecuador on April 5, 2025.

Reuters: Erik Prince, founder of Blackwater, attends a police and military presentation, in Guayaquil, Ecuador on April 5, 2025.

A customer enters during a soft opening at Burdell in Oakland, Calif., on Sept. 6, 2023. The Michelin Guide restaurant recently received an onslaught of poor reviews following a viral Reddit post. Douglas Zimmerman/SFGATE

A customer enters during a soft opening at Burdell in Oakland, Calif., on Sept. 6, 2023. The Michelin Guide restaurant recently received an onslaught of poor reviews following a viral Reddit post. Douglas Zimmerman/SFGATE

Minneapolis Police officer William Martin stands outside burning buildings near Lake Street in Minneapolis, Minnesota, following protests and property damage surrounding the police killing of George Floyd. Photo by Tony Webster/Minnesota Reformer.

Minneapolis Police officer William Martin stands outside burning buildings near Lake Street in Minneapolis, Minnesota, following protests and property damage surrounding the police killing of George Floyd. Photo by Tony Webster/Minnesota Reformer.

Recent comments