All Is Well... Or Is It?

Authored by Jim Quinn via The Burning Platform blog,

“If you depreciate the money, it makes everything look like it’s going up.” – Ray Dalio

“People don’t realize how hard it is to speak the truth to a world full of people who don’t realize they’re living a lie” – Edward Snowden

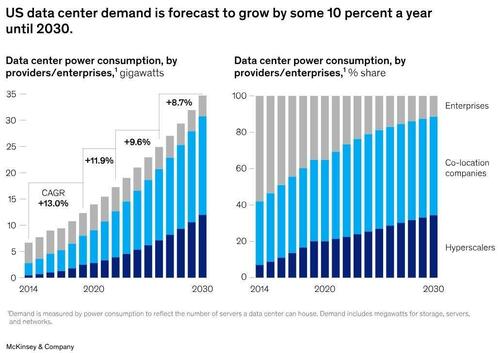

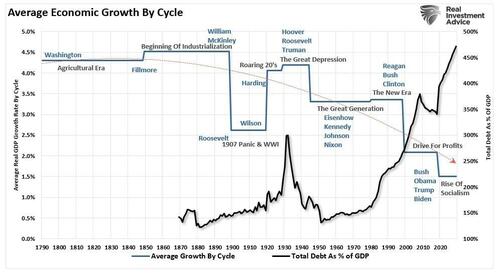

My government overlords and their legacy media propaganda outlets tell me the economy is booming because GDP is between 4% and 5%, the stock market is near all-time highs, inflation is declining, unemployment is low, and AI is going to transform our world for the better. According to their narrative, All is Well. Meanwhile, all hell is breaking loose in every facet of our everyday lives. We are seeing 6 sigma (once in 500 million) events in multiple markets (gold, silver, JPY bonds) within one week. Well functioning non-manipulated markets based on price discovery do not crash by 40% in one day, like silver did last week.

Government shutdowns, ICE shootings, massive welfare program fraud, passing more bloated spending bills, fake staged shutdowns, violent upheaval in Democrat run urban shitholes, uncovering and ignoring the 2020 election fraud, Democrats (with RINO support) desperately trying to stop the SAVE Act voter ID bill to continue their election fraud scheme, and Trump tariffing and threatening every country on earth if they don’t do what he says, makes every day seem like an exhausting slog towards perdition.

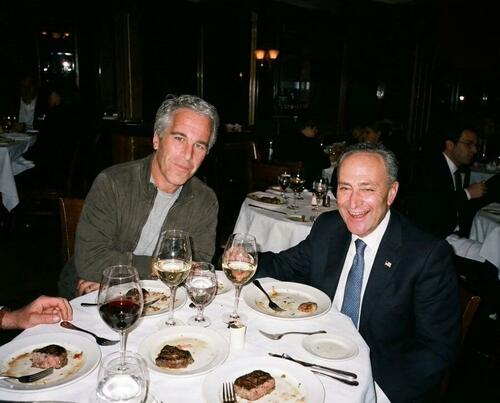

And now we know for a fact the world is run by Satan worshiping, vile, child molesting pedophiles, powerful sadistic billionaires, who use politicians, bankers, and their propaganda media whores to coverup their crimes against humanity. The information which has seen the light of day is revolting, disgusting, criminal, and makes any normal person physically ill. Imagine the material they haven’t released or have already destroyed. The evilness, degeneracy, and immorality of their acts is incomprehensible to the average person trying to live a moral life, earn a living and raise a family.

What is really stupefying to me is no one other than Epstein and Maxwell have been arrested. And it is pretty clear the Trump DOJ has absolutely no plans to arrest anyone for the most heinous crimes ever documented. Meanwhile, Trump rages against Thomas Massie, who was solely responsible for forcing the release of these incriminating documents, while being completely silent regarding the evil men who committed these despicable depraved acts upon children.

More revealing is the complete blackout on all the legacy media outlets of the Epstein file release. Nothing. Nada. Zilch. It’s almost as if they have been instructed to circle the wagons and pretend the Epstein files don’t exist. Remember the videos of dozens of news anchors mouthing the exact same propaganda slogans during the covid scamdemic? Our government and media are completely controlled by evil men wielding undue influence and power over every aspect of our lives. Without Twitter and some dedicated alt-media websites, the truth about the true nature of how our world actually runs would be completely silenced.

Our overlords use the CIA, Mossad, NSA, FBI and other means to control the narrative and lead the ignorant masses to their demise. It is absolutely true the MSM being silent about the Epstein files means at least 80% of the population has absolutely no idea they were even released. And even if they know, after decades of government school indoctrination, they are incurious and incapable of critical thought, just as the pedophile psychopaths planned. Aldous Huxley was right about so many things, especially how our masters deal with the truth.

“Great is truth, but still greater, from a practical point of view, is silence about truth” – Aldous Huxley

Silence about the truth is their plan and they continue to implement it with deceptive gusto, while manipulating the propaganda levers of mind control through the media, Wall Street, the DC swamp, billionaire funded NGOs creating chaos across the land, and bought off social media influencers pushing whatever narrative they are instructed to spew by Israel and their child sacrificing co-conspirators throughout the government, finance, media, and entertainment industries. The narrative is ALL IS WELL, when anyone capable of examining the facts knows all is not well. In fact, our current situation is awful and deteriorating by the minute. I will briefly examine whether things are well in the markets, the economy, personal finances, politics, and global relations.

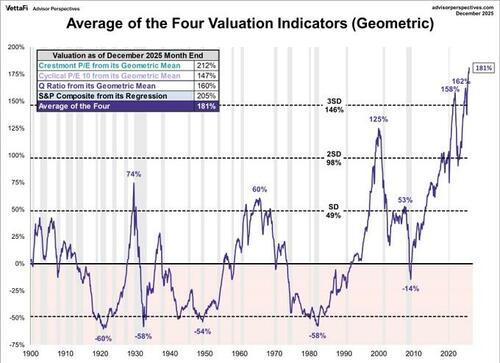

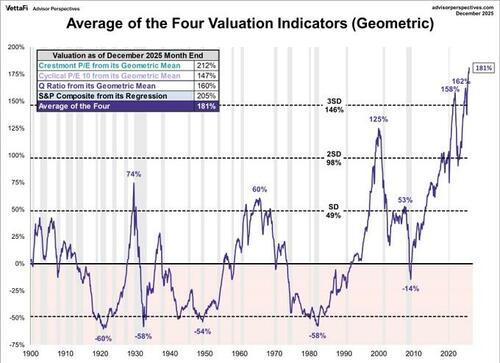

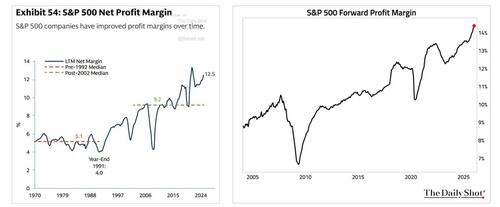

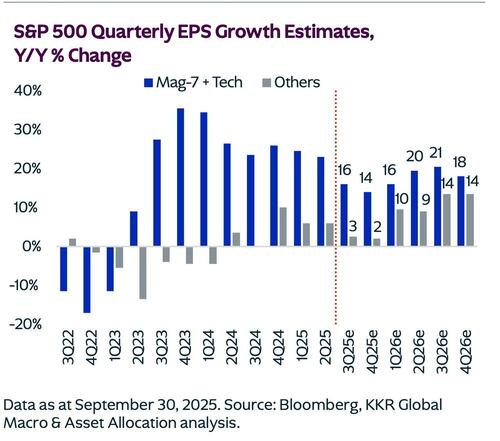

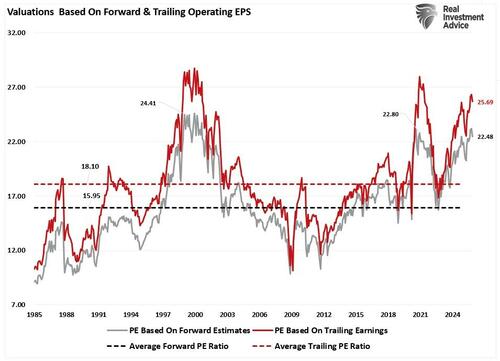

The standard response by those promoting the ALL IS WELL narrative is the stock market being within 2% of an all-time high. Scott Bessent and his band of hedge fund acolytes know they can manipulate the market upward whenever Trump does or says something astoundingly stupid. It can work in the short term because daily moves are based on emotion and momentum trading, but over the long term, earnings, valuations and reality will always win the day. The stock market valuation is currently 3 standard deviations above the long-term average and 45% above the Dotcom bubble valuation. We appear to be in a bubble seeking a pin.

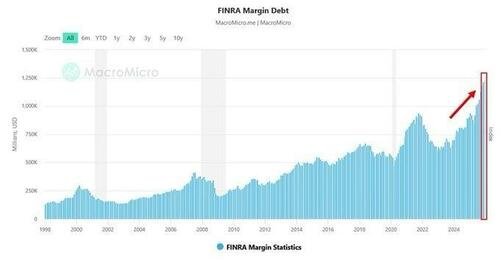

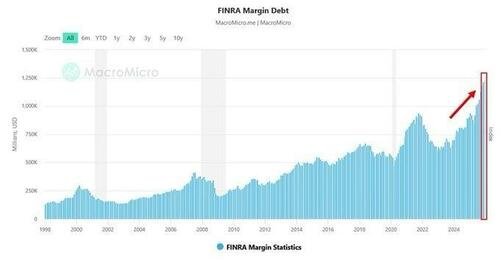

There is nothing like having the most overvalued market in history with margin debt at an all-time high as Wall Street has lured the suckers in at the top. Smart money exiting and selling to the noobs who have leveraged themselves in this “can’t miss opportunity of a lifetime”, is par for the course this century, as we pop our 4th bubble in 25 years. The engineered take down of gold and silver last week was violent and rapid, with no escape for the leveraged. The bloodbath when the margin calls begin to cascade during the coming stock market collapse will be a sight to see. It will be blood in the streets once again. Some people never learn.

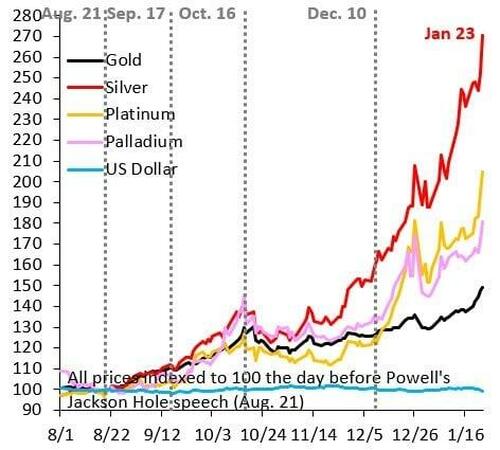

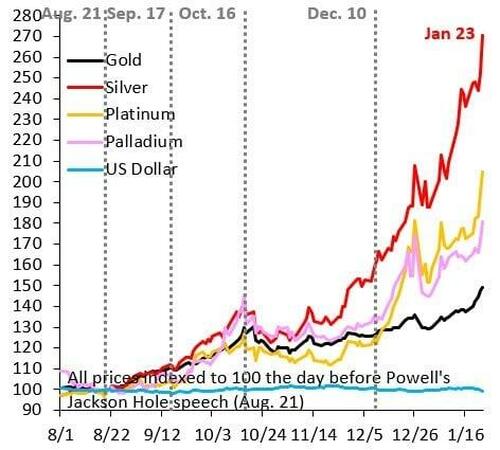

Charts become out of date pretty quickly when markets move as crazily as they have over the last month. Despite the USD only falling by about 1% since Powell’s August 21 speech confirming more rate cuts and the initiation of QE to infinity when markets were at record highs and the economy was supposedly booming, gold and silver took notice by soaring by 46% and 120% respectively. And this is after last week’s crash. When gold and silver act like meme stocks, all is not well beneath the surface of this economic system. Something is broken, on par with September 2019.

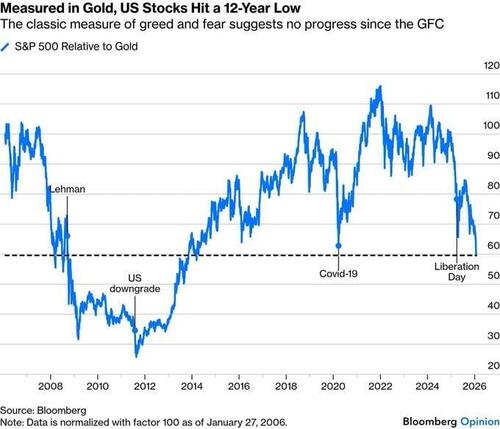

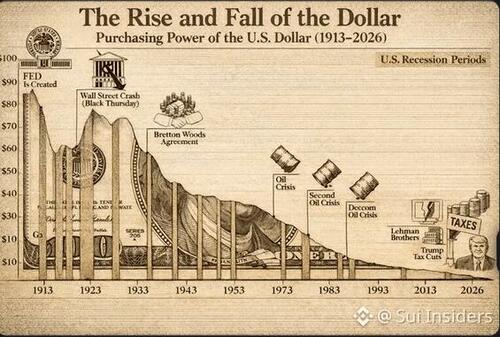

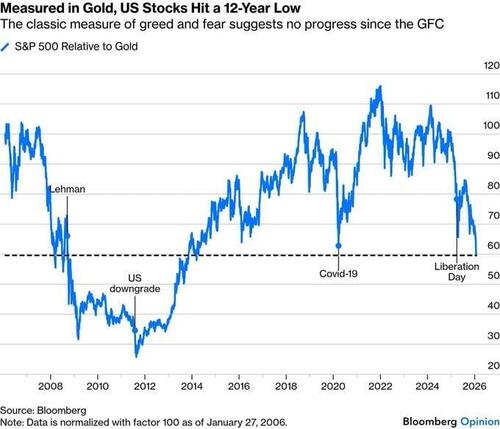

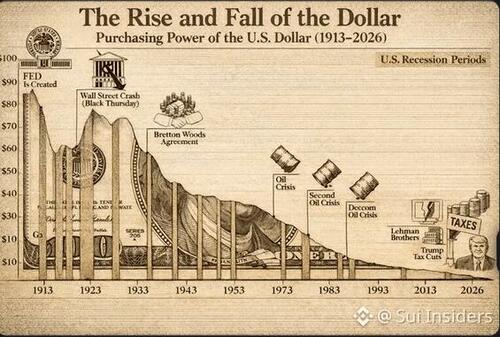

When you hear the bubble headed bimbos on CNBC cackle like Kamala about the all-time high in the S&P 500, you might want to keep the chart below in mind. The stock market measured in gold is at a 12 year low and is exactly where it was during the 2008 Great Financial Crisis. Those vacuous nitwits will never tell you gold has been the investment of the 21st century, going up by a factor of 17.5 versus a factor of 5 for the S&P 500. Gold isn’t really going up, the value of your perpetually printed fiat is going down.

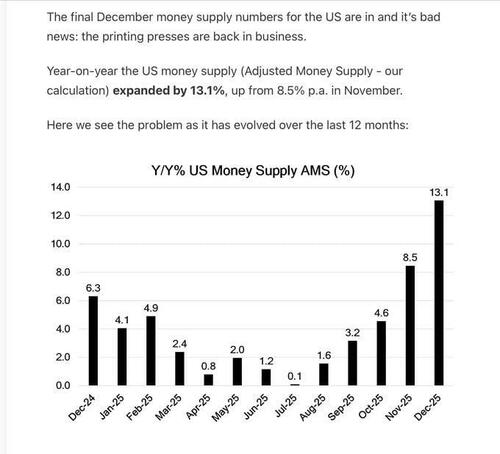

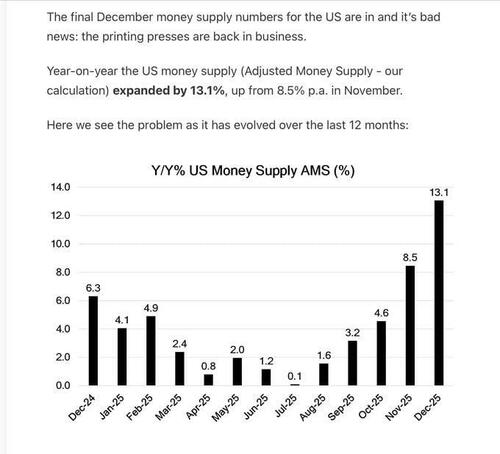

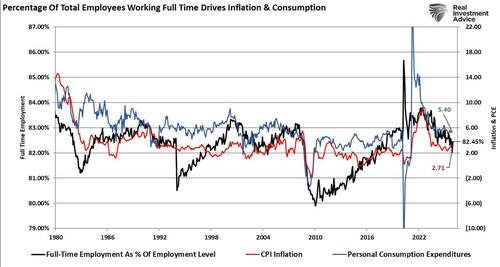

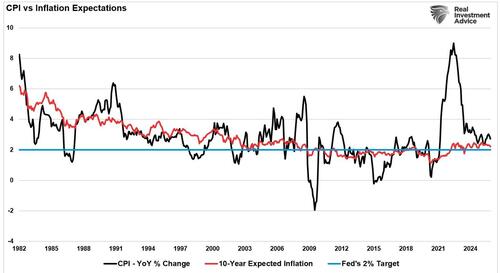

If you want to know the real reason gold and silver have soared and inflation numbers have begun to go higher, look no further than Powell and his Fed cronies firing up the old fiat printer by printing like we are in a financial crisis. Why would the Fed need to rapidly expand the money supply, cut rates by 175 basis points, and begin new QE bond purchases if ALL WAS WELL? Because all is unwell. This Potemkin economy is nothing but kabuki theater smoke and mirrors, with the average person struggling to survive, seeing utility, food, rent, insurance, taxes, tolls, and all daily living expenses continuing to outpace their income.

While Trump, his minions, and the banking cabal pretend the USD is solid as a rock, the rest of the world (mostly China) is in the midst of de-dollarizing their holdings. The tide has turned as the tsunami of inflation unleashed in 1913 has already wiped out 97% of the purchasing power of the USD. This flailing empire of debt is completely dependent upon the USD being the world’s reserve currency and will do anything (including war and kidnapping other world leaders) to maintain that supremacy. But, $2 trillion annual deficits, a $38.6 trillion national debt, over $200 trillion in unfunded welfare liabilities, and trying to provoke World War 3 should make the final 3% depreciation of the USD a real extravaganza of wealth destruction, bloody war, and societal collapse.

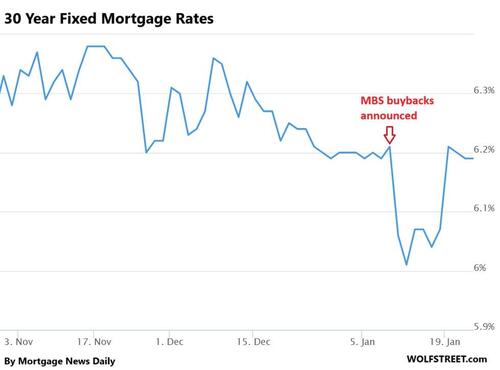

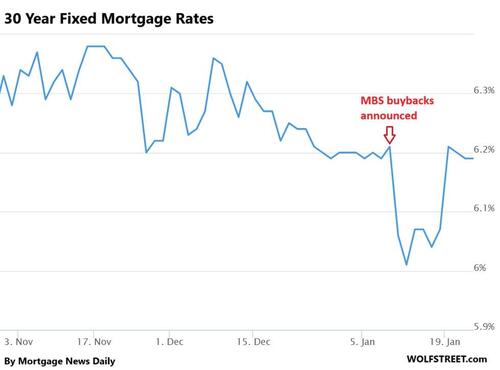

If ALL IS WELL, why has Trump used every possible means to bully Powell into cutting interest rates drastically, even demanding 1% rates again? If the economy is as fantastic as he says and the stock market is at all-time highs, why would we need much lower rates? The Fed began cutting in September of 2024, reducing rates by 1.75%. The 10 Year Treasury was at 3.65% when Powell began cutting. Today it is at 4.27%. For the math challenged, that is a .62% INCREASE since the Fed started cutting. The cuts have done nothing to make housing more affordable, while drastically reducing the interest income senior citizens and conservative savers were earning on their money market accounts.

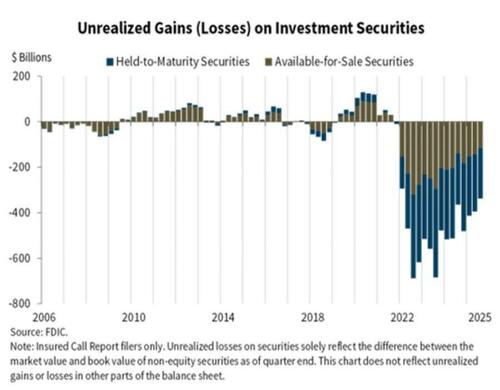

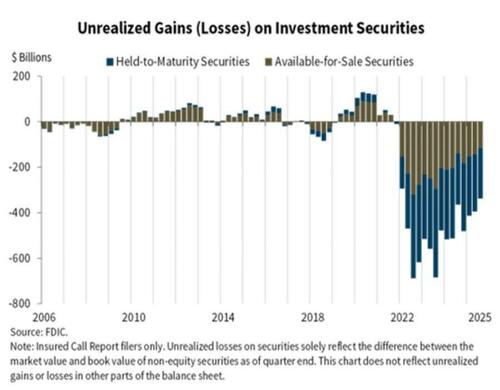

The real reason Powell has cut rates and Trump wants them cut more is because they are both beholden and controlled by the banking cabal and billionaire financiers. The titans of finance are sitting on hundreds of billions of unrealized losses due to their purchase of government bonds when interest rates were 0%. In a financial crisis, those unrealized losses would become realized losses due to forced selling. Trump, Powell and Warsh know what is coming and will do anything to protect their billionaire brethren, while throwing grandma and you under the bus.

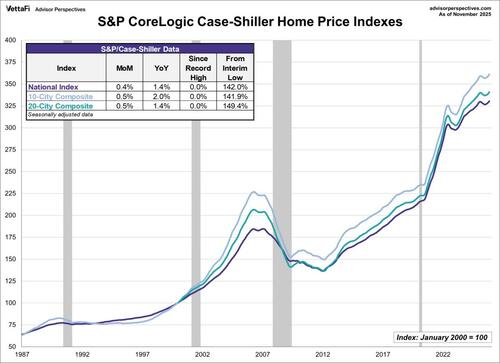

The selection of Kevin Warsh as the next Fed chairman is a bit of a head scratcher, because he has spent years criticizing Yellen and Powell about keeping interest rates too low and implementing QE to infinity in response to the Fed/Wall Street created financial debt disaster in 2008. He is supposedly a hawk, when Trump wants an ultra-dove who will slash rates. Trump has also done a 180 on home prices, as he declared during his campaign he wanted them 30% lower to help young people, and now he wants them higher to keep Boomers rich and his Wall Street pals richer.

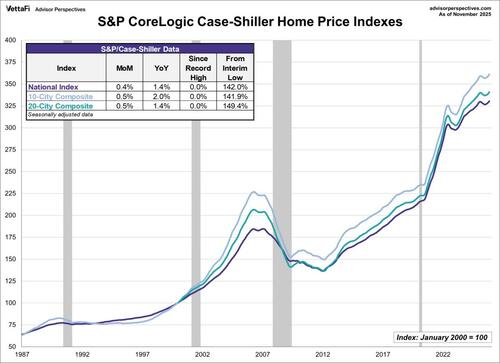

We currently have the most overvalued home prices in history, 60% higher than the 2005 bubble, and Trump wants the bubble to get bigger. After the last bubble, prices fell 30% over the next seven years, until the Fed, their Wall Street owners, and the government colluded to drive prices up by having hedge funds buy up the excess inventory, initiating the current bubble. I don’t know what will prick this bubble, but it is clearly unsustainable, as the average person can no longer afford to buy a home. A 50% decline over several years would be a best case scenario, but I believe the coming financial crisis will ignite a contagion that can’t be stopped.

The housing market is currently frozen, as sellers refuse to reduce prices and buyers can’t afford the current prices. This is why Trump desperately wants 3% mortgage rates again. Ain’t happening. The devastating inflation created by the Fed’s ZIRP has not been unwound. Inflation helps the banking cabal and billionaires, but destroys the standard of living for the average American. The curious selection of Warsh seems like a setup for when they “pull it”. Does Trump want a fall guy for when it all goes to hell, or is this all part of the Great Taking/CBDC plan to subjugate the masses in poverty, while the satanic demon child sacrificers reap the riches and increase their power and control over the world?

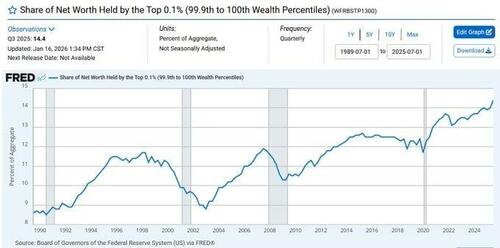

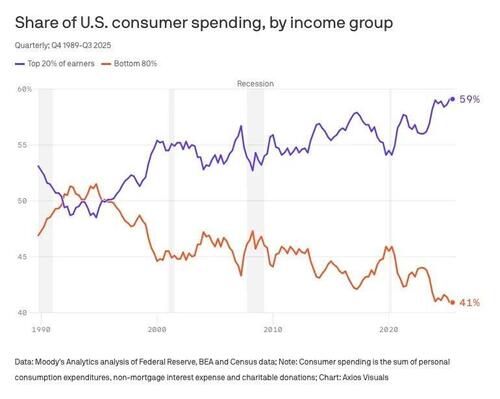

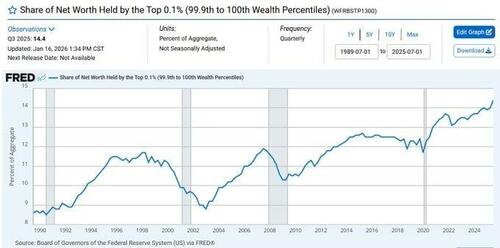

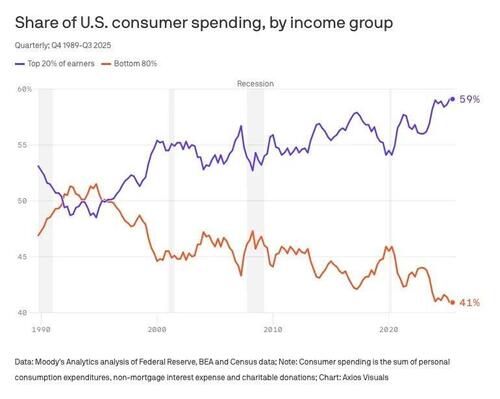

While financial and housing markets are simultaneously the most overvalued in world history, the average person trying to just live their life, raise a family, maintain a decent standard of living, and go on a modest annual vacation to the beach or mountains, is more financially stressed than they have ever been. The people who are not stressed are the 0.1% who rule the world (aka Epstein friends and family). They control over 14% of the country’s net worth, up from less than 9% in 2003. This has happened under the rule of both parties. The ruling class has engineered the financial system in way that siphons the riches to them, while steadily depleting the wealth of the masses.

Klaus Schwab’s Great Reset vision is materializing before our very eyes. The bottom 80% own nothing, have less and less to spend, but they aren’t very happy. When 80% of the population is seeing their standard of living decline rapidly, while observing the wealthy getting wealthier, and the evil elite normalizing pedophilia, child mutilation, and degeneracy as a lifestyle, the groundwork for violent revolution should be underway, with guillotines and gallows being constructed across the land.

The average person has depleted their savings and now lives month to month on their credit card, paying 20% interest to the Wall Street cabal. This is the way our overlords want it. The plebs are so busy trying to survive, while AI replaces their jobs, they have no time or hope, keeping them from ever revolting. The proles will never revolt because they don’t even know they are oppressed.

“The masses never revolt of their own accord, and they never revolt merely because they are oppressed. Indeed, so long as they are not permitted to have standards of comparison, they never even become aware that they are oppressed” – Orwell’s 1984

No matter how hard the propaganda machine insists the economy is great, the average person knows they are being screwed over by the ruling class and lied to by their president and his government apparatchiks. Consumer confidence is at a 12 year low, and falling, because consumers are out of money. When, even using the massively manipulated CPI promulgated by your government overlords, your dollar purchases 26% less than it did in 2019, while your income rose 15%, your confidence might be eroding. In reality, we all know prices are up at least 50%, no matter what Big Brother declares with certitude.

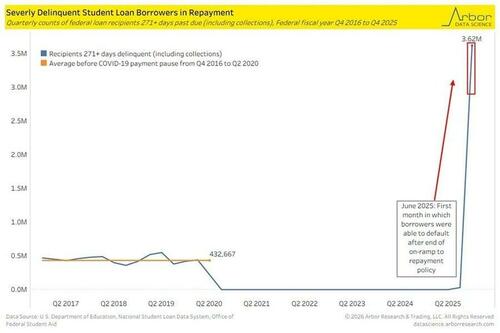

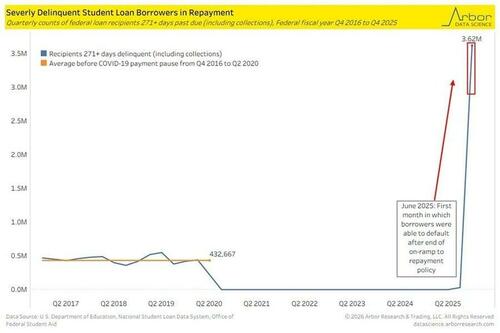

When it comes to consumers, especially the young, does the following chart seem to support the ALL IS WELL narrative? The Biden student loan “pause” is over and 3.6 million young adults who were lured into believing a degree in Transgender African Lesbian Studies would get them a high paying job FAFO. This is just student loan debt. Charts showing auto loan debt, credit card debt, and mortgage debt are all showing delinquency rates at the highest rates in over a decade. Yes, the richest of the rich are doing fabulously well as their stock portfolios soar and their AI scam continues to rake in more fools, but the average working stiff knows they have been abandoned by the people they elected, like always. Satanic Pedophiles rule!!!!

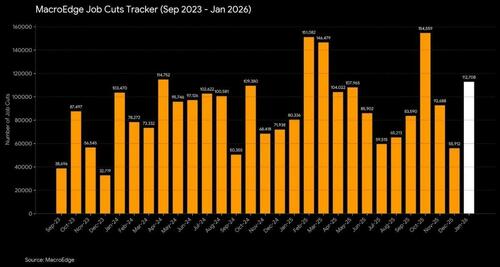

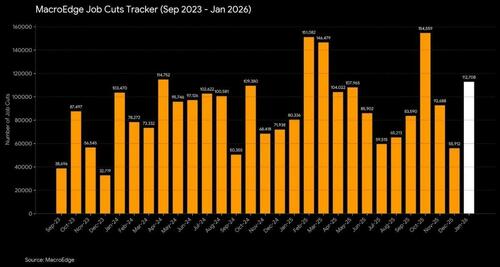

I believe the only thing keeping this shitshow from crashing down immediately is the no hire – no fire jobs market which has been in effect for the last year. If you still have some sort of job and can make the minimum payment on your credit card and your monthly rent payment, financial Armageddon is temporarily delayed. It is defaults on debts that begin the banquet of consequences for the economy, corporations, politicians, and bankers. We are essentially in an extend and pretend phase which is transitioning into another debt debacle crisis. Job cuts will be the spark that ignites the powder-keg of debt. Job cuts in January were 35% higher than last January and double the number in December. Not supportive of the ALL IS WELL narrative.

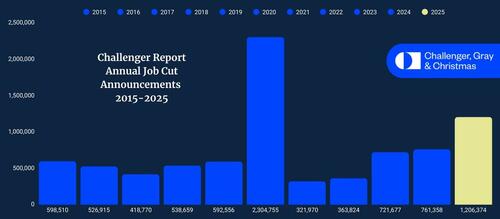

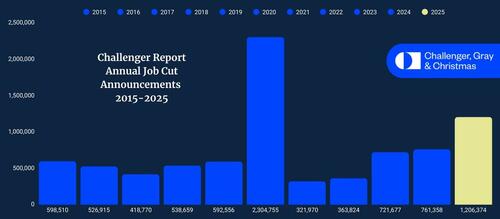

Meanwhile, on an annual basis the Challenger, Gray & Christmas job cut announcements in 2025 were 58% higher than 2024, and the highest in a decade, excluding the Covid scam year of 2020. The trend is not Trump’s friend.

The number of recently announced job cuts by major employers does not bode well for 2026:

- US Government: 307,000 employees

- UPS: 78,000 employees

- Amazon: 30,000 employees

- Intel: 25,000 employees

- Nissan: 20,000 employees

- Nestle: 16,000 employees

- Microsoft: 15,000 employees

- Bosch: 13,000 employees

- Dell: 12,000 employees

- Verizon: 13,000 employees

- Accenture: 11,000 employees

- Ford: 11,000 employees

- Novo Nordisk: 9,000 employees

The consumer confidence of AI and robots is probably at all-time highs, if they measured such stuff.

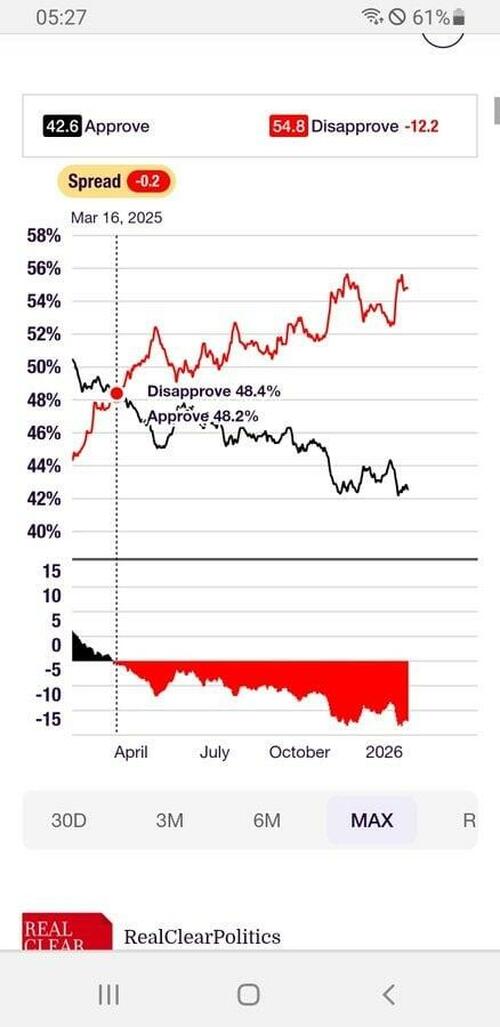

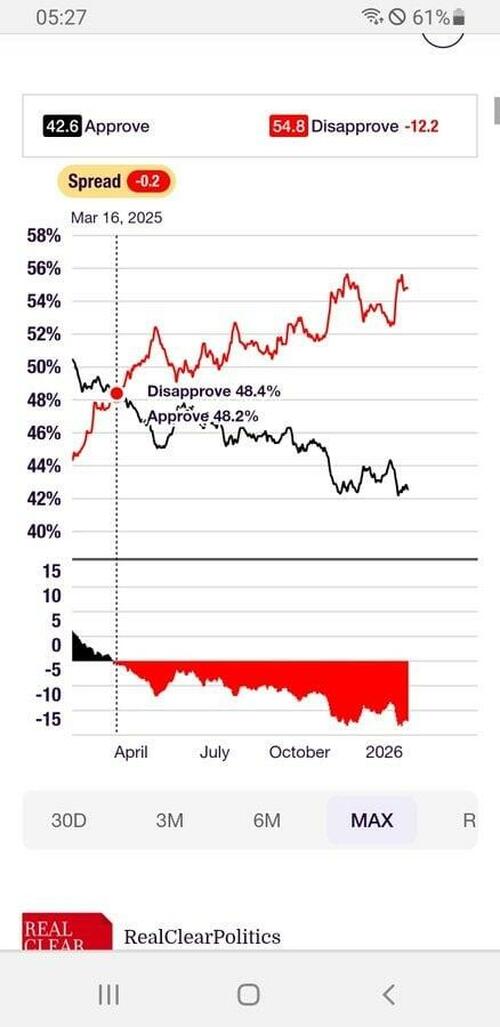

Based on the facts, not narratives, ALL IS NOT WELL and it will never be well again. So what does this mean for you and me? The mid-term elections are in ten months. Based on history, the president’s party loses seats 90% of the time. Based upon this do nothing GOP congress accomplishing nothing beneficial to the average person, Trump will surely lose the 6 seat majority House by at least 25 seats and at least a couple Senate seats. The GOP will not even pass the SAVE Act to secure honest elections. The Uni-party doesn’t seem to want honest elections. Trump’s approval rating continues to plummet and his daily unhinged posts on Truth Social are not helping. I expect Trump to act in an even more authoritarian manner as the elections approach. The MAGA NPCs will approve.

The real question in my mind is whether they “pull it” before or after the mid-terms. Based on Trumps actions, totally contrary to what he campaigned on and promised his voters, I have begun to believe he was installed to usher in another global financial collapse, with his “solution” being totalitarian government control of everything and everyone. The First and Second Amendment will be discarded. When the financial system enters collapse mode, they will bail-in (take) your 40lks, investment accounts and bank accounts in order to “Save the System”. All good patriots will go along, just like they did during the Covid plandemic. Your beloved overlords will dole out a certain amount of CBDC tokens to replace the money they stole from you.

Trump is one of them, as revealed by the Epstein files. When your government redacts the names of the pedophiles who raped children rather than the victims, you know your government does not represent you. The release of these monstrously despicable documents, with no effort to prosecute or arrest anyone, is meant to make us feel helpless and powerless to hold these fiends accountable. We are ruled by demonic, child sacrificing, satanists and we are not voting our way out of this. They seem to want violent upheaval, war, and chaos across the globe because they think it will benefit them. No one is coming to rescue us, because they are all in on it. After listening to Putin’s assessment of the West, you know why they are trying to destroy Russia.

“The West is being run by satanic pedophiles. They want to normalize pedophilia. They got accustomed for centuries to filling their bellies with humans flesh and their pockets with money. But the vampire ball is coming to an end.” – Vladimir Putin

We are truly in an existential battle between good and evil. The sinister psychopaths and their fiendish acolytes wield their power and wealth like a cudgel against the common man. They take joy in the misery and suffering of others. This is nothing but a game to them, and we are all expendable pieces on their board. Time is growing short and trust in any and all politicians, bankers, academics, and media personalities has dissolved. Our future as a country and a people will depend on the individual choices of millions of good people over the next few years. We outnumber these Satan worshiping deviants by millions. The law does not matter, because they wrote the law. They need to pay for their crimes by any means necessary. Buy more guns and ammo. Prepare for the ultimate battle.

“The greedy elite would rather be extremely rich in a suffering nation than modestly rich in a successful nation. The greater the misery, the greater their power, since power is the difference in wealth and influence between one person and another.” –Jesse, September 2012

Tyler Durden

Sat, 02/07/2026 - 15:10

President President Donald Trump (2L), Florida Gov. Ron DeSantis (L), and Secretary of Homeland Security Kristi Noem (R) tour a detention center for illegal immigrants, dubbed Alligator Alcatraz, located at the site of the Dade-Collier Training and Transition Airport in Ochopee, Fla., on July 1, 2025. Andrew Caballero-Reynolds/AFP via Getty Images

President President Donald Trump (2L), Florida Gov. Ron DeSantis (L), and Secretary of Homeland Security Kristi Noem (R) tour a detention center for illegal immigrants, dubbed Alligator Alcatraz, located at the site of the Dade-Collier Training and Transition Airport in Ochopee, Fla., on July 1, 2025. Andrew Caballero-Reynolds/AFP via Getty Images

Will Lewis, the chief executive and publisher of The Washington Post, has stepped down

Will Lewis, the chief executive and publisher of The Washington Post, has stepped down

The Uber logo is shown on the building in Los Angeles, Calif., on Feb. 14, 2024. Mike Blake/Reuters

The Uber logo is shown on the building in Los Angeles, Calif., on Feb. 14, 2024. Mike Blake/Reuters

via AFP

via AFP

A bird flies above a flag of the United Nations at the 'Palais des Nations' (Palace of Nations), which houses the United Nations offices in Geneva on Dec. 9, 2024. Fabrice Coffrini/AFP via Getty Images

A bird flies above a flag of the United Nations at the 'Palais des Nations' (Palace of Nations), which houses the United Nations offices in Geneva on Dec. 9, 2024. Fabrice Coffrini/AFP via Getty Images China's special climate envoy, Xie Zhenhua speaks during a joint China and U.S. statement on a declaration enhancing climate action in the 2020s on day 11 of the COP26 Climate Change Conference at the SEC in Glasgow, Scotland, on Nov. 10, 2021. Jeff J Mitchell/Getty Images

China's special climate envoy, Xie Zhenhua speaks during a joint China and U.S. statement on a declaration enhancing climate action in the 2020s on day 11 of the COP26 Climate Change Conference at the SEC in Glasgow, Scotland, on Nov. 10, 2021. Jeff J Mitchell/Getty Images Yalqun Yaqup, deputy director-general of the Xinjiang region public security department (L), next to Xu Guixiang, director of the information office of China's Xinjiang region, delivers a speech during a press conference against a long-delayed U.N. report that warns of possible crimes against humanity in Xinjiang, on the sidelines of the 51st Human Rights Council, in Geneva on Sept. 22, 2022. Fabrice Coffrini/ AFP via Getty Images

Yalqun Yaqup, deputy director-general of the Xinjiang region public security department (L), next to Xu Guixiang, director of the information office of China's Xinjiang region, delivers a speech during a press conference against a long-delayed U.N. report that warns of possible crimes against humanity in Xinjiang, on the sidelines of the 51st Human Rights Council, in Geneva on Sept. 22, 2022. Fabrice Coffrini/ AFP via Getty Images

Recent comments