Futures Muted Ahead Of Two Key Events

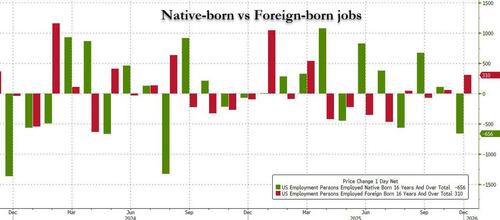

Stock futures are muted, with traders awaiting two major catalysts: A possible Supreme Court ruling on whether Trump’s tariffs are legal and December payrolls — a key datapoint for the trajectory of interest rates. As of 8:00amm, S&P 500 futures are up 0.1%, with Nasdaq 100 contracts +0.2% with Mag 7 stocks mixed premarket. Mortgage stocks jump after President Donald Trump said on his social media platform that he was directing the purchase of $200 billion in mortgage bonds. LoanDepot (LDI) +16%, Rocket Cos (RKT) +5%. A four-day streak of gains set the greenback on course for its best week since November, with the yen losing the most ground among major peers. Treasuries extended Thursday’s slide, with the 10-year rate rising two basis points to 4.18% as investors braced for Friday’s payrolls report and a possible Supreme Court ruling on President Donald Trump’s tariffs. Commodities are mixed: oil and silver rallied 0.5% and 1.3%, respectively, while base metals are mostly lower this morning. Today's US economic calendar includes December jobs report and October housing starts (8:30am), January preliminary University of Michigan sentiment (10am) and 3Q household change in net worth (12pm). Scheduled Fed speakers include Kashkari (10am), Bostic (12pm) and Barkin (1:35pm). We also get the Supreme Court ruling on Trump’s tariffs, typically released at 10am New York time.

In premarket trading, Mag 7 stocks are mixed (Alphabet +0.8%, Nvidia +0.3%, Apple +0.08%, Tesla +0.4%, Meta -0.2%, Microsoft -0.4%, Amazon -0.4%).

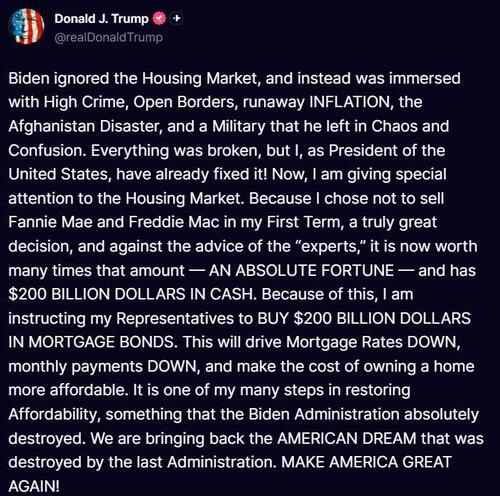

- Mortgage stocks jump after President Donald Trump said on his social media platform that he was directing the purchase of $200 billion in mortgage bonds. LoanDepot (LDI) +16%, Rocket Cos (RKT) +5%.

- Aquestive Therapeutics (AQST) slumps 47% after flagging an FDA saying the agency has identified deficiencies that preclude labeling discussions for Anaphylm at this time.

- AXT Inc. (AXTI) slides 14% after the semiconductor company’s fourth-quarter revenue forecast disappointed. The firm said revenue was impacted by fewer-than-expected export control permits for indium phosphide being issued by China’s Ministry of Commerce.

- Intel (INTC) is up 2% after President Donald Trump praised Intel CEO Lip-Bu Tan on social media after a meeting between the two.

- Oklo (OKLO) rises 19% and Vistra (VST) rallies 14% as Meta Platforms agreed to a series of electricity deals for its data centers that will make it the biggest buyer of nuclear power among its hyperscaler peers.

- Olin (OLN) is down 8% after the chemicals company forecast adjusted Ebitda for the fourth quarter that missed the average analyst estimate.

- Revolution Medicines (RVMD) gains 13% after the Financial Times reported that Merck is in talks to buy the cancer drugmaker.

- WD-40 Co. (WDFC) slumps 7% after the lubricant spray maker posted disappointing earnings per share for the first fiscal quarter, where sales increased only 1% from the year-ago period.

In other corporate news, Rio Tinto is in talks to buy Glencore to create the world’s biggest mining company with a combined market value of more than $200 billion. In tech, TSMC’s quarterly sales beat estimates, bolstering hopes for sustained global AI spending in 2026. Elon Musk’s AI startup xAI burned $7.8 billion in cash in the first nine months of the year, according to internal documents. General Motors shares are lower in premarket trading after it announced another $6 billion in charges tied to cutbacks in its electric vehicle and battery operations. And Johnson & Johnson, one of 17 companies Trump called on last summer to cut drug prices, reached a deal with the government to do so for some Americans.

The S&P 500’s early-year rally has gone off the boil over the past two sessions. The period has been marked by rotation away from some of the past years’ biggest artificial-intelligence names toward a broader set of tech players and sectors, with investors largely united in seeing the bull run continue.

Meanwhile, traders are preparing for two back-to-back risk events on Friday that may offer global equities their biggest test since a rebound from April’s tariff-driven slump. The payrolls data for December is particularly important for the clues it will offer on the outlook for US interest rates. Also on Friday we get the SCOTUS ruling on Trump tariffs: If the Supreme Court rules against Trump’s tariffs — with betting markets seeing a good chance of this — there are two schools of thought on how markets will react.

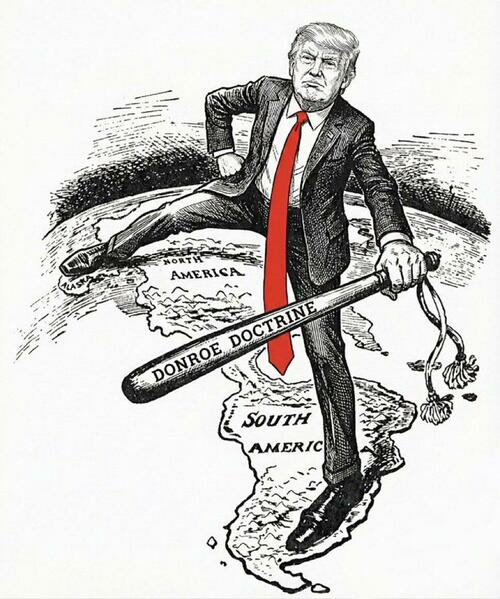

Stocks could rip on the prospect of a boost to company profits and consumer spending, while there may also be some relief that Trump’s excesses can be curbed. In the week since the US raid on Venezuela, Trump has threatened military strikes against drug cartels, told defense contractors to end buybacks and dividends, pledged to stop institutional investors buying more homes, and told Fannie Mae and Freddie Mac to buy $200 billion in mortgage bonds. Conversely, stocks may not like the prospect of lower Federal revenues and a wider deficit that pushes Treasury yields higher at a time when economic data give the Fed little reason to cut rates again anytime soon. See our Trader’s Guide to the decision.

“Returning those funds would weigh heavily on investor sentiment and could reignite a US bond selloff,” wrote Ipek Ozkardeskaya, senior analyst at Swissquote. “That said, US budget concerns have a long track record of being forgotten quickly. With or without tariffs, US debt continues to balloon.”

According to Goldman, NFP matters more. with Goldman expecting around 70k, in line with consensus. There are signs of labor-market stabilization. The Challenger data yesterday stood out… “The year closed with the fewest announced layoff plans all year… while December is typically slow, this coupled with higher hiring plans is a positive sign after a year of high job cutting plans.” If unemployment ticks down and NFP prints north of ~125k, that’s where rate volatility reawakens (bond vol small uptick). The sanguine rates view has been anchored on labor deceleration… but despite secular AI forces, overall GDP strength may matter more.

“The market is hoping for the jobs data to land on the fairway. Too much job creation would hint the economy is getting hot while a number close to zero would point, in contrast, to a slump,” said David Kruk, head of trading at La Financiere de l’Echiquier. “Neither option is good.”

The options market is signaling a muted S&P 500 reaction, with about a 0.6% move expected in either direction. JPMorgan’s head of global market intelligence, Andrew Tyler, expects the print to be in line or slightly stronger than consensus, triggering modest stock-index gains. Here is JPM's reaction matrix (full preview here).

- Above 105k. SPX is down 0.5% – 1%: probability 5%

- Between 75k – 100k. SPX gains 0.25% to 1%: probability 25%

- Between 35k – 75k. SPX gains 0.25% – 0.75%; probability 40%

- Between 0k – 35k. SPX loses 0.25% to gains 0.5%: probability 25%

- Below 0k. SPX is down 0.5% to 1.25%: Probability 5%

The tariff decision and jobs data will land in a surprisingly calm backdrop. The VIX — historically volatile in the first quarter — has been remarkably subdued amid a whirlwind of geopolitical news in the first week of 2026. In flows, money market funds attracted their third-largest weekly inflows ever, with the first week of the year typically strong for these funds, while US equities had outflows, Bank of America said.

In Europe, Stoxx 600 is up 0.5% with mining shares among the biggest gainers, after Rio Tinto and Glencore held talks to form the world’s largest miner. Technology and consumer stocks outperform, while insurers lag.Here are some of the biggest movers on Friday:

- Glencore shares rise as much as 9.9% in London, hitting the highest since July 2024, after the miner confirmed it is in talks with Rio Tinto for a potential combination of some or all of their businesses including an all-share takeover, which would create the world’s biggest mining company.

- Tecan shares rise as much as 9%, the most since August, after the Swiss maker of laboratory equipment reported order growth in the second half of 2025 that was better than expected.

- L’Oreal shares rise as much as 5.1%, the most since July, as UBS upgrades the cosmetics group to buy from neutral, predicting an improvement in industry growth and the cosmetics group’s like-for-like sales outperformance.

- TeamViewer shares rise as much as 8.4%, the most since September, after the software company reported FY25 sales in line with lowered estimates following a profit warning in October.

- Yara International shares climb as much as 2.8% after the fertilizer company outlined ambitions to grow free cashflow by $600m by 2030, compared to 2024 levels, ahead of its capital markets day.

- Sainsbury’s shares drop as much as 6.4% after the UK grocer reported disappointing sales for the holiday period. Analysts noted that while food sales were good, the non-food units (general merchandise, clothing and Argos) were weaker than expected and indicate ongoing consumer uncertainty.

- Sartorius shares drop as much as 2.9% after RBC Capital Markets cut its rating on the stock to sector perform from outperform, citing “likely cautious industry commentary and strong share outperformance.”

- SocGen shares fall as much as 2.6% after Kepler Cheuvreux cut its recommendation to reduce from buy following a rally over the past three months.

- Euronext shares fall as much as 3.8% after BofA Global Research cut its rating to neutral due to high trading comps in 1H as volatility subsides.

Asian stocks fluctuated, with Japan outperforming regional peers, as investors awaited key US economic data and a possible US Supreme Court ruling on US tariffs.

The MSCI Asia Pacific Index rose as much as 0.4% before paring gains, putting it on track for a weekly gain of about 1.6%, which would mark its best full week at the start of a year since 2023. Japanese stocks climbed as the yen weakened against the dollar and Fast Retailing reported strong earnings. Benchmarks also rose in South Korea, Hong Kong and China, while Taiwan slipped. Asian equities have had a mostly strong start in 2026, helped by continued enthusiasm over artificial intelligence, though geopolitical tensions have sparked some concerns. Investors are now focused on a potential decision by the top US court as early as Friday on the legality of President Donald Trump’s tariffs, with large implications for Asian exporters. Next week, results are due from companies including TSMC and Tata Consultancy Services. Investors also await South Korea’s monetary policy meeting and Japan’s producer price data.

In FX, the dollar rises for a fourth consecutive session to the highest in a month, up against most major currencies ahead of payrolls data and a potential Supreme Court decision on President’s Trump’s tariffs. The yen is underperforming.

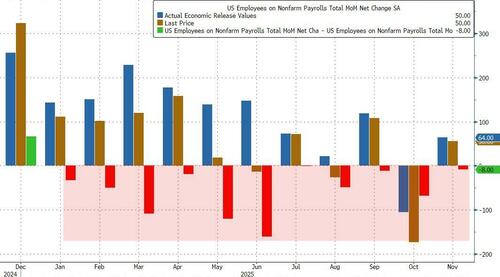

In rates, treasuries are weaker, with 10-year yields up about two basis points. Bonds across Europe and the UK little changed, though gilts are on track for the best week in months. Treasuries futures hold small losses in early US trading, near session lows with yields 1bp-2bp higher, underperforming European bond markets slightly. Move unwinds the late Thursday rally for long-end tenors — and related move in swap spreads — that followed Trump’s directive that Fannie Mae and Freddie Mac purchase $200 billion in mortgage bonds. US 10-year yield near 4.185% is about 2bp higher on the day with German and UK counterparts little changed. Curve spreads are little changed, with 5s30s around 110bp, holding Thursday’s flattening move. Ahead of jobs report, swap contracts price in about 10bp of Fed easing is price in over January and March policy meetings; median economist estimate is for 70k nonfarm payrolls increase vs 64k in November; crowd-sourced whisper number is 69k. Focal point’s of Friday’s US session include December jobs report and potential Supreme Court ruling on Trump’s tariffs, typically released at 10am New York time.

In commodities, oil held onto its biggest daily gain since October, as Iran attempted to quell escalating protests while Trump threatened repercussions if demonstrators were targeted. Trump also said that a second wave of attacks on Venezuela was called off due to improved cooperation from the authorities. Brent now up 0.9%, trading above $62/barrel. Gold prices little changed, silver rebounding and copper pushing closer to $13,000/ton.

Today's US economic calendar includes December jobs report and October housing starts (8:30am), January preliminary University of Michigan sentiment (10am) and 3Q household change in net worth (12pm). Scheduled Fed speakers include Kashkari (10am), Bostic (12pm) and Barkin (1:35pm). We also get the Supreme Court ruling on Trump’s tariffs, typically released at 10am New York time.

Market Snapshot

- S&P 500 mini little changed

- Nasdaq 100 mini +0.2%

- Russell 2000 mini +0.1%

- Stoxx Europe 600 +0.4%

- DAX little changed, CAC 40 +0.6%

- 10-year Treasury yield +2 basis points at 4.19%

- VIX +0.2 points at 15.65

- Bloomberg Dollar Index +0.2% at 1211.28

- euro -0.2% at $1.164

- WTI crude +0.5% at $58.02/barrel

Central Banks

- BoJ officials are set to keep rates on hold this month, Bloomberg reported citing sources; adds that officials have no preconceptions on the pace of hiking rates. Officials see little need to shift underlying inflation view. Will closely watch impact of weakening JPY. Likely to raise economic growth outlook on stimulus. The Bank is said to weigh downgrade of CPI outlook on government measures.

- ECB's Radev said the current level of rates is appropriate.

- TD is now expecting the RBA to raise rates by 25bps at its next meeting in February.

- Thai Central Bank Chief said gold trading has significant impact on Thai Baht.

Top Overnight News

- Trump directed Fannie Mae and Freddie Mac to purchase $200 billion in mortgage bonds to bring down housing-loan rates. Mortgage debt and US home-lender stocks rose premarket. BBG

- The US Supreme Court will probably rule that the Trump administration’s fentanyl and reciprocal trade tariffs are unlawful, in a decision that may come today. But any refunds probably wouldn’t be immediate and other statutes may be used to recreate the levies. BBG

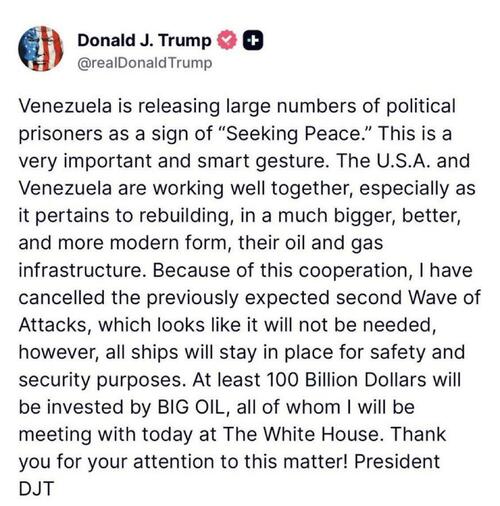

- Trump on Venezuela: "I cancelled the previously expected second Wave of Attacks, which looks like it will not be needed, however, all ships will stay in place for safety and security purposes". Trump also said Thursday that the world’s largest oil companies had pledged to spend $100 billion to fulfill his promise of reviving Venezuela’s flagging oil sector. Politico

- US shale bosses have warned Trump that his mission to seize Venezuela’s oil sector and drive down crude prices will put American output on the chopping block. Trump is set to meet US Big Oil chiefs on Friday, and said Venezuela is cooperating and “cancelled” a second wave of attacks on the country. FT, BBG

- Treasury Secretary Bessent said US won't force institutional investors to divest from home buying, also said lowering the suspicious activity report threshold to USD 3,000 and noted probe related to money services businesses in Minnesota.

- Meta signed a series of electricity deals for its data centers, making it the biggest buyer of nuclear power among its peers. BBG

- Majority of US House voted to support the bill to renew health insurance subsidies for three years.

- China’s consumer inflation picked up modestly in December, while factory-gate prices remained in contraction, capping another year marked by persistent deflationary pressures amid weak domestic demand. Dec CPI comes in at +0.8% (inline w/the Street and up from +0.7% in Nov) while the PPI improved to -1.9% (up from -2.2% in Nov and vs. the Street -2%) WSJ

- Chinese crackdowns on chemicals used to make illicit fentanyl may have played a significant role in the sharp reduction of US overdose deaths. WaPo

- Hedge funds made their largest asset gains on record in 2025, as investors shift away from struggling private equity investments and seek to offset exposure to equities amid concerns about a bubble. The size of the global HF industry increased by about $628 bn in 2025. FT

- South Korean Finance Ministry said will allow around-the-clock FX trading from July. said: To explore the possibility of joining CPTPP. To bring in various improvements to stock and forex markets for MSCI upgrade. To prepare policy support for semiconductor defence, biopharmaceutical, petrochemical, steel and steel industries. To introduce digital asset spot ETFs. USD 350bln in US investment package is to bolster shipbuilding and nuclear energy sectors.

Trade/Tariffs

- US GOP is reportedly pushing ahead to prevent China from getting access to US tech such as chips, via Axios.

- EU decision on Mercosur should come before 16:00GMT, Politico reported. Examination of the safeguard text will begin at around 10:00GMT. Italy is reportedly still weighing how much backlash it can absorb before agreeing to the deal, according to the diplomats cited. Italy continues to edge closer to supporting the agreement.

- Japan's Finance Minister Katayama will meet counterparts in Washington between January 11th to 14th on rare earth supplies.

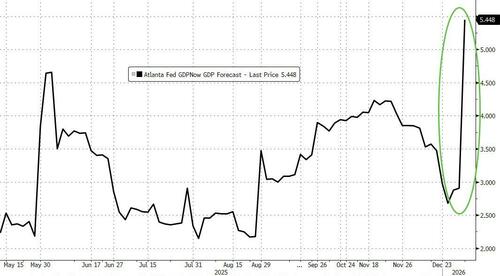

- US President Trump posted that data shows the US has the lowest trade deficit since 2009, and is going even lower, adds GDP is predicted to come in at over 5%, and success of the country is due to tariffs.

- Japanese food and alcohol products are reportedly seeing customs delays in China, according to Nikkei.

- UK PM Starmer will exclude the City of London from his push for “closer alignment” with the EU, following lobbying by financial services firms against any return to Brussels rule, FT reported.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks followed suit to the mixed performance on Wall Street with the regional bourses predominantly in the green, albeit with traders bracing for the US Non-Farm Payrolls report and a potential Supreme Court's ruling on tariffs. ASX 200 was ultimately flat as strength in energy and consumer stocks was offset by losses in financials, tech and mining, while Rio Tinto shares fell by more than 6% after reports that the Co. and Glencore revived merger talks. Nikkei 225 outperformed following the stronger-than-expected Household Spending data from Japan, which showed surprise Y/Y growth of 2.9% (exp. -0.9%), while the gains were led by index heavyweight Fast Retailing after it posted higher profits and upgraded its guidance. Hang Seng and Shanghai Comp were indecisive after mixed inflation data from China and the substantial weekly liquidity drain by the PBoC, while there was a mixed reaction in tech stocks following reports that China is to approve some NVIDIA (NVDA) H200 purchases as soon as this quarter.

Top Asian News

- Japan megabanks are to jointly lend USD 1.5bln to the Saudi government.

- Capital Economics said regarding China's inflation that the recent pickup in consumer inflation in China was driven by temporary factors like weather-related food price hikes and not successful policy measures. said:With these disruptions easing, headline inflation could turn negative again.

- South Korea's Blue House said President Lee and Japanese PM Takeichi are to discuss regional peace and stability and rapidly changing global politics, while the sides may discuss China-Japan disputes at their summit next week.

- China's Vice Premier Ding Xuexiang met with Disney's (DIS) CEO in Beijing and said they welcome companies to invest in China, according to Xinhua.

- Mediatek (2454 TT) 2025 Revenue +12.3% Y/Y.

- Acer (2353 TT) - FY25 (TWD): Revenue 28.5bln (prev. 24.5bln Y/Y).

- TSMC (2330 TT) December (TWD) rev. 335.0bln (prev. 343.6bln M/M), 2025 rev. rose 32% Y/Y to 3.81tln.

European equities (STOXX 600 +0.4%) have opened mostly on a strong footing, tracking tailwind from APAC which finished higher after tentative trade during most part of the session. European sectors have opened slightly skewed to the green. Basic Resources is boosted by upside in Glencore (+8%) after the Co. and Rio Tinto (-2%) resumed talks on a mining megadeal. Elsewhere, ASML (+4.4%) jumps following strong Q4 TSMC (+0.7% pre-market) earnings, where its revenue jumped 20%.

Top European News

- German Industrial Production MoM (Nov) M/M 0.8% vs. Exp. -0.4% (Prev. 1.8%); driven mainly by autos.

- German Balance of Trade (Nov) 13.1B vs. Exp. 16.5B (Prev. 16.9B, Rev. 16.9B).

- German Imports MoM (Nov) M/M 0.8% vs. Exp. 0.2% (Prev. -1.2%).

- German Exports MoM (Nov) M/M -2.5% vs. Exp. 0% (Prev. 0.1%).

FX

- DXY has been edging higher since APAC trade as traders position for the US jobs report, with the US data yesterday also pointing to no imminent meltdown in the labour market (with the 4-week initial claims average hitting its lowest level since April 2024, while Revelio estimated growth of 71k jobs). Headline nonfarm payrolls are expected to be relatively in line with the prior. Consensus looks for 60k nonfarm payrolls to be added to the economy vs the 64k in November.

- JPY is the laggard amid a double-whammy from the firmer USD alongside net-dovish BoJ sources, via Bloomberg, which suggests BoJ officials are set to keep rates on hold this month, and that officials have no pre-conceptions on the pace of hiking rates. USD/JPY looks set to test a couple of resistance levels (19th Dec high at 157.76 and the 20th Nov peak at 157.89) ahead of 158.00.

- Elsewhere, G10s are broadly lower with the antipodeans among the worst performers despite firmer copper prices and positive risk sentiment, but after Chinese CPI Y/Y missed forecasts. European FX are mildly pressured by the USD with region-specific catalysts on the lighter end. EUR/USD saw no reaction to above-forecast November Retail Sales or commentary from ECB’s newest member Radev, who joined as Bulgaria officially adopted the EUR.

Fixed Income

- A contained session for fixed income as we count down to US NFP.

- Into that, USTs are holding in a narrow 112-05 to 112-12+ band. As it stands, markets ascribe around a 13% chance of a cut in January, with a move not implied until the June meeting, where there are c. 22% implied odds for a hold. For 2026 as a whole, pricing currently looks for the Fed Funds Rate to end the year in a 3.00-3.25% band vs the current 3.50-3.75%, according to CME FedWatch.

- Bunds are also rangebound. No move to the morning's very strong November Industrial Production, a series that was driven primarily by 7.8% M/M growth in autos. That aside, specifics for EGBs are a little light with all eyes on NFP. For the bloc, we await the EU-Mercosur deal vote; it should pass; however, the support of Italy is not guaranteed, but is needed to hit the 'qualified majority' rule. On that point, France is set to vote against the Mercosur deal, as things currently stand with the safeguards.

- China's Finance Ministry sold 10-year bonds with the yield at 1.8627%. Into this, the OAT-Bund 10yr yield spread remains steady around the 70bps mark.

- US FHFA Director Pulte said President Trump's USD 200bln mortgage bond order can be executed quickly and that Fannie Mae and Freddie Mac have cash to buy.

- US President Trump instructing representatives to buy USD 200bln in Mortgage Bonds to drive down mortgage rates and make cost of owning a home more affordable.

Commodities

- Following Thursday’s bid higher, which saw WTI Feb return above USD 58/bbl and Brent Mar briefly topping beyond USD 62/bbl, benchmarks have fallen back lower at the start of Friday’s European session. WTI and Brent extended the lower bound of APAC’s USD 0.55/bbl range to trough at USD 57.62/bbl and USD 61.83/bbl respectively before rebounding to USD 58/bbl and USD 62.20/bbl.

- Spot XAU started the Asia-Pac session on the backfoot, slowly falling from USD 4484/oz to USD 4453/oz, before oscillating in a tight c. USD 25/oz band as the European morning continues as markets await the highly-anticipated NFP report and the potential SCOTUS tariff decision.

- After 2 days of selling from its ATH at USD 13.39k/t, 3M LME Copper has started to rebound from Thursday’s trough of USD 12.52k/t and is currently trading at USD 12.92k/t as the European session continues. The recent selloff in red metal comes amid a selloff in the tech-heavy NQ, with copper being a much-needed material in the semiconductor space.

- Senior Thai Financial Official said they are looking into potential tax measures on gold trading and/or imports.

- US shale chiefs warned that Venezuelan oil will hobble US drillers and that the President’s effort to reduce crude prices will hurt the sector struggling to sustain production growth, according to FT.

- US President Trump said companies will spend at least USD 100bln in Venezuela and he is meeting with oil executives on Friday.

- Marathon Petroleum (MPC) reportedly interested in Venezuelan oil and plans to submit a bid.

- US Interior Secretary Burgum said the US is ending the discount on Venezuelan oil for China. Knocking Russia out of the Venezuelan oil market. Venezuela won't use Russian diluent anymore.

- Russian crude oil production came in at 9.33mln BPD in December, Bloomberg reports; over 100k BPD below November's level due to drone activity and the impact of sanctions.

Geopolitics: Ukraine

- Russian drone attack on Kyiv causes explosions and triggers a fire, according to the mayor.

- US Interior Secretary Burgum said the US is ending discount on Venezuelan oil for China. Knocking Russia out of the Venezuelan oil market. Venezuela won't use Russian diluent anymore.

Geopolitics: Middle-East

- Iran Supreme Leader Khamenei said US President Trump should focus on running his own country. Iran won't back down in the face of vandalism. Will not tolerate foreign-backed operatives.

- Iran's Supreme Leader Khamenei is to give a speech about protests momentarily, according to state media.

- Iranian state media claimed that terrorist agents from the US and Israel set fires and sparked violence on the streets amid unrest, according to Sky News.

- Palestinian media reported Israeli raids continue on various areas of the Gaza Strip, according to Sky News Arabia.

- Israel rejected Lebanon's claim that Hezbollah has been disarmed, saying the effort is far from sufficient and that the group is rearming with Iranian support.

Geopolitics: Other

- Iran Supreme Leader Khamenei said US President Trump should focus on running his own country. Iran won't back down in the face of vandalism. Will not tolerate foreign-backed operatives.

- China's Foreign Ministry, on US President Trump's remarks on Taiwan, said there is no room for any external interference and the issue is purely an internal matter.

- Iranian state media claimed that terrorist agents from the US and Israel set fires and sparked violence on the streets amid unrest, according to Sky News.

- South Korea's Blue House said President Lee and Japanese PM Takeichi are to discuss regional peace and stability and rapidly changing global politics, while the sides may discuss China-Japan disputes at their summit next week.

- US President Trump said they will start hitting cartels on land and he has asked Venezuela to free political prisoners.

- Palestinian media reported Israeli raids continue on various areas of the Gaza Strip, according to Sky News Arabia.

- Israel rejected Lebanon's claim that Hezbollah has been disarmed, saying the effort is far from sufficient and that the group is rearming with Iranian support.

- Russian drone attack on Kyiv causes explosions and triggers a fire, according to the mayor.

US Event Calendar

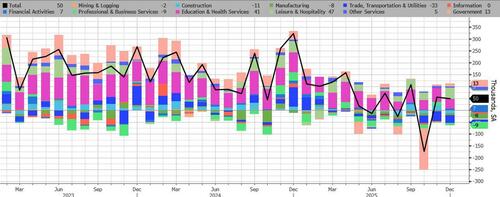

- 8:30 am: Dec Change in Nonfarm Payrolls, est. 70k, prior 64k

- 8:30 am: Dec Change in Private Payrolls, est. 75k, prior 69k

- 8:30 am: Dec Change in Manufact. Payrolls, est. -5k, prior -5k

- 8:30 am: Dec Average Hourly Earnings MoM, est. 0.3%, prior 0.1%

- 8:30 am: Dec Average Hourly Earnings YoY, est. 3.6%, prior 3.5%

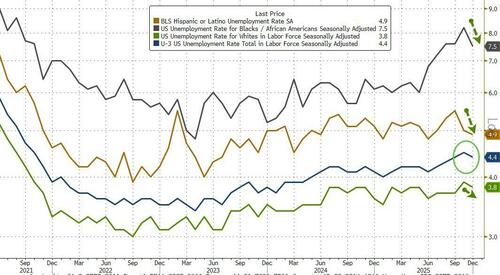

- 8:30 am: Dec Unemployment Rate, est. 4.5%, prior 4.6%

- 8:30 am: Oct Housing Starts, est. 1330k

- 8:30 am: Oct P Building Permits, est. 1350k

- 8:30 am: Oct Housing Starts MoM, est. 1.76%

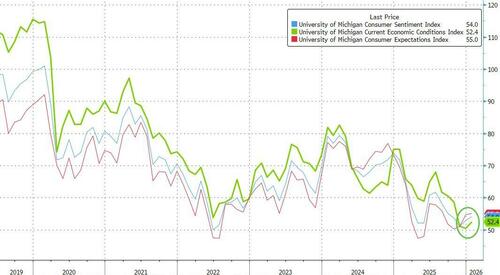

- 10:00 am: Jan P U. of Mich. Sentiment, est. 53.5, prior 52.9

DB's Jim Reid concludes the overnight wrap

Markets took a bit of a breather yesterday, though headline stability for the S&P 500 (+0.01%) masked a sizable sectoral rotation, with tech underperforming. Meanwhile, bonds continued to lose ground on both sides of the Atlantic, with a combination of solid US data and a rebound in oil prices raising prospects of a more hawkish Fed and pushing 10yr Treasury yields +1.8bps higher to 4.17%.

However, before we get onto all that, it’s worth noting that today is the first day we could find out the Supreme Court’s ruling on the Trump administration’s tariffs. As a reminder, the Court are ruling on whether the use of the International Emergency Economic Powers Act (IEEPA) permits the imposition of widespread tariffs, and these IEEPA tariffs make up around half of the increases we’ve seen under Trump. The previous legal challenges in the lower courts were successful against the tariffs, but they’ve been appealed by the Trump administration, hence we’re waiting for the Supreme Court ruling now. As it stands, prediction markets think the Supreme Court is likely to rule against the tariffs, with Polymarket giving just a 25% chance they rule in favour. However, even if the tariffs are struck down by the Court, remember that the administration have several other legal avenues they can pursue. For instance, the sectoral tariffs (e.g. on steel and aluminum) aren’t covered by the court ruling, whilst another option would be to use Section 122 of the 1974 Trade Act, which permits temporary 15% tariffs for 150 days. Generally our house view on tariffs this year is that they'll likely consistently come in below the headline rates as the administration has to deal with cost of living issues ahead of mid-terms. However the path could still be volatile with the IEEPA decision probably the greatest potential source of this.

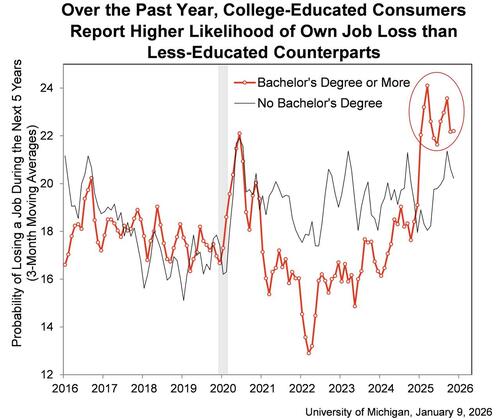

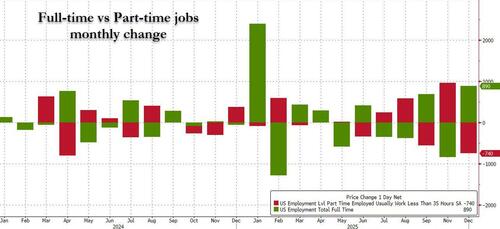

Irrespective of whether we get a court ruling today, we’ll definitely get the US jobs report for December, which is out at 13:30 London time. In terms of what to expect, this will be a more “normal” report again, as the last one was delayed by the shutdown and saw the release of two months of payrolls at once. For today, our US economists think that nonfarm payrolls would be up by +50k, and the unemployment rate would tick down to 4.5%, reversing the consistent upward trend since the summer. But they caution there’s elevated uncertainty around their unemployment forecast, given that the previous month’s estimates from the BLS were associated with slightly higher than usual standard errors. Moreover, the BLS are incorporating annual revisions to the seasonally adjusted household survey data for the most recent 5 years. So the random number generator that is the initial payrolls print could be even more random than normal.

Ahead of all that, yesterday actually brought another strong batch of US data, which followed on from the ISM services on Wednesday that hit a 14-month high. For instance, the weekly jobless claims came in beneath expectations at 208k (vs. 212k expected), whilst the October trade deficit was smaller than expected at $29.4bn (vs. $58.7bn expected). So that helped lift the Atlanta Fed’s GDPNow estimate, which now sees Q4 growth at an annualised pace of +5.4%. This will be flattered by gold exports though, but Q4's print could still grab attention.

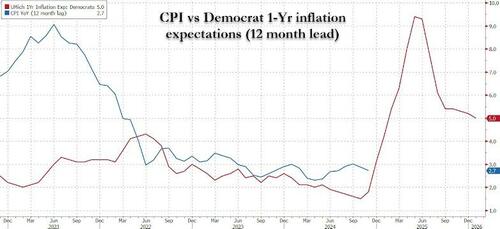

However, that strong data wasn’t entirely welcomed by markets, as it led investors to price in a slightly more hawkish path for the Fed this year. Indeed, the amount of rate cuts priced by the December meeting was down to 57bps by the close, -2.1bps on the day. And in turn, that helped to lift Treasury yields across the curve, with the 2yr yield (+1.7bps) up to 3.49%, whilst the 10yr yield (+1.8bps) rose to 4.17%. Matters also weren’t helped by the latest rise in oil prices, with Brent crude rising +3.39% to $61.99/bbl, its biggest daily rise since October. That meant inflationary concerns were also back in focus after a topsy turvy week for oil, albeit in a relatively narrow range post the weekend's Venezualen news. Indeed, the US 2yr inflation swap (+4.0bps) moved up to 2.38%, its biggest daily jump since July.

In Fed-related news, the New York Times quoted Trump as saying in an interview that “I have in my mind a decision” on the next Fed Chair, but that “I haven’t talked about it with anybody.” However, Treasury Secretary Bessent later said that Trump hasn’t yet interviewed one of the four final candidates and that the President could make the announcement either side of his visit to Davos in two weeks’ time.

For equities it was a very mixed bag yesterday. The S&P 500 (+0.01%) was essentially unchanged by the close, but this masked some sharply divergent performances. The main theme was a rotation away from tech, with the information technology sector (-1.54%) the worst performer in the S&P but energy (+3.20%) and consumer staples (+2.26%) stocks posting outsized gains. So while the NASDAQ fell -0.44% with Nvidia down -2.15%, 70% of the S&P 500 constituents were higher on the day and the small cap Russell 2000 (+1.11%) reached a new all-time high.

Defence stocks did well after Trump’s post after Wednesday night's close that the military budget should increase to $1.5tn in 2027 which came hot on the heels - just before that close - of him suggesting that defence companies would have to halt dividends and buybacks until federal contractors expedite production and delivery times. The likes of Lockheed Martin (+4.34%) almost erased the previous day’s decline, though the overall S&P 500 Aerospace & Defense index was only +0.18% by the close after a +4% opening gain. Defence companies also benefited globally, as BAE Systems (+5.04%) was the second best performer in the FTSE 100.

Shortly after the equity close, we saw further headlines on housing policy as Trump posted that he was directing Fannie Mae and Freddie Mac to buy $200bn of mortgage bonds to help bring mortgage rates down. While this figure needs to be viewed in the context of a roughly $9trn agency MBS market, spreads between mortgage bonds and Treasuries tightened by nearly 10bps on the news with home-lender stocks gaining in after-hours trading.

Over in Europe, bonds and equities were on the softer side for the most part. So the STOXX 600 (-0.19%) lost ground for a second day running, with the STOXX Technology Index (-2.52%) leading the declines. Nevertheless, the German DAX (+0.02%) continued its outperformance of 2026 so far, inching up to another record high, whilst Spain’s IBEX 35 (+0.33%) also hit a new record. Otherwise, yields on 10yr bund (+1.3bps) and OATs (+0.6bps) both moved up a bit. Germany manufacturing orders were the highest YoY rate for 15 years if you exclude the Covid bounce back period, and as I said in my CoTD yesterday here, I'm still surprised how negative global sentiment is towards Germany. When the US spends big, everyone only talks about the growth impulse regardless of how inefficient the spending might be. However for Germany everyone is talking about the potential inefficiencies, and less about the obvious growth impact. Germany Industrial Production today is the next data point to watch on this front.

In Asia the Nikkei (+1.56%) and the Topix (+0.88%) are leading the way, supported by a weaker yen. The KOSPI is +0.39%, marking its sixth consecutive session of gains, while the S&P/ASX 200 is flat as I type. The Hang Seng (+0.10%) is edging up but the Shanghai Composite (+0.59%) is stronger, following a modest rise in China’s consumer inflation in December, although factory-gate prices continue to contract (details below). US equity futures are flat.

Turning back to China, consumer prices increased by +0.8% y/y as anticipated, reaching their highest level since February 2023 and marking a third consecutive month of growth in December. This rise follows a +0.7% increase in November. In contrast, producer prices have decreased by -1.9% y/y, slightly better than the expected -2.0% decline, and easing from November’s -2.2% drop. This data extends China’s streak of factory-gate deflation beyond three years, underscoring persistent excess capacity and weak pricing power within the industrial sector. However our economists think PPI does turn positive later this year. See their reflections on the number this morning here.

Looking at the day ahead, data releases include the US jobs report for December, the University of Michigan’s preliminary consumer sentiment index for January, German industrial production and Euro Area retail sales for November. Central bank speakers include the ECB’s Lane, and the Fed’s Kashkari and Barkin.

Tyler Durden

Fri, 01/09/2026 - 08:28

Click on graph for larger image.

Click on graph for larger image. The second graph shows homeowner percent equity since 1952.

The second graph shows homeowner percent equity since 1952.  The third graph shows household real estate assets and mortgage debt as a percent of GDP.

The third graph shows household real estate assets and mortgage debt as a percent of GDP.

via AP

via AP

via AFP

via AFP

Recent comments