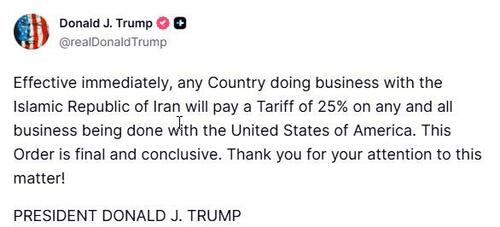

Trump Imposes 25% Tariff On Any Country Doing Business With Iran "Effective Immediately"

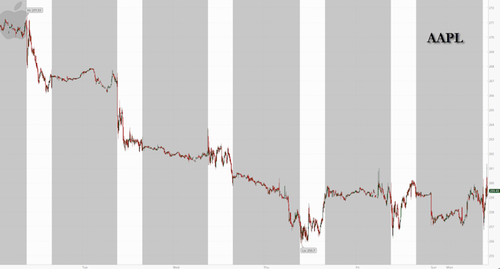

After it quietly faded away in late summer, that trade war with China is about to make a triumphal reappearance.

In a day that was already flooded by a relentless firehose of newsflow, Trump added to the leaning tower of chaos when said on Truth Social that he was imposing a 25% tariff on goods from countries “doing business” with Iran (most notably China which is its largest oil client), ratcheting up pressure on the government in Tehran that has been rocked by widespread protests.

Trump said that the new duty would be “effective immediately,” without providing any details about the scope or implementation of the charges, leaving traders to act first and ask questions later if at all (a big reason why there is zero liquidity in the market is because people are trading with zero conviction and unwind trades just as fast as they put them on).

The action has the potential to disrupt major US trading relationships across the globe: as Bloomberg notes, Iran’s partners include not only neighboring states, but large economies including India, Turkey and especially China.

“Any Country doing business with the Islamic Republic of Iran will pay a Tariff of 25% on any and all business being done with the United States of America. This Order is final and conclusive,” he said.

Previously, Trump had imposed tariffs as high as 50% on Indian goods tied to their purchase of Russian oil, and while India initially reduced its purchases of Russian crude it has since ramped them back up; China on the other hand, never even noticed the Trumpian edict.

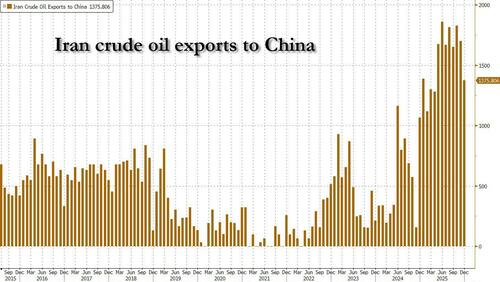

Needless to say, the additional 25% tariff - assuming it sticks - hitting Beijing exports risks upsetting the trade truce Trump negotiated with Chinese President Xi Jinping late last year. China is the world’s top buyer of Iranian crude and the nation’s independent refiners were increasing their intake of the oil as of last month.

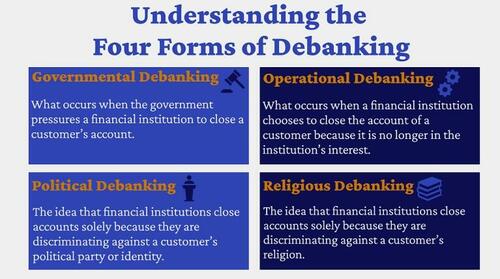

While the lack of details in the Trump declaration was confusing, adding to the sheer chaos is an impending decision by the US Supreme Court on the legality of Trump’s global tariffs. If the justices rule against him, it could hamper his ability to quickly impose duties on Iran’s partners. The court’s next opinion day is Wednesday.

As for Iran, it has been experiencing weeks of mass unrest, which was initially sparked by a currency crisis and worsening economic conditions but has increasingly been aimed at the regime. It’s amounted to the biggest challenge to the Islamic Republic’s ruling system since 1979. While Supreme Leader Ayatollah Ali Khamenei’s regime has weathered protests before, the demonstrations are spreading and drew hundreds of thousands of people, by some accounts, across the country over the weekend. Iranian authorities have sought to stamp out the protests with more than 500 people killed so far and more than 10,000 arrests, according to the Human Rights Activists News Agency.

Trump has openly backed the protesters and warned Tehran against violently repressing the demonstrations. In an interview on Fox News last week, he said the US would hit Iran “very hard” if it continued to shoot at protesters.

As reported earlier, Trump president told reporters on Sunday that the Iranian leadership has reached out to seek talks and that a meeting is being set up, without offering details on timing. Still, he said that his administration is considering potential options and indicated he was coordinating with allies in response to Iran.

“We’re looking at it very seriously. The military is looking at it, and we’re looking at some very strong options,” Trump told reporters. “I’m getting an hourly report and we’re going to make a determination.”

Also over the weekend, a White House official said that Trump has been briefed on a range of options for military strikes in Iran, including nonmilitary sites. The president is seriously considering authorizing an attack, according to the official who requested anonymity to detail internal discussions.

Still, there is hope for a peaceful resolution: Iranian Foreign Minister Abbas Araghchi has opened channels of communication with Trump’s Middle East envoy, Steve Witkoff, a spokesman from the ministry said Monday.

Meanwhile, Iran has warned the US and Israel - which coordinated to carry out strikes on nuclear facilities in the country last year - against any attempt to intervene. Tehran and Washington have not had formal diplomatic ties for decades.

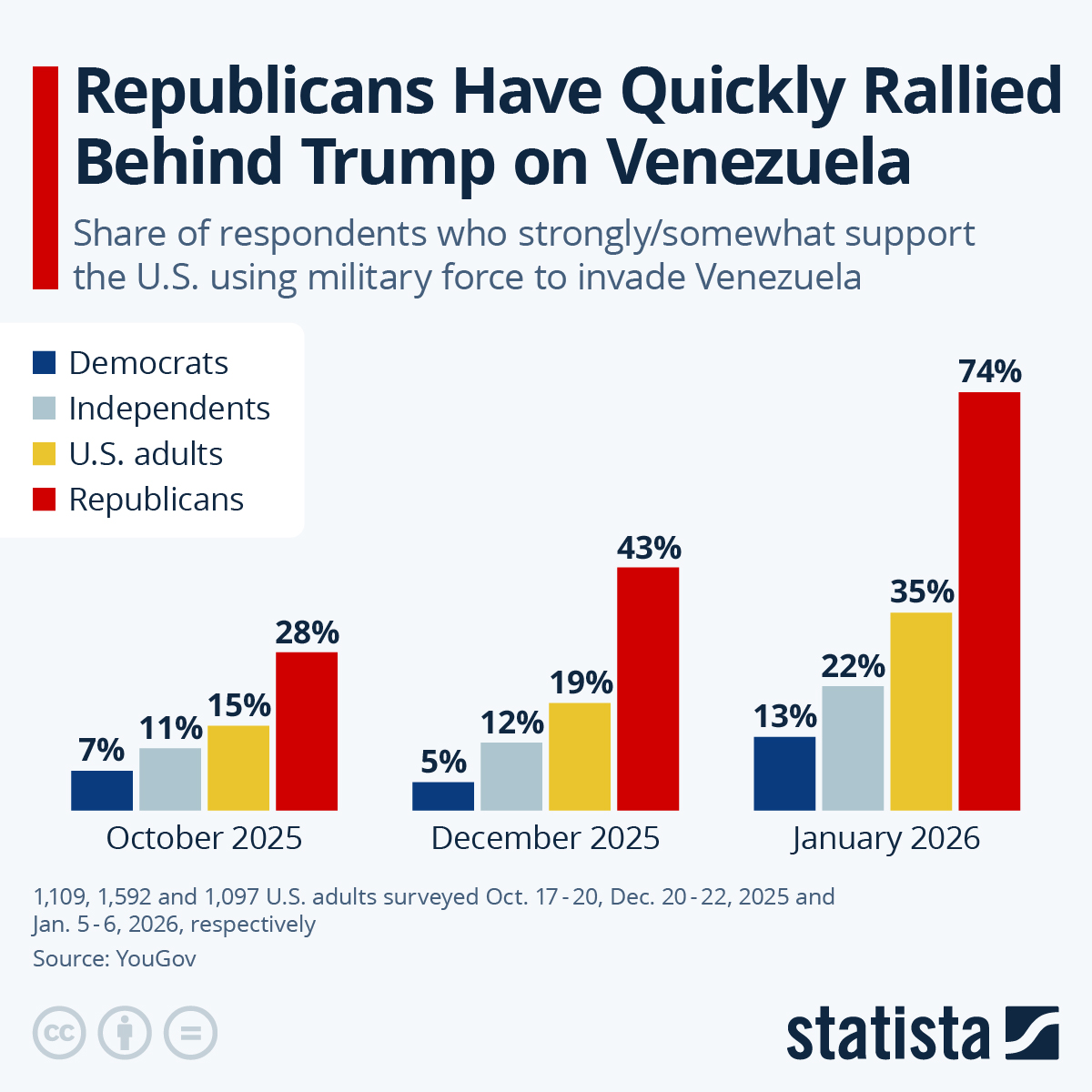

Trump’s threats to Iran have the region on edge, coming on the heels of a US strike earlier this month in Venezuela - another oil-rich country - which led to the capture of strongman Nicolas Maduro. Should the US or its ally, Israel, intervene, that threatens to draw neighboring countries into the crisis and risk access to the Strait of Hormuz, a key waterway for energy exporters.

Tyler Durden Mon, 01/12/2026 - 18:23

The U.S. Supreme Court in Washington on Jan. 5, 2026. Madalina Kilroy/The Epoch Times

The U.S. Supreme Court in Washington on Jan. 5, 2026. Madalina Kilroy/The Epoch Times (Image credit: Illustrated | Getty Images)

(Image credit: Illustrated | Getty Images)

Megan Garcia with her son Sewell Setzer III. Photograph: Megan Garcia/AP

Megan Garcia with her son Sewell Setzer III. Photograph: Megan Garcia/AP

Recent comments