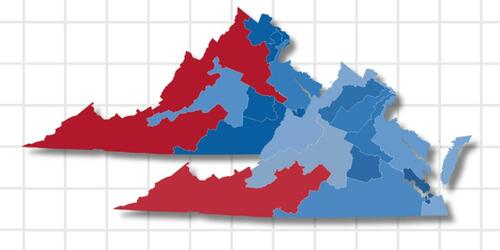

Judge Temporarily Blocks Democrat-Backed Referendum To Redraw Virginia's Congressional Map

Authored by Aldgra Fredly via The Epoch Times,

A county judge in Virginia issued an emergency restraining order on Feb. 19, pausing a referendum backed by Democrats that aims to redraw the state’s congressional maps.

Tazewell County Circuit Judge Jack Hurley issued the order following a Feb. 18 motion by the National Republican Congressional Committee (NRCC) that sought to challenge House Bill 1384.

HB1384 schedules a referendum for April 21 on a proposed constitutional amendment to allow the General Assembly to redraw the state’s congressional districts.

Virginia’s redistricting plan was projected to give Democrats four more U.S. House seats.

The Republican request for a restraining order argued that Democrats were ramming redistricting-related bills through the Legislature despite legal hurdles that prevent such a rushed process.

In its Feb. 18 filing, NRCC argued that HB1384 violates the Constitution by calling a referendum less than 90 days after it cleared the Legislature for the second time.

The Constitution requires at least 90 days between the final passage and submission to the voters, according to the filing.

In his ruling, Hurley found that temporary relief was warranted in this case to preserve “the status quo between the parties pending a hearing on a motion for a preliminary injunction.”

He also found the plaintiffs were likely to succeed in their claim that ballot language, as set by HB1384, violates the state’s Constitution because it is misleading, in particular, the “restore fairness” language, because it “would lead a voter to believe he or she were doing something unfair by voting against the proposed amendment.”

Hurley’s order temporarily restrains local officials from “administering, preparing for, taking any action to further the procedure of the referendum, or otherwise moving forward with causing an election to be held on the proposed constitutional amendment contained within House Joint Resolution 6007.”

The restraining order will remain in effect through March 18, according to the ruling. Early voting on the amendment was scheduled to begin on March 6 and conclude on April 21.

In a statement, NRCC spokesperson Mike Marinella hailed Hurley’s order as a “massive win in defending honest representation” for all residents in Virginia.

“For a second time, the Virginia courts have ruled against Virginia Democrats’ partisan attempt to ignore their own Constitution and rig the system in their favor,” Marinella said.

Hurley had initially blocked the effort in a January ruling, but the Virginia Supreme Court later allowed the plan to proceed to an April voter referendum after an appeal.

Hurley’s latest order has now halted the ballot initiative.

Virginia House Speaker Don Scott, a Democrat, has indicated the Democratic Party will appeal the judge’s decision.

He said he is confident Hurley’s latest order will not stand, given the state Supreme Court’s earlier reversal of his previous order.

“The Supreme Court of Virginia has already made clear that this matter will go to the voters, but Republicans unhappy with that ruling went back to their friendly judge,” Scott said.

House Minority Leader Hakeem Jeffries (D-N.Y.) told CNN on Feb. 15 that Democrats will do “whatever it takes” to make Virginia’s redistricting plan successful, adding the party is ready to spend “tens of millions of dollars” on the Virginia ballot initiative.

“Republicans started this redistricting war, and Democrats have made it clear we’re going to finish it. We’re going to make sure that there is a fair national map,” he said.

Republicans, who hold a narrow House majority, have already passed redistricting plans in Texas, Missouri, Ohio, and North Carolina.

Earlier this year, Florida Gov. Ron DeSantis said he would call a special session for April for the Sunshine State’s GOP-controlled Legislature to draw new U.S. House districts.

Tyler Durden Fri, 02/20/2026 - 14:00

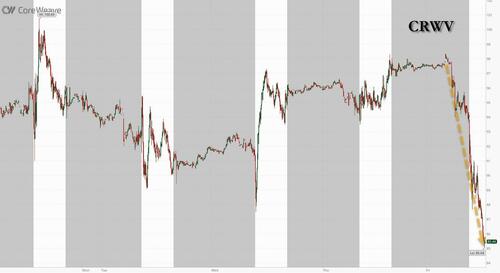

CoreWeave's Lancater data center: Photo: Bloomberg/Getty Images

CoreWeave's Lancater data center: Photo: Bloomberg/Getty Images

Recent comments