algebra questions and answers pdf

Algebra Question & Answer PDFs offer focused practice‚ containing around 100 problems with detailed solutions‚ covering diverse algebraic expressions and equations.

These resources present step-by-step solutions to word problems‚ including those with radicals‚ fractions‚ and exponents‚ aiding comprehension and skill development.

What are Algebra Question & Answer PDFs?Algebra Question & Answer PDFs are digitally formatted documents specifically designed to help students master algebraic concepts through practice and guided learning. These PDFs typically contain a curated collection of algebra problems‚ ranging in difficulty from basic to advanced‚ covering essential topics like linear equations‚ quadratic equations‚ systems of equations‚ polynomials‚ and rational expressions.

Crucially‚ these aren’t just problem sets; they include detailed‚ step-by-step solutions. This allows learners to not only check their answers but also understand the reasoning behind each step‚ fostering a deeper comprehension of the underlying principles. Many PDFs also focus on algebra word problems‚ providing equations‚ variable definitions‚ and numerical solutions. Resources like UCLA Linear Algebra Midterm II Solutions exemplify this‚ offering solved exam questions. They serve as valuable self-study tools‚ supplementing classroom learning and exam preparation.

Why Use Algebra Question & Answer PDFs?Algebra Question & Answer PDFs provide a highly effective and convenient learning resource. They offer targeted practice‚ allowing students to focus on specific areas where they need improvement. The inclusion of detailed solutions is paramount; learners can analyze the problem-solving process‚ identifying where they went wrong and reinforcing correct methodologies.

Unlike textbooks‚ PDFs are easily accessible on various devices‚ enabling study anytime‚ anywhere. They’re particularly useful for self-paced learning and exam preparation. Resources like “Algebra: Chapter 0” offer foundational practice‚ while documents addressing “Convergence of Solutions” demonstrate advanced applications. Furthermore‚ PDFs often present a variety of problem types – from simple equations to complex word problems – building proficiency and confidence. They’re a cost-effective alternative to tutoring‚ providing readily available support for mastering algebra.

Fundamental concepts like solving linear and quadratic equations‚ alongside mastering systems of equations through substitution and elimination‚ form the bedrock of algebraic understanding.

Linear Equations: Solving for ‘x’Mastering linear equations is foundational in algebra‚ involving isolating the variable ‘x’ to determine its value. PDFs dedicated to algebra questions and answers frequently present a range of linear equations‚ from simple one-step problems to more complex multi-step scenarios.

These resources demonstrate techniques like applying inverse operations – addition/subtraction and multiplication/division – to both sides of the equation‚ maintaining balance. Step-by-step solutions within these PDFs illustrate how to simplify expressions‚ combine like terms‚ and ultimately solve for ‘x’.

Practice problems often include equations with variables on both sides‚ requiring students to strategically move terms to isolate ‘x’. Understanding the properties of equality is crucial‚ and these PDFs reinforce this through numerous examples. Successfully solving linear equations builds confidence and prepares students for tackling more advanced algebraic concepts.

Quadratic Equations: Factoring and the Quadratic FormulaQuadratic equations‚ expressed in the form ax² + bx + c = 0‚ represent a significant step up in algebraic complexity. Algebra question and answer PDFs provide extensive practice in solving these equations using two primary methods: factoring and the quadratic formula.

Factoring involves breaking down the quadratic expression into a product of two binomials. PDFs demonstrate various factoring techniques‚ including simple trinomials and difference of squares. When factoring isn’t straightforward‚ the quadratic formula – x = [-b ± √(b² ⏤ 4ac)] / 2a – guarantees a solution.

These resources showcase how to identify the coefficients a‚ b‚ and c‚ and correctly apply the formula. Step-by-step solutions illustrate handling the discriminant (b² ― 4ac) to determine the nature of the roots (real or complex); Mastering both methods is vital for success in higher-level mathematics.

Systems of Equations: Substitution and EliminationSystems of equations involve solving for multiple unknowns using a set of two or more equations. Algebra question and answer PDFs offer targeted practice with two common solution methods: substitution and elimination.

Substitution involves solving one equation for one variable and substituting that expression into the other equation‚ reducing it to a single variable problem. PDFs clearly demonstrate this process‚ emphasizing algebraic manipulation skills.

Elimination (or addition) focuses on manipulating the equations to eliminate one variable when they are added or subtracted. These resources illustrate multiplying equations by constants to achieve matching coefficients. Step-by-step solutions guide learners through each technique‚ building confidence and problem-solving abilities. Understanding both methods provides flexibility in tackling diverse system-of-equation challenges.

Algebra PDFs delve into polynomials‚ factoring‚ and rational expressions‚ offering practice with addition‚ subtraction‚ multiplication‚ division‚ and simplification techniques.

Polynomials: Addition‚ Subtraction‚ Multiplication‚ and DivisionAlgebra Question & Answer PDFs extensively cover polynomial operations‚ providing numerous examples and solutions for addition‚ subtraction‚ multiplication‚ and division.

These resources demonstrate how to combine like terms during addition and subtraction‚ and how to apply the distributive property effectively during multiplication.

Furthermore‚ they guide learners through the process of polynomial long division and synthetic division‚ crucial skills for simplifying complex expressions.

Practice problems within these PDFs often involve varying degrees of polynomials‚ reinforcing understanding of exponents and coefficients.

Solutions are presented step-by-step‚ clarifying each operation and helping students avoid common errors in polynomial manipulation.

Mastering these operations is foundational for more advanced algebraic concepts‚ making these PDF resources invaluable for skill development.

Factoring Polynomials: Common Factors and Special CasesAlgebra Question & Answer PDFs dedicate significant attention to factoring polynomials‚ a cornerstone of algebraic manipulation. They begin with identifying and extracting common factors from polynomial expressions‚ simplifying the factoring process.

Crucially‚ these resources detail special factoring cases‚ including the difference of squares‚ perfect square trinomials‚ and the sum and difference of cubes.

Numerous examples illustrate each case‚ accompanied by detailed‚ step-by-step solutions that clarify the application of appropriate formulas and techniques.

Practice problems progressively increase in complexity‚ challenging students to recognize patterns and apply factoring skills effectively.

The PDFs often include explanations of how factoring relates to solving polynomial equations‚ reinforcing the concept’s practical application.

Successfully mastering these techniques is vital for simplifying expressions and solving equations efficiently.

Rational Expressions: Simplifying and OperationsAlgebra Question & Answer PDFs provide comprehensive coverage of rational expressions‚ focusing on simplification and performing various operations. These resources begin by explaining how to simplify rational expressions by factoring both the numerator and denominator‚ identifying and canceling common factors.

Detailed examples demonstrate multiplication‚ division‚ addition‚ and subtraction of rational expressions‚ emphasizing the importance of finding a common denominator.

Step-by-step solutions clearly illustrate each operation‚ including techniques for handling complex fractions.

Practice problems range from basic simplification to more complex operations‚ building proficiency gradually.

The PDFs often include cautions about restricted values that make the denominator zero‚ reinforcing the concept of domain.

Mastering these skills is crucial for advanced algebraic manipulations.

Algebra Question & Answer PDFs delve into radical expressions‚ exponential/logarithmic functions‚ and complex numbers‚ offering solutions and practice for mastery.

Radical Expressions: Simplifying and Solving EquationsAlgebra Question & Answer PDFs frequently feature radical expressions‚ demanding proficiency in simplification and equation-solving techniques. These PDFs provide examples demonstrating how to manipulate expressions containing square roots‚ cube roots‚ and other radicals.

Solutions often involve isolating the radical‚ then raising both sides of the equation to a power to eliminate it. Crucially‚ checking for extraneous solutions is emphasized‚ as this step is vital when dealing with radicals.

Practice problems within these resources cover a spectrum of difficulty‚ from basic simplification of radical terms to solving complex equations involving multiple radicals. Understanding the properties of radicals and applying them correctly are key skills reinforced through these materials. The PDFs offer detailed‚ step-by-step guidance‚ enabling learners to build confidence and accuracy.

Exponential and Logarithmic FunctionsAlgebra Question & Answer PDFs dedicate significant attention to exponential and logarithmic functions‚ crucial components of advanced algebra. These resources present problems requiring the application of logarithmic properties – product‚ quotient‚ and power rules – for simplification and equation solving.

PDFs demonstrate how to convert between exponential and logarithmic forms‚ a foundational skill. Solving exponential equations often involves taking logarithms of both sides‚ while solving logarithmic equations requires converting to exponential form.

Practice problems range from evaluating simple expressions to tackling more complex scenarios involving change-of-base formulas. Detailed solutions illustrate each step‚ emphasizing the importance of understanding the inverse relationship between exponential and logarithmic functions. These materials build a strong foundation for calculus and related fields.

Complex Numbers: Operations and ApplicationsAlgebra Question & Answer PDFs thoroughly cover complex numbers‚ extending algebraic principles into the realm of imaginary and complex quantities. These resources detail operations like addition‚ subtraction‚ multiplication‚ and division of complex numbers‚ often expressed in the form a + bi.

PDFs demonstrate techniques for simplifying expressions involving i (the imaginary unit‚ √-1) and rationalizing denominators containing complex numbers. Conjugates play a vital role‚ particularly in division‚ and are explained with illustrative examples.

Applications extend to solving quadratic equations with negative discriminants‚ revealing complex roots. Detailed solutions showcase how complex numbers arise in various mathematical contexts‚ building a solid understanding of their properties and utility.

Algebra Question & Answer PDFs feature numerous word problems‚ including age‚ distance-rate-time‚ and work scenarios‚ with equations‚ variables‚ and solutions.

Age Problems: Setting Up EquationsAlgebra Question & Answer PDFs frequently include age problems‚ a classic application of algebraic thinking. These problems typically involve relationships between people’s ages at different points in time – past‚ present‚ and future.

Successfully tackling these requires translating wordy descriptions into precise mathematical equations. A common strategy is to represent ages with variables (like ‘x’ or ‘y’) and then formulate equations based on the given information. For instance‚ a statement like “John is twice as old as Mary” translates to x = 2y.

The key is to carefully define your variables and accurately represent the age relationships. PDFs often demonstrate this process step-by-step‚ showing how to set up the equations‚ solve for the unknowns‚ and ultimately determine the ages in question. Practice with these examples builds proficiency in this essential algebraic skill.

Distance‚ Rate‚ and Time ProblemsAlgebra Question & Answer PDFs consistently feature distance‚ rate‚ and time problems‚ fundamental exercises in applying algebraic principles to real-world scenarios. These problems leverage the core formula: Distance = Rate x Time (d = rt).

The challenge lies in deciphering the problem’s details to correctly identify the knowns and unknowns. PDFs often present variations where rates are combined (e.g.‚ a boat traveling with or against a current) or times are expressed in different units.

Effective problem-solving involves carefully assigning variables to represent distance‚ rate‚ and time‚ then constructing equations based on the given information. Step-by-step solutions within these PDFs demonstrate how to manipulate the d = rt formula and solve for the desired variable‚ building a strong foundation in algebraic modeling.

Work Problems: Combined RatesAlgebra Question & Answer PDFs frequently include work problems centered around combined rates‚ assessing the ability to model collaborative efforts. These problems typically involve multiple individuals or machines working together to complete a task.

The key concept is that the combined rate is the sum of individual rates. If Person A completes a job in ‘x’ hours and Person B in ‘y’ hours‚ their combined rate is (1/x + 1/y) jobs per hour.

PDF solutions demonstrate setting up equations to represent the portion of work completed by each entity and solving for the time it takes to finish the job collectively. These examples build proficiency in translating word problems into algebraic expressions and applying rate-time-work relationships.

Algebra Question & Answer PDFs detail solutions for equations with fractions‚ radicals‚ and inequalities‚ providing clear‚ step-by-step guidance for diverse algebraic challenges.

Solving Equations with FractionsAlgebra Question & Answer PDFs frequently include detailed examples demonstrating how to solve equations containing fractional terms. A core technique involves finding the least common denominator (LCD) of all fractions present in the equation.

This LCD is then multiplied across every term on both sides of the equation‚ effectively eliminating the fractions. This crucial step transforms the equation into a more manageable form‚ typically a linear or quadratic equation.

Following this‚ standard algebraic techniques – combining like terms‚ isolating the variable – are applied to solve for the unknown. PDF resources often showcase multiple examples‚ progressing from simpler to more complex fractional equations.

Careful attention is given to checking solutions‚ as multiplying by the LCD can sometimes introduce extraneous roots that don’t satisfy the original equation. These PDFs emphasize this verification process.

Solving Equations with RadicalsAlgebra Question & Answer PDFs dedicate sections to solving equations involving radical expressions‚ such as square roots‚ cube roots‚ and beyond. A primary strategy is to isolate the radical term on one side of the equation.

Once isolated‚ both sides of the equation are raised to the power of the radical’s index (e.g.‚ squared for a square root‚ cubed for a cube root). This operation aims to eliminate the radical‚ transforming the equation into a polynomial form;

Subsequently‚ standard algebraic methods are employed to solve for the variable. However‚ a critical step is verifying each potential solution in the original equation.

Raising both sides to a power can introduce extraneous solutions – values that satisfy the transformed equation but not the original radical equation. These PDFs consistently highlight the importance of this verification process to ensure accuracy.

Solving Inequalities

Algebra Question & Answer PDFs provide comprehensive guidance on solving algebraic inequalities‚ mirroring the techniques used for equations but with crucial distinctions. The goal remains isolating the variable‚ but multiplying or dividing both sides by a negative number necessitates flipping the inequality sign.

These PDFs emphasize this rule to avoid errors‚ illustrating it with numerous examples. Interval notation is frequently used to express the solution set‚ offering a clear visual representation of all values satisfying the inequality.

Particular attention is given to absolute value inequalities‚ demonstrating how to split them into separate cases and solve each accordingly.

Verification‚ while not always strictly necessary‚ is encouraged to confirm the solution set’s validity‚ especially with more complex inequalities.

Algebra PDFs‚ like UCLA’s Linear Algebra Midterm II solutions and “Chapter 0” textbooks‚ offer foundational practice and advanced problem-solving techniques.

UCLA Linear Algebra Midterm II SolutionsUCLA’s Linear Algebra Midterm II Solutions represent a valuable resource for students seeking to deepen their understanding of core algebraic concepts. This PDF document provides detailed‚ step-by-step solutions to a comprehensive set of problems covering topics typically found in a second midterm exam for a university-level linear algebra course.

Students can utilize these solutions to verify their own work‚ identify areas where they struggle‚ and learn alternative approaches to problem-solving. The document’s clarity and thoroughness make it an excellent study aid‚ particularly for those preparing for similar assessments. It’s a practical example of how solved problems can illuminate complex mathematical principles.

Beyond simply providing answers‚ the solutions demonstrate the logical progression required to arrive at the correct result‚ reinforcing fundamental algebraic techniques and fostering a stronger grasp of linear algebra’s underlying principles. Accessing and studying this resource can significantly enhance a student’s overall performance.

Algebra: Chapter 0 ― Textbook Foundations“Algebra: Chapter 0” serves as a foundational textbook‚ signaling a deliberate return to the basics – a crucial starting point for mastering algebraic concepts. This resource isn’t merely about presenting formulas; it’s about establishing a solid groundwork upon which more complex ideas can be built. It emphasizes building a strong understanding of prerequisite skills before diving into advanced topics.

While not directly a question-and-answer PDF‚ the textbook’s exercises and accompanying solutions implicitly function as such. Students can work through problems and then check their answers‚ reinforcing their learning through practice. The textbook’s approach is designed to foster a deep‚ intuitive grasp of algebra‚ rather than rote memorization.

This foundational text provides the necessary building blocks for success in subsequent algebra courses‚ ensuring students possess the essential skills to tackle more challenging problems and concepts effectively. It’s a cornerstone for algebraic proficiency.

Convergence of Solutions of Bilateral Problems“Convergence of Solutions of Bilateral Problems in Variable Domains”‚ authored by A.A. Kovalevsky (2017)‚ delves into the intricate row and column structure of solutions within matrix polynomial equations. Though highly theoretical‚ understanding solution behavior is fundamental to solving complex algebraic problems.

This research utilizes computer algebra systems like Mathematica to analyze the stability of solutions derived from equations of motion‚ offering insights into their convergence. While not a direct question-and-answer resource‚ the document’s analytical approach exemplifies a rigorous method for verifying algebraic solutions.

The study’s focus on solution structure and stability provides a deeper understanding of why certain solutions are valid‚ complementing practical problem-solving techniques found in typical algebra PDFs. It represents a higher-level exploration of algebraic principles.

Algebra PDFs facilitate learning through step-by-step solutions‚ ample practice problems‚ and identification of common errors—building proficiency and solidifying understanding of concepts.

Step-by-Step Solutions: Understanding the ProcessAlgebra Question & Answer PDFs truly shine when offering detailed‚ step-by-step solutions. These aren’t simply answers; they’re roadmaps demonstrating how to arrive at the correct result. This is crucial for students struggling with specific concepts or problem-solving techniques.

The provided examples showcase how equations are manipulated‚ variables are isolated‚ and solutions are verified. For instance‚ word problems are broken down‚ showing the translation from textual descriptions into mathematical expressions. This process includes defining variables‚ setting up the equation‚ and then solving it systematically.

Furthermore‚ these PDFs often highlight key algebraic principles applied at each stage‚ reinforcing theoretical understanding alongside practical application. Examining solutions to problems involving radicals‚ fractions‚ or exponents reveals the order of operations and the correct application of algebraic rules. This methodical approach fosters a deeper comprehension than merely memorizing formulas.

Practice Problems: Building ProficiencyAlgebra Question & Answer PDFs aren’t just about seeing solutions; they’re fundamentally about practice. The inclusion of numerous problems – some documents contain upwards of 100 – allows students to actively engage with the material and solidify their understanding. Repeated exposure to diverse problem types is key to building proficiency.

These PDFs often present a range of difficulty levels‚ starting with simpler exercises and progressing to more complex scenarios involving radicals‚ fractions‚ and exponents. This gradual increase in challenge helps students build confidence and develop their problem-solving skills incrementally.

Consistent practice‚ coupled with reviewing the step-by-step solutions‚ enables students to internalize algebraic concepts and recognize patterns. This ultimately leads to faster and more accurate problem-solving abilities‚ preparing them for more advanced mathematical studies.

Algebra Question & Answer PDFs are invaluable tools for pinpointing frequent errors. By meticulously reviewing solved problems‚ students can identify areas where they consistently stumble. Often‚ mistakes stem from simple arithmetic errors‚ incorrect application of formulas‚ or misunderstandings of fundamental algebraic principles.

The detailed solutions provided within these PDFs allow for a comparative analysis – students can directly compare their own work with the correct approach‚ highlighting discrepancies. Recognizing these patterns of errors is crucial for targeted improvement.

Furthermore‚ studying solved problems exposes students to common pitfalls related to radicals‚ fractions‚ and exponents. This proactive approach to error identification fosters a deeper understanding and prevents the repetition of mistakes in future problem-solving endeavors.

The post algebra questions and answers pdf appeared first on Every Task, Every Guide: The Instruction Portal

.

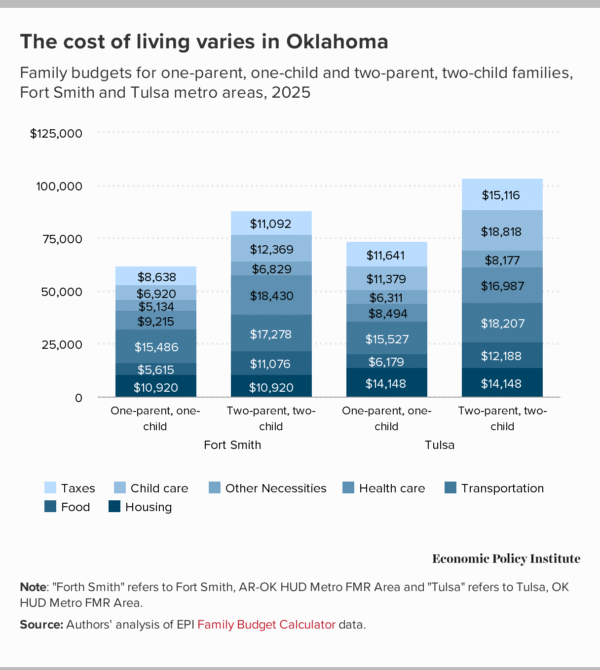

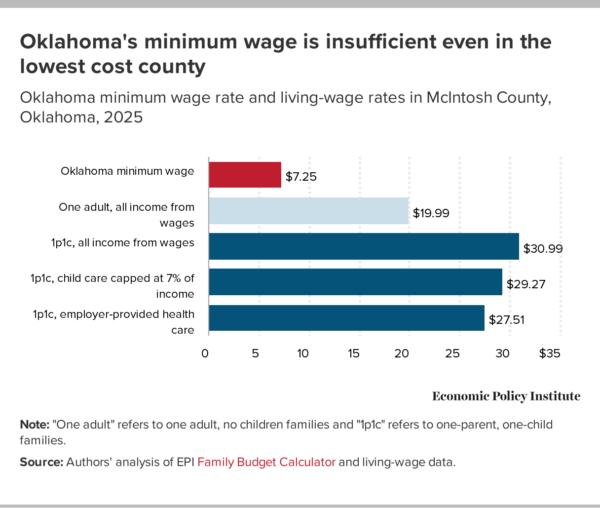

The Family Budget Calculator can be used to calculate living wages

The Family Budget Calculator can be used to calculate living wages

Oklahoma needs a higher minimum wage

Oklahoma needs a higher minimum wage

Recent comments