The March 2010 U.S. trade deficit increased $1 billion from last month $39.4 billion (revised) to $40.4 billion. Exports were up $4.6 billion from last month whereas imports increased $5.6 billion from January.

March exports of $147.9 billion and imports of $188.3 billion resulted in a goods and services deficit of $40.4 billion, up from $39.4 billion in February, revised. March exports were $4.6 billion more than February exports of $143.3 billion. March imports were $5.6 billion more than February imports of $182.7 billion

Exports were up 20.4%, imports, 24.2% for the year and exports increased 3.2% and imports 3.06%.

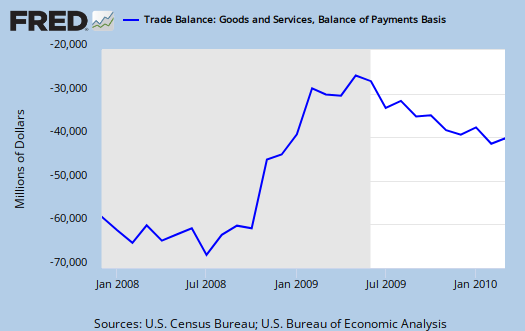

Below are imports vs. exports of goods from the official start of this recession. Notice the increase in volume on both exports and imports in March.

Below are Petroleum imports, as reported on March 14th. Cruel oil imports jumped 11.6% in March.

Here are all imports, minus petroleum, data end date March 2010. So we can see the rest of imports decreased.

Remember how advanced skills in math and science were the jobs of the future? Advanced technology is a trade deficit of $4.9 billion.

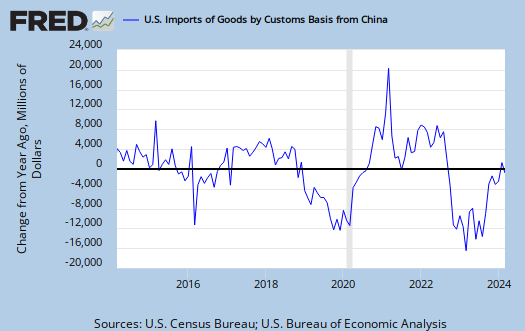

Below is the annual percent change of Chinese imports into the United States. China was 42% of the total trade deficit, including oil. OPEC (read oil) is our next worse trade deficit, at 22.5%.

Here is the U.S. Census on Foreign Trade.

Buy, Buy, Buy

'Course it's hard to buy anything other than food that's not made in China so . . . since imports ex-oil are DOWN, technically, "things" may not be improving. So, given the perverse nature of the stock market, this is a buying opportunity on Wall Street, right?