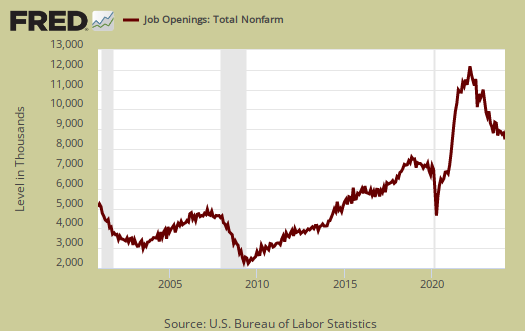

The BLS April 2016 JOLTS report shows job openings once again matching their July 2015 record high. Actual hiring though slid and openings now far exceed the number of people hired. The Job Openings and Labor Turnover Survey history shows a new trend as job openings have surpassed actual hiring and this has been going on since February 2015. For April, job openings were 5.8 million while hires were both 5.1 million. The bottom line is some of those job openings might be phantom, with businesses not being as serious about really beefing up their payrolls as their on paper activities would suggest.

There were 1.8 official unemployed persons per job opening at the start of the recession, December 2007. Below is the graph of the official unemployed per job opening, currently at 1.37 people per opening. This ratio hasn't been seen May 2001.

If one takes the U-6 broader measure of unemployment that includes people who are forced into part-time work and the marginally attached, the ratio is 2.69 people needing a job to each actual job opening. In December 2007 this ratio was 3.2. The U-6 ratio to job openings hasn't been this low since March 2007.

Job openings for the past fourteen momths have mostly exceeded hire levels which is not the case for most of the survey's history. Currently job openings stand at 5,788,000. Corporations might claim they cannot find skilled workers but odds are they cannot find cheap workers. Unfortunately this survey tells us nothing about reason to open a job or the efforts to locate a candidate.

Below is the graph of actual hires, currently 5,092,000. Just in February hires were 5,510,000, so this is quite a drop. Worse, hires are now slightly below pre-recession levels. These numbers are not adjusted for increased population and so on, so that's actually worse than it sounds. In December 2007, the first month of the recession, hires were 4,968,000. More interesting in June 2009, the height of the recession, hires exceeded job openings by 1.2 million. The monthly April decline for hires was 198,000.

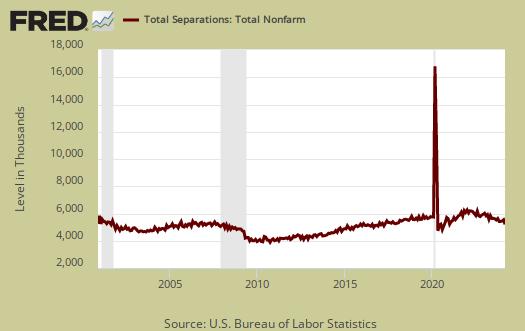

Graphed below are total job separations, currently at 4.99 million. The term separation means you're out of a job through a firing, layoff, quitting or retirement and is also called turnover. From a year ago, separations were 4.89 million, which is essentially no change.

Layoffs and firings were 1.646 million. Below is a graph of just layoffs and firings to see the labor flow. Labor flow means the way people are hired, stay at a job, quit, get fired, get another job and so on. It is the overall flow of the labor market for as people are get jobs, they also lose them.

Graphed below are openings, separations and hires levels, so we can compare the types of labor flows. Labor is not static as people flow in an out of jobs. The level of unemployed in April was 7,920,000.

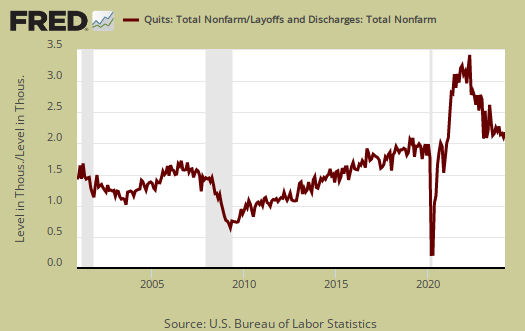

Graphed below are people who quit their jobs minus those who were fired and laid off. The lower the bar on the below graph, the worse labor conditions are. Quits are what they sound like, workers quit their current jobs often to obtain better ones. People feeling free enough to leave their current positions is considered a positive labor market sign. Quits were 2.919 million. A year ago quits were 2.681 million and quits are now near prerecession levels.

Below is a graph of the quits to layoffs ratio, currently at 1.77. This ratio of people who quit their jobs vs. those who were fired gives an indicator of worker churn as well as if there might be a shortage. If the ratio is below 1.0, this means more people are being laid off and fired than people who quit. When the ratio is much higher, this means more people quit their jobs and thus implies there is better opportunity elsewhere and workers feel free enough to move on to obtain those new better jobs. The quits to fires ratio was 1.9 in 2006.

For the year, there was a gain of 2.7 million employed and in spite of different employment reports the net job gains hasn't changed in the last 11 months. The duration in so called permanent jobs these days is very low, so due to labor flows the net gain of jobs over time belies the monthly headline buzz of jobs gained from the employment report. From the JOLTS report:

Over the 12 months ending in April, hires totaled 62.4 million and separations totaled 59.7 million, yielding a net employment gain of 2.7 million. These totals include workers who may have been hired and separated more than once during the year.

One must wonder if the focus should be away from reported openings and to actual hires. The JOLTS report tells nothing about jobs offshored or foreign workers being imported on guest worker Visas to work those supposed job openings. It does seem strange that hires is so much less than openings, yet without concrete global data, what is going on is not a picture painted.

For the JOLTS report, the BLS creates some fairly useful graphs beyond the above and they have oodles of additional information in their databases, broken down by occupational area. That said, one doesn't know if the openings are quality jobs from the JOLTS statistics.

The JOLTS takes a random sampling of 16,000 businesses and derives their numbers from that. The survey also uses the CES, or current employment statistics, not the household survey as their base benchmark, although ratios are coming from the household survey, which gives the tally of unemployed.

The April 2016 unemployment rate was 5.0%. U-6 alternative unemployment rate was 9.7%. JOLTS includes part-time jobs and does not make a distinction between part-time, full-time openings. A job opening reported to the survey could literally be take out the trash twice a week and be counted. This is a shame, it would be nice to know a little more about the quality of these new opportunities. Here are our past JOLTS overviews, unrevised.

Recent comments