The personal income & outlays BEA economic report for November 2010 is out. This is PCE, which is normally the largest component of GDP. From the report, we predict Q4 2010 PCE will be at least 4% in growth.

Personal income increased 0.3% in November and PCE or personal consumption expenditures increased 0.4%. In October 2010, personal consumption expenditures increased 0.5% and personal income grew by 0.4%. Below is the percent change in personal income and then the raw values.

Real disposable income increased 0.2 percent in November, the same increase as in October.

Below is real disposable income per capita. Per capita means evenly distributed per person.

Pretty flat huh? The population in the U.S. increased 228,000 in the month of November. So, what sounds really good initially, if one looks at population growth, not so great. Remember the numbers reported in the press headlines are aggregates.

Personal consumption expenditures is the largest part of GDP, so a 0.4% increase isn't great, but better than growth for the earlier part of the year. Below is a graph of real PCE.

For the first two months of the 3 which make up Q4 GDP, or October, November and December, it's looking like 4% growth Q4 GDP report for Consumption, at least. C or PCE was 2.4% in Q3 2010 GDP.

I calculate that if there is no PCE growth for December, PCE would be 3.97% Q4 2010 GDP.

The compounded annual rate of change, or , where for each quarter, the data was a simple average of the monthly PCE chained values, or

.

Real Personal Consumption Expenditures monthly data was retrieved from the St. Louis Fed.

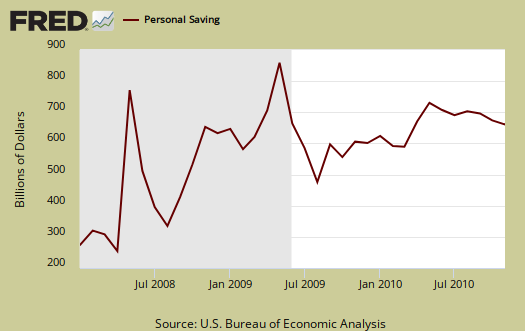

Personal Savings was also up with a 5.3% rate of DPI (disposable personal income), with a 5.4% increase in October as well.

When digging into the nitty-gritty on wages and salaries, we have a slowing of any increase, which considering the great income inequality and divide, this is not good. Goods, and manufacturing payrolls decreased.

Private wage and salary disbursements increased $6.6 billion in November, compared with an increase of $31.2 billion in October. Goods-producing industries' payrolls decreased $3.0 billion, in contrast to an increase of $3.8 billion; manufacturing payrolls decreased $1.9 billion, in contrast to an increase of $2.6 billion. Services-producing industries' payrolls increased $9.6 billion, compared with

an increase of $27.4 billion. Government wage and salary disbursements increased $0.8 billion, compared with an increase of $3.2 billion.

Below is personal income minus transfer payments. This graph shows how much personal income increased that wasn't funded by the government. Transfer payments are payment from the government to individuals where no actual services (work) was performed. This includes social security, unemployment insurance, welfare, veterans benefits, Medicaid, Medicare and so on.

The only good news in this report is PCE, once again, in reality, the middle class is getting squeezed so one must wonder where the money is coming from to increase PCE.

We've talked much about the attack on social security, hidden through tax cuts. Here's a distressing piece of data correlated to the never ending underfunding of social security.

Contributions for government social insurance -- a subtraction in calculating personal income -- increased $0.7 billion in November, compared with an increase of $4.6 billion in October.

To visualize more data from this report, consider playing around with more of the St. Louis Federal Reserve Fred graphs.

Recent comments