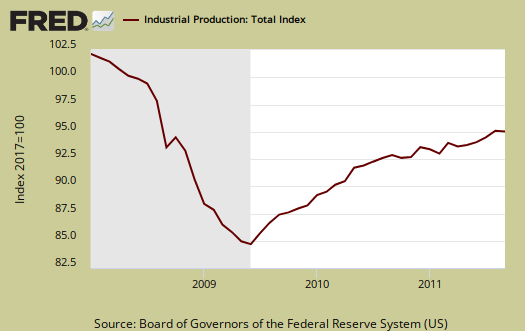

The Federal Reserve's Factory Production report shows a 0.2% increase for September 2011 Industrial Production, otherwise known as output for factories and mines. For Q3 2011, industrial production increased 5.1%, annualized. August's industrial production was revised down to zero from to 0.2%. Here is the Federal Reserve's detailed report.

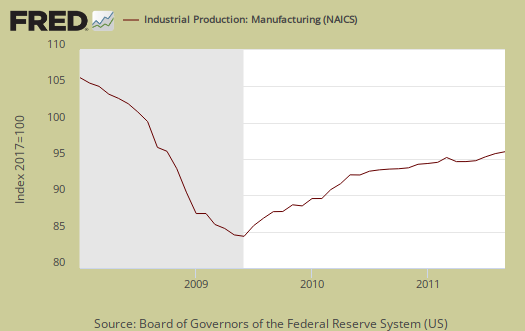

Utilities dropped another -1.8% in September. In August utilities declined -2.9%. While the Federal Reserve blames weather and temperature for utilities production decline, NOAA's monthly weather statistics show August was 2nd warmest on record. Yet believe this or not, temperature days did drop from July, so this seemingly bizarre temperature factor from the Fed. is statistically correct. Mining industrial production increased 0.8% and manufacturing increased 0.4% for September.

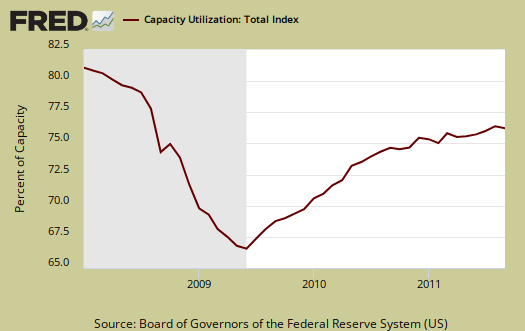

Total Industrial production is still down -5.8% from pre-recession levels, in other words going on 4 years, even while up 3.2% from September 2010. The Fed also reports capacity utilization, is -3.0 percentage points below the entire 1972-2010 average, but is up 1.7 percentage points from a year earlier.

Here are the major industry groups yearly industrial production percentage changes from a year ago.

- Manufacturing: +3.9%

- Mining: +5.2%

- Utilities: -3.6%

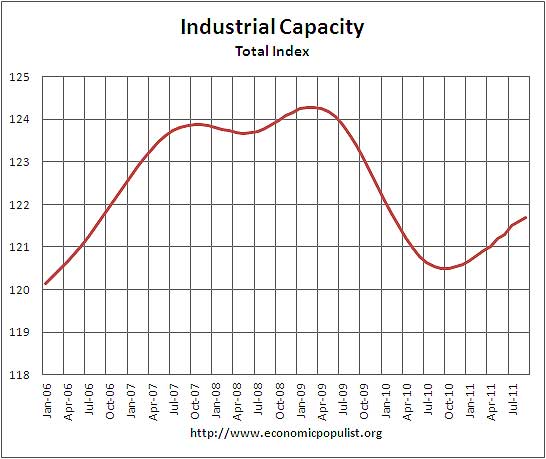

Below is the graph of raw capacity, indexed against 2007 output. This is just how much capacity does the U.S. have to make stuff. Look at how total capacity has declined for the first time in the historical data for this recession. This index represents the raw facilities, potential to make stuff. Raw capacity is the underlying number by which utilization is calculated. This month capacity increased +0.1 and capacity growth is 1% for the year. We are back on the rise, but still below pre-recession levels.

Below is the Fed's description of Market groups from the report and their monthly percent changes.

The output of consumer goods increased 0.1 percent in September. The index for durable consumer goods rose 0.9 percent; gains in the production of automotive products, home electronics, and miscellaneous goods more than offset a decline in the output of appliances, furniture, and carpeting. The production of nondurable consumer goods edged down 0.1 percent, as a decrease in the index for consumer energy outweighed a rise in the output of other nondurable consumer goods. The gain for non-energy nondurables reflected higher output for food and tobacco; the indexes for its other three major categories---clothing, chemicals, and paper---all fell. For the third quarter, the output of consumer goods increased at an annual rate of 3.7 percent after having decreased 1.6 percent in the second quarter.

In September, the production of business equipment rose 1.0 percent, its third consecutive gain of 1 percent or more, and was 10.3 percent above its year-earlier level. The index for transit equipment advanced 1.9 percent, the index for information processing equipment moved up 1.4 percent, and the production of industrial and other equipment increased 0.3 percent. For the third quarter, the output of business equipment rose at an annual rate of 12.6 percent. The output of transit equipment jumped 31.8 percent, the largest increase among the major components of business equipment for the quarter. The principal contributors to the gain were civilian aircraft and trucks.

The production of defense and space equipment increased 1.2 percent in September after a similarly sized gain in August.

The index for construction supplies rose 0.2 percent in September for its fifth consecutive monthly increase. In the third quarter, the production of construction supplies advanced at an annual rate of 6.3 percent, its largest quarterly increase in more than a year. The production of business supplies moved down 0.2 percent in September after having declined 0.4 percent in August, but in the third quarter overall, output rose at an annual rate of 2.4 percent.

The output of materials to be further processed in the industrial sector edged up 0.1 percent in September after having recorded a 0.2 percent loss in August. The index for durable materials increased 0.2 percent and was up for a third consecutive month in September. Among the major categories of durable materials, consumer parts rose 0.3 percent, equipment parts increased 0.7 percent, and other consumer durables fell slightly. Following a decrease of 0.6 percent in August, the production of nondurable materials increased 0.4 percent in September, with gains in textile, paper, and chemical materials partly offset by decreases for containers and miscellaneous nondurable materials. The output of energy materials edged down in September. For the third quarter, the output of materials rose at an annual rate of 4.8 percent after having been little changed in the second quarter.

Below is the industrial production graph for construction, in black. Even though it has increased for 5 months, we can see this entire sector is still decimated after the housing bubble burst.

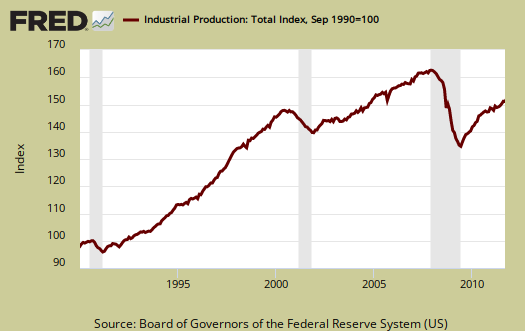

Below is another graph of industrial production since September 1990, indexed to that month. Look at the slope, the growth through the 1990's and then compare to 2000 decade. It was in 2000 when the China trade agreement kicked in and labor arbitrage of engineers, advanced R&D, I.T., STEM started in earnest.

Capacity utilization, or of raw capacity, how much is being used, for total industry is now 77.4%. This is -3.0 percentage points below the average from 1972 to 2010, 80.4%. Capacity utilization has increased 1.7 percentage points from September 2010.

Below are capacity utilization's monthly percentage point change.

- manufacturing: +0.2%

- mining: +0.5%

- utilities: -1.6%

- selected high-technology industries: -0.6%

- crude: +0.8%

- primary: -0.4%

- finished: +0.2%

Capacity utilization is how much can we make vs. how much are we currently using and this month shows signs of life, although the U.S. is still not producing what it is capable of, a reflection of the output gap. Note, this index is normalized to a specific year, currently from most reports, the 2007 yearly average (see year in the graph). Therefore, one cannot take absolute values of capacity utilization, i.e. 80%, and claim this is an indicator of a healthy economy, for it all depends on what year capacity utilization is normalized to. One can take the slope, or rate of change from the peak of a recession and determine recovery, but again, these percentages are relative, they are not absolute ratios to a static point in time. Also recall utilization is a percentage of real total capacity. Notice that total capacity in the United States has declined.

According to the report, manufacturing uses 77.8% of capacity, utilities 10.4% and mining 11.8%.

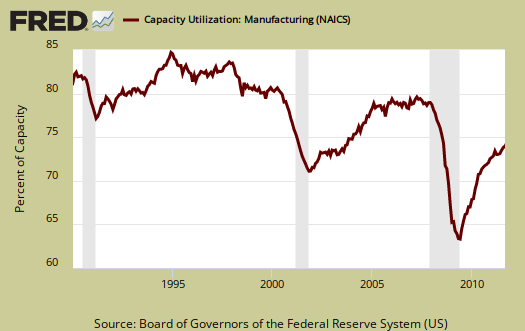

Below is the Manufacturing capacity utilization graph, normalized to 2007 raw capacity levels, going back to the 1990's. Too often the focus is on the monthly percent change, so it's important to compare capacity utilization to pre-recession levels and also when the economy was more humming.

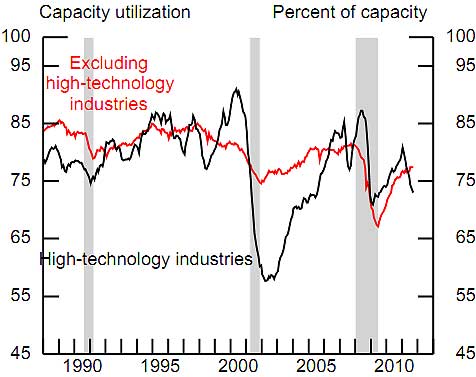

One of the more interesting graphs is high technology capacity utilization, shown below. These high tech sectors seems to correlate to when the high tech industry offshore outsourced in droves to China and communications equipment is one area that is being offshore outsourced.. High Technologies capacity utilization keeps dropping and this month was another -0.4%.

If you are baffled by what crude, finished mean, read these stages of production definitions.

The Federal Reserve releases detailed tables for more data, metrics not mentioned in this overview.

Recent comments