Last November I wrote a diary called The Panic of 2008? in which I predicted:

This is NOT the Great Depression II. Nor is this the stagflationary 1970s. It is going to unfold as some other Beast. Only the broad outlines of this Beast appear discernable now: it will likely feature (1) increasing import prices; (2) wage stagnation (that does not keep up with price inflation); (3) real asset deflation; and (4) possibly a Japan-style "liquidity trap."

That prediction has been borne out so far. In view of the events of this last week, particularly the run on Fannie and Freddie, and the failure of IndyMac, revisiting the Big economic Picture seems timely. The Panic of 2008 is unfolding like a neutron bomb over the financial and construction sectors of the economy, leaving the infrastructure of the rest of the economy basically intact. Asset prices - stocks and real estate - are declining, wages are stagnant, import inflation is setting records. But The Panic of 2008 nevertheless signifies an important turning point.

I. Introduction

The genesis of the Panic of 2008 was the tremendous housing-centered credit bubble earlier in the decade. Fog-the-mirror credit was extended to those who had no hope of ever paying it back, by mortgage brokers whose sole financial interest was "closing the deal." The loans were immediately bundeled together and sold off to "investors" who thought they were buying "AAA" rated debt, which turned out to be cr*p. The availability of all of those mortgages also led to a massive overbuilding of residential housing, at inflated prices due to artificially stimulated demand. So now, just as the bad credits are blowing up, the underlying assets are in decline, triggering the next series of defaults -- much as each not-quite-watertight compartment in the sinking Titanic's filling up with water, tipped the ship just enough for water to spill into the next compartment.

II. The 3 modes of financial crises

To recap, it is worthwhile to return to this excellent summary of 3 types of financial crises by Prof. Brad DeLong. First, he identifies 3 classes of financial crises:

- Liquidity crises

- Solvency crises that are easily cured by easier monetary policy that boosts asset values

- Solvency crises that aren't easily cured by easier monetary policy

that he then describes in fuller detail:

A full-scale financial crisis is triggered by a sharp fall in the prices of a large set of assets that banks and other financial institutions own, or that make up their borrowers' financial reserves. The cure depends on which of three modes define the fall in asset prices.

The first -- and "easiest" -- mode is when investors refuse to buy at normal prices not because they know that economic fundamentals are suspect, but because they fear that others will panic, forcing everybody to sell at fire-sale prices. [My note: in this mode, unlike modes 2 and 3, underlying assets are worth more than accumulated debts, but they are not "liquid" -- they cannot be sold at other than discount prices prior to the date at which payments on debt become due].

The cure for this mode -- a liquidity crisis caused by declining confidence in the financial system -- is to ensure that banks and other financial institutions with cash liabilities can raise what they need by borrowing from others or from central banks.

....In the second mode, asset prices fall because investors recognize that they should never have been as high as they were, or that future productivity growth is likely to be lower and interest rates higher. Either way, current asset prices are no longer warranted.

This kind of crisis ... [is] because the problem is that banks aren't solvent at prevailing interest rates. Banks are highly leveraged institutions with relatively small capital bases, so even a relatively small decline in the prices of assets that they or their borrowers hold can leave them unable to pay off depositors, no matter how long the liquidation process.

....

The problem is not illiquidity but insolvency at prevailing interest rates. But if the central bank reduces interest rates and credibly commits to keeping them low in the future, asset prices will rise. Thus, low interest rates make the problem go away........

The third mode is like the second: A bursting bubble or bad news about future productivity or interest rates drives the fall in asset prices. But the fall is larger. Easing monetary policy won't solve this kind of crisis, because even moderately lower interest rates cannot boost asset prices enough to restore the financial system to solvency. [My note: This mode is the full-fledged deflationary spiral and liquidity trap].

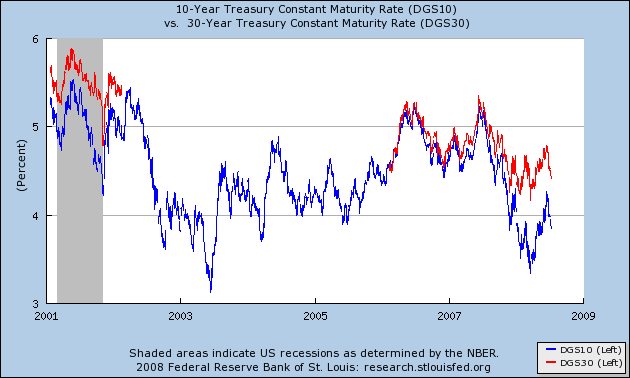

Applying DeLong's 3 modes to recent events, we see that what began as a "subprime" mortgage default event in February 2007 turned into a "liquidity" event in August 2007 as two Bear Sterns sponsored hedge funds collapsed. The Federal Reserve, dealing with a "mode 2" event, quickly lowered rates from over 5% to 2%. This allows banks to rebuild balance sheets and restore solvency and liquidity.

What happened this past week is the first indication that we may have begun to pass into a "mode 3" insolvency crisis, where even low interest rates cannot save fragille or overleveraged financial institutions like IndyMac -- and maybe even mortgage giants Fannie and Freddie.

III. The Neutron Bomb over the Financial Sector

As I wrote in my last diary, so far the data paints a picture of a total meltdown of the financial sector of the economy, with the rest of the economy, while under considerable stress from soaring gasoline prices, hasn't buckled yet. But make no mistake, this is a fragile basis for stabilization or recovery. As I pointed out in a diary one year ago entitled, Are Hard Times Near? The Great Decline in Interest Rates is Ending, for nearly 30 years American consumers have relied on increasing asset prices (stocks or real estate) or decreasing interest rates (to refinance debt) during those times like the last 8 years in which their incomes and wealth have not increased. Only once before (the recession of 1991) have all of these sources been closed off. The evidence is that Americans are increasingly adding purchases (like, of gas for their cars) to their credit card balances, and eating their seed corn by taking loans from their 401K plans. This cannot go on for very long.

IV. Meanwhile, Import prices have soared.

On Friday we also got an update on import prices. They are soaring, and the year-over-year comparisons are getting worse every month. Inflation in import prices, at 20.5% annually, is now worse than even during the 1970s oil shocks:

This is what happens to Banana Republics whose currencies are not worth holding on to. More on the ramifications of this in part VI. below.

V. A turning point this week?

But if so far we have only seen a "neutron bomb", then the events of the last week are warnings that an "atomic bomb" may be ticking, and a much worse "hydrogen bomb" is possible.

Until just a few weeks ago, the idea that the two huge Government Sponsored Entities (GSE's), Fannie and Freddie, might need rescuing, was a fringe idea. Then on Wednesday former Fed governor William Poole said they were "insolvent" triggering a classic panic -- an outright run on their shares. By the end of yesterday there were rumors floated and denied of nationalization and Fed intervention. If either scenario comes to pass, that would be like an "atomic bomb" having wide but not universal ramifications for the economy.

Fannie and Freddie did not write subprime mortgages or liar loans. While only a small fraction of Fannie and Freddie's $5 Trillion combined portfolio's (of conforming 80% or less mortgages) would likely fail, even 5% of that (a reasonable worst case scenario) is $250 billion. That would be an enormous tab for the taxpayer to pick up. Even if the taxpayer does not pick up this tab, but merely "purchases" the entities and becomes their new owners, (and becomes entitled to the income stream generated by the mortgages) that is going to add some serious red ink to the deficits. Taxes are going to have to be raised, budgets severely cut, or a large amount of new debt (bonds) will have to be issued. This is not good news for the world's biggest debtor, Uncle Sam.

In view of Uncle Sam's possible $100 billion+ new liability, something unheard of happened. Usually when the stock market tanks on bad news, investors "flee to quality" which typically means buying US treasury bonds. Yesterday, for the first time in living memory, that didn't happen. While gold, oil, and most other commodities rallied; and while most foreign currencies (e.g., Euro, Yen) rallied (i.e., the dollar lost value; US Treasury bonds not only did not rally, instead, they sold off significantly (orange line Thurs., to green line Fri.):

If the nationalization of Fannie and Freddie would be an "atomic bomb", then the ramifications to the FDIC insurance system of more bank collapses like IndyMac would be like a "hydrogen bomb", setting the stage for unthinkable commodity prices and a rout of US Treasury bonds orders of magnitude worse.

At the end of 2007, according to the FDIC's financial statement, it held $53 billion in its deposit insurance fund. According to the FDIC press release announcing the seizure of IndyMac:

Based on preliminary analysis, the estimated cost of the resolution to the Deposit Insurance Fund is between $4 and $8 billion

While the IndyMac failure does not impair that fund, if there are many more such failures lurking, ultimately the FDIC would have to resort to Uncle Sam's printing press to make good on its insurance. And that would make the selloff in US Treasuries on Friday look like a picnic.

VI. Conclusion: Slouching ever so slightly closer to a Banana Republic

As readers of my comments and diaries know, I dislike Armageddon scenarios. They are extremely, extremely rare for a reason. Even with all of the mismanagement and collapse of the Bush/Greenspan credit bubble -- problems widely observed, reported on, and known to investors for the last several years -- US Treasury bond yields are still firmly in the range they have occupied since January 20, 2001:

But what is happening is that the US dollar has substantially lost its position as the world's reserve currency, as reflected in this graph of foreign holdings:

The US has largely escaped the ramifications of being a deadbeat debtor nation due to the privileged position of having the world's reserve currency. As that wanes, more and more inflation will be imported in response to ever more debt creation, even if necessary in response to a crisis. If long term rates go up 1/4% in view of a possible seizure of Fannie and Freddie, imagine what will happen to them if there is full nationalization, and if there is printing of money to fund FDIC insurance. Even a 1% increase in long term borrowing rates will create serious problems for consumers and for Uncle Sam's continuing to finance his debt.

The Panic of 2008 is the turning point. The average US citizen is seeing a declining standard of living relative to the rest of the world. Interest rates will begin to rise, not in a drastic end-of-the-world move, but gradually, inexorably, and increasingly so long as Uncle Sam and his citizens continue to accumulate debt.

Comments

excellent analysis!

I was with you also on the not an Economic Armageddon message but I do am thinking we are at a turning point.

This is what I read last night which put the hair on my head on end.

Fannie, Freddie Turmoil May Hike Rates, Slow Recovery, buried deep within this article:

Freddie Mae/Freddie Mac hold about $6 trillion out of $12 trillion in mortgages, that's half.

Then, this fact:

That's 10% at least showing signs of duress and now as I understand it, due to falling prices, it makes more sense economically to plain walk away from a mortgage where the underlying asset is so significantly less than the loan and this is going on as well.

So, 10% is $1.2 trillion. Ok, now I'm really standing back thinking a tsunami is really approaching in spite of the chicken littles of the world.

Our friggin' Congress doesn't even show up to work, never mind put their politics on hold for a couple of weeks, get the experts in, write up what they recommend and plain pass it now. As far as I know this Senate bill (we need to look at this) is only going to assist about 500k or so mortgages, that's out of 4M (last 24 months it's about 4M in foreclosure).

Seems to me something much more dramatic in terms of refinancing vehicles needs to happen, say something that takes a partial loss on a distressed property, evaluation to stem these from being total losses (foreclosure, put up for resale cycles).

The great American write-down

As I see it, the adjustment is already happening. In my neighborhood, there seems to be 1-3 newly vacant homes on nearly every block. My subdivision is about one or two steps above the starter home level, and it's pretty much the same story for every neighborhood on this side of town from the middle level on down.

I know several people who are trying to negotiage short sales of a home they own, and I am one of them. I wound up owning two houses, and I am not an investor or flipper, nor did I fall for the adjustable rate pitch (as an IT pro I know better than to bet that my salary is going UP). Neither of them is worth anywhere near their appraisal price when I bought them, and that is true for a huge percentage of homes purchased over the last two or three years: http://www.reuters.com/article/businessNews/idUSN117179120080212

My bankruptcy attorney has someone in his office who does nothing but handle short sales, and business is brisk.

The only way the vacant homes will ever move is if one of three things happens: a) the price has to come down to what someone who fits in with the neighborhood can afford, or b) we would have to go back to allowing all the liar loans backed by monopoly money, or c) the gummint will have to step in and start giving the houses away. Bank-owned property sales (in my area $130-140K as opposed to the $160s for private owners), and short sales (where the bank cooperates because it doesn't want another property to manage) are making the great write-down happen even as we speak.

I know someone in the business of arranging financing who could get you whatever type of loan would fit your comfort level, but he's not in business any more. If they are serious about going back to sound finances, the prices will all have to come down. Way down.

So, if home equity vanishes (as it is), and wages stagnate (as they have since the turn of the century), and jobs keep being lost (ditto), don't things come to a grinding halt, just as back in the 1930s?

Similar story in my neighborhood

I too live in a highly desireable solidly middle class neighborhood. It was rare that a home in decent condition was ever on the market here more than 3 weeks. Now they sit for months and months with "reduced price" signs. We are also seeing them being auctioned off at a rate of one or so every two months. Even more than a few orange repo tags on the windows as well -something almost unheard of in this neighborhood a few short years ago.

Whats surprising to me is this is the midwest, where we don't get the rapid rises and falls in prices they stay pretty stable. The majority of the homes lost are not from subprime loans - they are largely from those who are losing their jobs to the constant drip of plant closings and are forced to move due to employment needs or income loss

Here is a site I found

I've known about this site for a while, this guy called it early as to the crash of the housing market.

http://patrick.net/housing/crash.html

I checked it out

Someone states the obvious which seems to escape many economic sites!

Yeah, notice that in most of the stuff on the housing crisis few comment that few salaries can handle these mortgages, period. When people were buying these things I thought, Good God, there is no way in hell they are going to make it and that's people with 6 figure salaries, duos. One layoff, or the interest only drops and they are history and that is what is happening.

doggone it

it must all be in your head - quit yer whinin' ;-)

(in re the McCain camp assertions that the economic woes are mental)

When I bought my first home, they put me thru the credit check ringer, even though I had stable employment, great credit and 20% down. it just blows my mind that lending institutions no longer require that to buy a home.

The second home was a totally different experience. we really had to stick to our guns to get a conventional loan - they put real used car sales tactics to use trying to push us into a gimmick ARM loan and borrow more than we wanted or needed. Once we got past that they tried to slip in all sorts of BS charges, and even tried to insist we needed PMI, again despite spotless credit , 20% down and buying well under appraised value. we threatened to walk at that point - the tune changed real quick.

Credit Slips

I try to put really accurate, in depth blogs in the middle column and credit slips has Elizabeth Warren, who specializes in consumer credit abuses. I haven't been tracking on just how much of this is pure predatory lending types of practices, but the obvious thing to me would be to refinance all of those mortgages into conventional mortgages minus all of that.

It sure seems like many lost their homes where it was needless, but I don't know the situation now or the statistics (good blog topic for someone wanting to go into depth on it maybe).

Fannie and Freddie

It was only Monday that I posted a diary here about the insolvency of the GSE's. Then I leave town for a couple days and suddenly everyone is talking about them.

If they blow up the bond market is screwed. If the Treasury bails them out the dollar is screwed.

Which poison will they pick? I'm betting they will kick the dollar to the curb.

where do we spin the gamble wheel?

I'm thinking you're right, I saw a lot of "dilution" of "stock" but that won't solve a thing sorts of articles and the 2x increase of the federal debt sure sounds like a disaster (if it happens). The fed announced $15B to inject into them, but I don't see any real options they have but to fry the dollar, which to me implies macro economic toast, esp. with oil and even worse, a possible decoupling from the US dollar/economy.

It's obviously all your fault, G.

You posted Monday, Wall Street and Washington read it on Tuesday, and by Friday, the deed was done!

The run on Fannie and Freddie was so quick, I've been wondering if it was a "bear raid". Not like I can read the minds of traders, but what do you think?

P.S. What did those banks who called for financial meltdown in late June, that you highlighted in a diary, know, and when did they know it?

I knew that

I was just hoping that no one else noticed that I was responsible for the entire economic meltdown in this country. Maybe I should run up a whole bunch of debt on credit cards like every other patriotic American.

anyone surfing around

There are numerous blogs giving the juice out there.

Implode-O-meter is one.

The Big Picture

The Mess That Greenspan Made

Calculated Risk

All have tidbits (besides what is here in the middle column) to calm your nerves or make the hair on the back of your neck stand on end.

Warning: 3 cups of coffee reading these can lead to heart fluctuations.

circular implosion

So, I noticed a trend lately.

I live in the uber-overpriced Seattle-Tacoma metroplex, almost 4,000,000 people rammed into only 6% of the State's area.

The housing collapse has been slower here than I'd like (only saying that because I make $65K and haven't been able to afford a house in years). What I'm seeing is an implosion in pricing. First the far out burbs were feeling it, then the closer ones then the closer ones, and now the core cities are starting to show it.

So now folks from the burbs are starting to move to the core cities (Seattle, Tacoma, Everett, Bellevue) and the prices are still falling!

So, I tend to think that as more folks move in (high fuel costs) the prices in the cities will stabilize at some point.

But yet our economy in the great State of WA is heavily trade dependent. Apples and software go out, Kia's and computers come in. A collapse in the dollar would have bad effects, especially on said potential recovery... damned if you do, damned if you don't.

What the hell is a working man supposed to do?

The Panic of 2008: a turning

When will someone arrest and try Bush and his administration for what they have done to this country? Do we need a repeat of the 1930s or another World War before they are held accountable?

The Panic of 2008: a turning

I agree with you. Bush and his kind have looted and raped America for their own interests. We the people will get even. They rich will be made to pay for what they have done to America. Class warfare? You betcha.

The Panic of 2008: a turning

Class warfare has been going on for the last thirty years, and it ain't the lower and middle classes who are winning.

The Panic of 2008: a turning

It's fine to blame the Executive Branch, but Americans do not elect a King or Dictator every 4 years; a President does not pass legislation - it is the House of Representatives and the Senate ("Congress"). Congress should be arrested and tried for what it has done to America. We need to make Congress accountable and stop allowing Congress to point the finger at the Executive for enforcing the laws Congress passed (sometimes even overriding a Presidential veto).

Oh, we can blame the President too. LOL And the US Supreme Court. LOL But mostly we have to blame ourselves for continually voting for members of Congress who fund the war in Iraq, who want to pass legislation to bail out the GSE's, who have passed laws (NAFTA, for example) allowing US manufacturing jobs to be lost; etc.

Crisis over the world

Actually there is crisis over the world not just U.S also in U.K. Mexico and other places.

Nice blog! I will subscribe to your blog stay in tune.

Check my blog too.

Business Management Tips

Best Regards.

Thx Daniel

Just a FYI, if you create a new account, log in, then you can track all of your comments, participate in the ratings (editing) system, post and I think I have signatures enabled if you want to link up to your own blog.

This is a community blog (all things economics).

2008 panic

ARTIFICIAL FINGERNAILS AND THE FINANCIAL CHARADE

There was once upon a time a simple distinction between services and products.

That which you could touch and hold was a product, for example a pencil, or a brick...that which you felt or was immaterial in the world of physics was termed a service, for example getting a hair cut or heart transplant.

Some time in recent history the financial wizards decided that they would create "products" out of their services.

I offer a simple example with old fashioned manicures.

Women ( later men) would go in for a cuticle treatment, and had a choice of how long they wanted their nails...short, medium or long. They also had a choice of the three basic primary colors....red, blue, or green. This is not accurate. The choices were all shades of the red spectrum....dark red, light pink, etc.

Now you have a menu of selections which takes the time of a full latte to decide.

Lengths and colors comprise the headings for full chapters in the menu.

What is the occasion, how long do you want the nail to last? What modern acrylic or other manmade material do you wish to use? ( should it be environmentally friendly? What do-dads do you want added... hearts, stars, etc?

In the good old days when my father went to the bank for a mortgage loan there was one choice...later we had flexible vs. fixed rates ( things started to get confusing because there were these things called points)

It seems that every new manager or person with some sort of authority and responsibility must try to "IMPROVE" their job or system

This means more paper work and the appearance of adding something to what people had before. This "value added" concept from the business schools has reached absurd levels in all the SERVICE industries. The most egregious occurs in the financial planning...business...i stress the latter term because I want everyone to know this means money...and there have been layer upon layer of people added to the financial serfvice industry who must get their cut.

Whereas the manufacturing (product) industry made every effort to trim costs and levels of cost...the US and UK are leading the world in this Financial services BUSINESS which really adds nothing to the commerce of vital commodities and exchange of material needs and superfluous plasma screen TV etc

Speculation is a blight...it is uncontrolled greed. There is no concern for the common good. Even the SEC short term restrictions on short selling (080717)sends a signal to the common guy on the street to try and profit from panic and pessimism...

and consequently to foster and feed the downward spiral.....’tis not the way things are supposed to be.

If I am 35 yrs old and want to start a savings/pension program...I have to decide my needs 35 years from now and what "RISKS" I want to take and therefore, what percentage returns.... this charade would make one believe that the Financial Planner...can choose...with some sort t of assurance...that this investment or "PRODUCT" will allow me to achieve my long term goals...

Well, we see that the hedge funds and the sub-prime debacle is rife with lots of smart PhDs with algorithms and complicated calculus...and it all turns out to be smoke and mirrors....Economics is not Physics....BUT we are led to believe that it is....by financial industry leaders and many political figures who benefit by the ruse. These same business leaders who pull down astronomical compensation packages beyond anything that is with in the realm of reason.

lets get back to the old days of simple and realistic expectations.....5% interest was fine... how can we expect 20-40% returns on investment when the mature economies are growing at 3% and inflation is at 2 or 3%; common sense tells even a high school drop out that something is not right. Unless you are a loan shark and usury is the prevailing standard...which means some schmuck ( or a whole society) is getting screwed.

False Needs

Capitalism, especially in its current incarnation, proliferates false needs. If we could get this straight, debt levels, and unfortunately much GDP would drop precipitously.

The idea is there are just some things, you really can do without, but we all choose to have anyway. A recession puts an exclamation point on the FALSE in every economic transaction.

Burton Leed

The Panic of 2008: a turning

The crisis of the market was not only in a particular state or country. This is the problem fased by all over the country and many investors and companies are in a downfall. Day to the range of US dollar is decreasing and interests rates will be raised in future. Yes The Panic of 2008 is a turning point.

=========================================================

john

Credit Card Debt

......

this article is somewhat very useful and informative.. thanks