This morning the BLS reported that consumer inflation ramined unchanged (seasonally adjusted) in April, (rising 0.2% NSA). Year-over-year prices have fallen -0.7% into deflation. YoY consumer deflation is only surpassed by 1949 in the post-Depression era.

The first 4 months of inflation data are still in accord with the optimistic scenario I laid out in January:

In the Optimistic scenario, the fiscal and monetary stimuli, together with intelligent new political leadership in Washington, halt the meltdown perhaps by mid-year, and wage reductions remain the exception. In the Pessimistic scenario, the stimuli fail, and wage reductions spread, leading to a wage-price deflationary spiral.

In the Optimistic scenario, monthly inflation remains positive, but perhaps at 1/3 to 1/2 the level of last year. By the end of June, first half 2009 inflation will be in the 1.4%-2.2% range. Year over year, however, as the 2008 numbers are replaced, DEflation will be realized, falling to (-2.0%) - (-2.7%) range....

In the Pessimistic scenario, monthly inflation remains near 0%-1% in the first half, and is firmly negative, though less than 2008 in the second half. By mid-year, YoY DEflation will be somewhere in the (-3%) - (-4.5%) range....

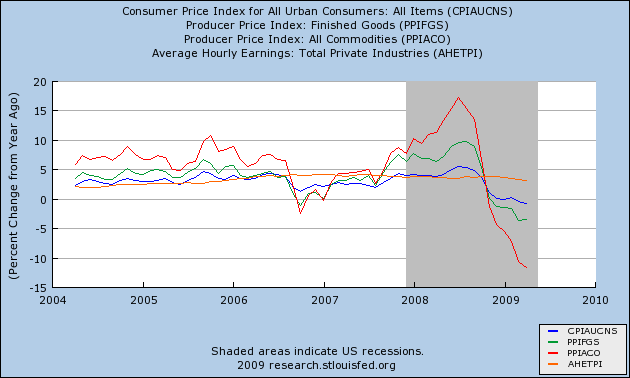

Four months later, NSA inflation for 2009 is so far at +1.3% (NSA). Nevertheless, if there were to be a recovery soon, we would need PPI for commodities to bottom and turn around. That hasn't happened yet.

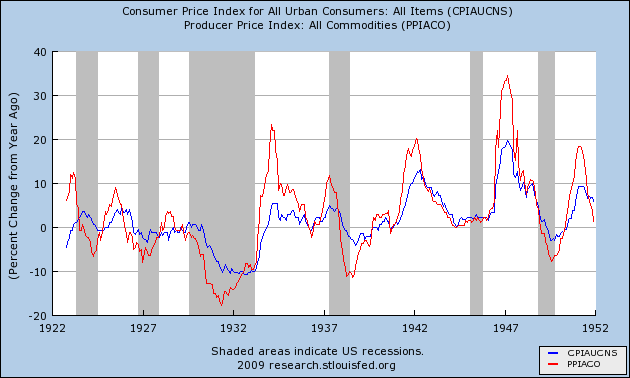

A bottom and turning around of inflation data would generally mean increased demand. So far that is not happening. April car sales, retail, and gasoline data all showed renewed cowering consumer zombies. For comparison, here is the consumer and commodity inflation data during the deflationary 1920-1950 era:

Note that commodities (in red) almost always turned up before the economy as a whole did. Typically CPI (in blue) bottomed at the end of deflationary recessions and the Great Depression.

While inflation hasn't bottomed yet, one emerging silver lining is that commodity prices (shown in red below) have fallen much further than PPI (green), which in turn has fallen more than CPI (blue), which in turn has fallen more than wages (orange):

Put together with refinancings enabled by 4.5% mortgages, and you have the price recipe you need for a recovery, once demand increases.

Comments

add to that the money supply

These are pretty amazing numbers considering the Bernanke money machine too.

I notice the oil companies are trying to push up gas for the summer and it seems decorrelated from the price of oil.

Anyone looked into that or have some charts? i.e. the price of gas, per season per the price of oil?

I still say we haven't seen the breaking point yet

After all, layoffs are a severely lagging indicator, especially governmental layoffs. We haven't seen the end of the first round of wage deflation yet, so we won't know if we're in a wage/price spiral (the pessimistic outlook) until at least Q409, maybe even Q110.

The key phrase in the above is "once demand increases". We won't see increasing demand until we see increasing jobs, and we won't see increasing jobs unless the federal spending is enough to counteract the effect of State Government Trapdoor Day.

We are still *very much* in danger of falling into a wage/price deflationary spiral.

-------------------------------------

Executive compensation is inversely proportional to morality and ethics.

-------------------------------------

Maximum jobs, not maximum profits.

unless

we see stagflation ... by all recipes we could see wages continuing to drop while prices start to rocket.

Yes, that's a danger as well

In fact it's the opposite danger, if the government wildly overestimates instead of underestimates the amount of spending needed, then that's exactly what will happen.

The only way we get out of this OK is if they hit the needle with the 50 caliber machine gun.....

-------------------------------------

Executive compensation is inversely proportional to morality and ethics.

-------------------------------------

Maximum jobs, not maximum profits.

Agreed, but am wondering...

I fully agree with your excellent comments, but given not only the lagging indicator(s), but those recent auto industry layoffs will have both an obvious and gradual multiplier effect, together with further credit derivatives meltdowns (leveraged buyouts coming due, commercial real estate loans going default, credit card loan securitization, auto loans, etc.) causing ever increasing unemployment, along with the exponential growth in jobs offshoring deriving from both TARP bailouts and that stimulus bill (where the "buy America" clause was killed) may give us a bizarre mix of decreasing wages/hyperinflation. May not fit the popular models, but this is a mighty unique economic situation we are facing.

Then, of course, these new bailouts to the insurance industry, a principal offshorer, which has encouraged others to offshore prior to their being insured, and now will undoubtedly further offshore jobs upon receiving said bailout funds.

the tipping point

So far I would claim except for a few brave economists, policy analysis, so far most are in complete denial of the effect of outsourcing, globalization, trade, insourcing, immigration (i.e. the race to the bottom) is having on a macro economic scale. Just now I notice more economists are talking about wages, income, but in terms of consumer driven economies and confidence.

I think we maybe over the tipping point on that fundamental principle to have a robust economy one must provide great jobs, stable income, i.e. a middle class to have it and that's on a macro economic scale. This is my hypothesis but I wish we didn't have to sit here, like we're in a huge dysfunctional family, watching those in power destroy it all before it finally dawns on them this is the case.

Wile E Coyote Effect.

Picture this: you get the feeling that you're hanging, no place special, weightless and suspended in mid-air, and something tells you this may last quite a while. For all intents and purposes, you should be falling, and gaining speed while you do. But it doesn't happen, and you're not Wile E. either. What's more, you’re incessantly being promised that you’ll never fall as long as you keep moving your arms and legs. And though you wonder what fate will have in store once you get too tired of swimming, you try very hard to believe that the breaststroke and the butterfly, when executed properly, nullify gravity, because you think you know what's next if you don't. Nothing to do but to keep swimming and tell yourself you have faith. Mind over matter and all that.

Yeah, and whatever you do, don't look down, or so they say, but that's easier said then done. You peeked, you couldn't help yourself, who do they think they're fooling, after all it's your life too, and more than it's theirs, and you see "they" are losing over a third in their life blood tax income, while they rake up debt as if it's cotton candy, the kind that you can feel is being spun out of your living tissue, and you're afraid that might start hurting something bad sometime soon. And if that would happen, you now realize that no medicare is all too bleeding very likely to pay for your medical bills, and the insurance that came with your job is sure to leave with it too, and one out of every 6 of your neighbors is out of work already and once it's one out of every five you're pretty darn sure it'll be your turn too.

And you might get up and shout, and vent your doubts and anger, or so you think, and so you keep repeating in your head, if only you were sure you would not have to be alone. What, you ask, is bound to become of the one who is the first to lose the belief? Is that one destined to fall into the bottomless pit reserved for ye of little faith and none at all, or will it be a ritual tearing off of life and limbs by the hands of the truer followers? What are the chances that the first head to stick out above the evenly waving fields of grain will be hailed as a liberator, and not cut off at the neck in order to let what everybody knows their place is to go on and on and on?

For now you see no other way, no choice or option, than to believe that believing will keep you from falling, like everyone else around you tells you they do, and you do feel somewhat comforted by the notion that ever since the days of old, those who live in their faith have pledged they will take care of their own. But mostly, if you're open and lucid and honest, you're just simply scared out of your wits. And what you're most afraid of above all is that somewhere high above the waving fields of grain, your very fear will freeze you, no place special, in mid-air, suspended and weightless and unable to keep on moving your arms and legs. And you think you know what's next.

Once again, debt deflation

Once again, debt deflation is upon us. The summer oil rally is just that...an attempt to lure in a few, but demand is softening. And why not? Who is actually buying anything? What businesses are actually making large capital investments right now? (Unless they have a long-term gov't/military contract, who is really buying big time? (Yes, we hear much spin from the IBM/Cloud Computing evangelists about China upgrading networks, etc. But is this credible over the next few reporting Quarters?)