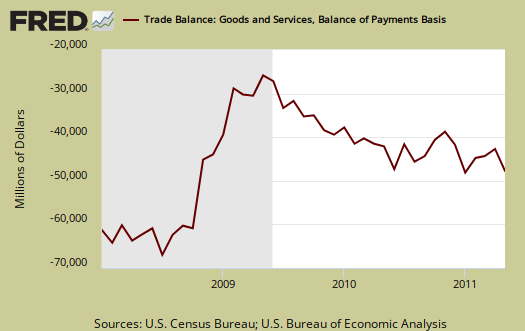

The May 2011 U.S. trade deficit increased $6.6 billion to $50.2 billion. This is a 15.13% monthly increase in the trade deficit. In January the trade deficit increased 18.5% and the trade deficit wasn't this big since October 2008. Exports decreased $1 billion from last month. China imports, not seasonally adjusted, increased 15.6% in May, with a trade deficit of $24.96 billion. Oil imports were the highest on record with a petroleum end use trade deficit of -$30.45 billion for May, which increased 16.5%. All of this is with another -5.9% monthly drop in Japan imports, not seasonally adjusted, due to the Tsunami.

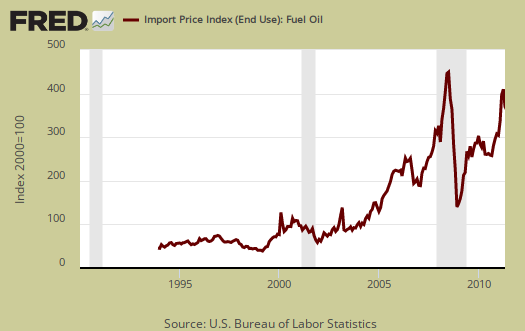

The United States basically has two major ongoing problems with the trade deficit, Chinese goods and Oil imports. Below is the not seasonally adjusted import price index for oil fuel. In May the average price for a barrel of oil was $108.70.

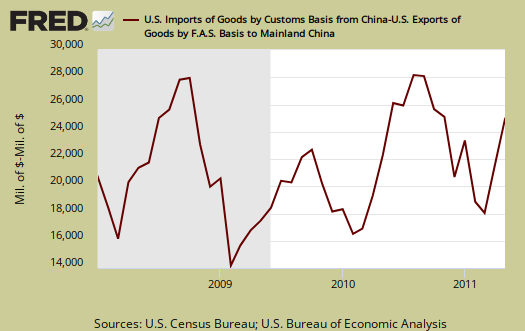

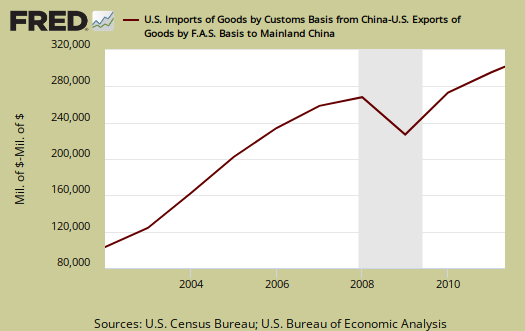

Below is the raw customs basis accounting of the trade deficit with China, not seasonally adjusted. China alone was 38.9% of the goods trade deficit for May.

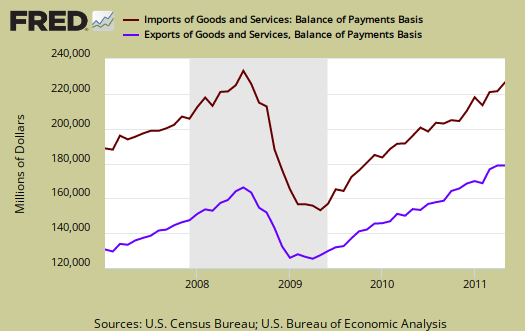

Below are imports vs. exports of goods and services from January 2007 to April 2011. Notice how much larger imports are than exports, but also notice the growth, or rate of change between months of U.S. exports. In May goods exports decreased $1.4 billion and services exports increased $0.4 billion.

Below is the list of good export decreases from March to April, seasonally adjusted. The drop is due to industrial supplies and materials, which includes fuel oil. Fuel oil was 26% of the total export drop in this category. Cotton took a major hit and was 18% of the total export decline as was organic chemicals.

- Automotive vehicles, parts, and engines: +$0.225 billion

- Industrial supplies and materials: -$1,842 billion

- Other goods: +$0.282 billion

- Foods, feeds, and beverages: -$0.63 billion

- Capital goods: +$0.374 billion

- Consumer goods: -$0.427 billion

Exhibit 7 gives Census accounting method breakdown for exports.

Here are the goods import monthly changes, seasonally adjusted. Fuel oil was 87% of the total Industrial supplies and materials increase. One of the more disgusting increases is computers. We imported almost $6 billion in computers, for one month. Remember, it was the United States which invented the things and made the industry. Now we have an $813 million import increase in them for May.

- Industrial supplies and materials: +$4.340 billion

- Capital goods: +$1.185 billion

- Foods, feeds, and beverages: +$0.86 billion

- Automotive vehicles, parts, and engines: +$0.579 billion

- Consumer goods: -$0.884 billion

- Other goods: -$0.258 billion

Running a trade deficit in advanced technology is not a good sign for those jobs of tomorrow. This deficit is increasing meaning we are literally outsourcing America's future.

Advanced technology products exports were $23.3 billion in May and imports were $31.2 billion, resulting in a deficit of $7.9 billion. May exports were $0.3 billion more than the $23.0 billion in April, while May imports were $1.2 billion more than the $30.1 billion in April.

Here is the breakdown with major trading partners, not seasonally adjusted. China is the worst trade deficit, with $25 billion, with last month's China deficit being $21.6 billion.

OPEC can be assumed to be oil and it jumped for May, but is not seasonally adjusted. Still we see every month, our problem is clearly China and oil imports. The amounts in parenthesis are April's deficit figures. Notice how the trade surplus list is super short.

The May figures show surpluses, in billions of dollars, with Hong Kong $2.1 ($2.6 for April), Australia $1.2 ($1.1), Singapore $0.8 ($1.2), and Egypt $0.4 ($0.5).

Deficits were recorded, in billions of dollars, with recorded, in billions of dollars, with China $25.0 ($21.6), OPEC $11.3 ($9.6), European Union $8.8 ($7.5), Mexico $6.3 ($5.5), Germany $3.8 ($3.8), Venezuela $3.1 ($2.8), Canada $2.7 ($2.4), Japan $2.6 ($3.6), Ireland $2.4 ($3.0), Nigeria $2.3 ($2.5), Taiwan $1.5 ($1.2), and Korea $1.3 ($1.0).

Once again, we are back on track for record breaking trade deficits, which detract from U.S. GDP. In 2008, we broke monthly trade deficit figures of $60 billion.

Below is a graph of trade deficit with China, per year. 2010 was a record for a trade deficit with China. With 2011 having a China trade deficit, accumulated of -106,755, we're well on our way to break last year's record.

Here is April's report overview (unrevised, although graphs are updated). Here is the BEA website for additional U.S. trade data.

You might ask what are these Census Basis versus Balance of Payment mentioned all over the place? The above mentions various accounting methods so we're comparing Apples to Apples and not mixing the fruit. The trade report in particular is difficult due to the mixing of these two accounting methods and additionally some data is seasonally adjusted and others are not. One cannot compare values from different accounting methods and have that comparison be valid.

In a nutshell, the Balance of Payments accounting method is where they make a bunch of adjustments to not count imports and exports twice, the military moving stuff around or miss some additions such as freight charges. The Census basis is more plain raw data the U.S. customs people hand over which is just the stuff crosses the border. The 2005 chain weighted stuff means it was overall modified for a price increase/decrease adjustment in order to remove inflation and deflation time variance stuff.

Bottom line, you want just the raw data of what's coming into the country and going out, it's the Census basis and additionally the details are only reported in that accounting format. Additionally the per country data is not seasonally adjusted so watch out trying to add those numbers into the overall trade deficit. It's a statistical no-no to mix seasonal and non-seasonally adjusted numbers.

The Census is also getting into the graphing game with some nice pie charts breaking down exports by country, as well as a chart showing petroleum as an overall percentage of the trade deficit. No surprise China eats the pie on goods imports, yet where oil is on their chart is a mystery due to not showing OPEC grouped.

data correction, in case you're coming from Google news

and noticed the percentages are wrong in that summary, sorry. I use Excel to calculate out percentages and made a typo in the spreadsheet, thus using the wrong month on percentage changes. Should be correct now.

Also, bear in mind country data is not seasonally adjusted, so giving a monthly percentage increase on China, isn't exactly fair. But regardless, I show further down in the post that China for the year is heading to a new record and year to year comparisons of country data are valid statistically.