Who can forget that infamous declaration by Greg Manikiw, Outsourcing is good for America, backed up by fictional economics from an an offshore outsourcing group.  Despite the never ending alarming U.S. unemployment rate, the jobs crisis and the stagnant wages, it seems Obama is touting the same philosophy. Economists, on the other hand, refuse to dare challenge this corporate party line and mention the O word, outsourcing.

Despite the never ending alarming U.S. unemployment rate, the jobs crisis and the stagnant wages, it seems Obama is touting the same philosophy. Economists, on the other hand, refuse to dare challenge this corporate party line and mention the O word, outsourcing.

Where are the jobs? John Bougearel really nails it on fictional CBO and BLS future employment projections.

American policies must take steps to stop the bleeding of jobs overseas, Obama’s new Council on Jobs and Competitiveness should be enacting policies and proposing legislation that repatriates US jobs and disincentivizes further outsourcing of US jobs. These policies would of course be hugely unpopular with Corporate America, but that is the crossroads where we now stand.

Bougearel lists the never ending fiction BLS job growth projections and now similar delusional numbers by the CBO for 2011-2015.

The CBO is projecting 2.5 million jobs will be created annually from 2011 to 2015. From the CBO: “As the recovery continues, the economy will add roughly 2.5 million jobs per year over the 2011–2016 period.”

That is more than 200,000 jobs being created per month every month for the next 5 yrs. Moody’s economists actually estimate 270,000 jobs will be created per month on average in 2011. Yet peak annual job growth ranged from 154,000 to 178,000 during the housing boom era circa 2004-2006.

To make matters worse, we have the new buzz words, same as the old buzz words, innovation. Innovation is great, it's awesome, but the reality is companies these days manufacture in China. Apple, with their great, someone finally gets it, iP<insert buzz here> product line and corresponding services, manufactures in China. Literally, there are now 920,000 people employed in the Chinese factory which manufactures your cool little gadgets. That's almost a million manufacturing jobs. Apple has 46,600 employees globally, but like many corporations, finding out which country they are even located in is kept secret. Regardless, one can see the majority of jobs making the iP<insert x> are in China.

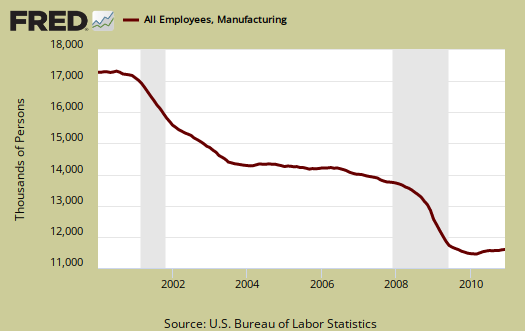

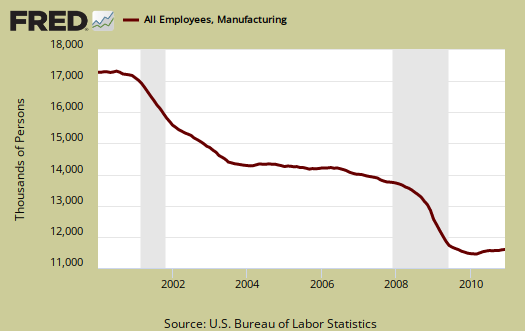

Compare China Foxconn manufacturing jobs to the below graph of total manufacturing jobs in the United States since 2000. Over 2 million manufacturing jobs have been lost since the official start of the Great Recession and since the 2000, the United States has lost 5.6 million jobs, or about 33% from year 2000.

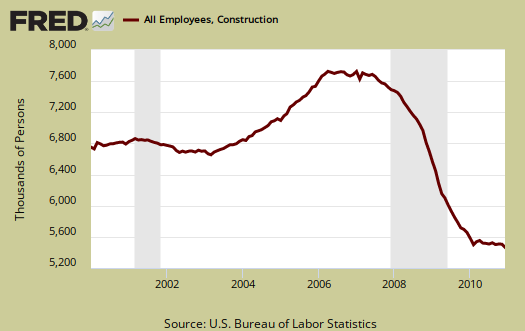

Now, compare the loss of manufacturing jobs to the FIRE, or financial activities jobs and construction jobs. These two occupational sectors are directly related to the housing bubble and financial crisis. From the peak of the housing bubble, December 2006, FIRE has only lost 767,000 jobs or about 10% drop in jobs from it's peak.

Construction on the other hand has been decimated from the housing bubble and is down 2.1 million jobs from it's peak in July 2006 or 38%. Still, construction pales in comparison to the loss of American manufacturing jobs.

To sum, we have manufacturing jobs, which are only indirectly affected by the housing sector, being more decimated and consistently decimated than those occupational sectors direct affected by the housing bubble and the financial crisis.

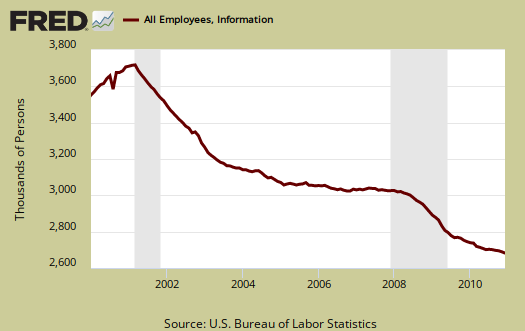

From the industries at a glance we can also see massive labor arbitrage in the information sector. This category has I.T. and software programming jobs contained within. Further U.S. worker displacement is done through foreign guest worker Visas, which unfortunately as counted as employed in the below statistics. Next time you hear rhetoric about a worker shortage consider the below graph. From it's peak in March 2001, Information is down 1 million jobs, but estimates on the number of H-1B workers alone imply for Americans, it's more like 1.7 million job losses.

Indeed, earlier we reviewed a study by the Hackett group showing 2.8 million jobs lost in administration, HR, and finance. Computer Economics states

Outsourcing expenses as a percentage of total IT spending rose at the median from 3.8% in 2008 to 6.1% in 2009. From 2009 to 2010, median spending on outsourcing as a percentage of total IT spending rose again to 7.1%.

In GDP, Jobs and Outsourcing, we have a host of indicators showing some GDP should be attributed as offshore as well as productivity gains point to global labor arbitrage.

A while ago, we showed Okun's law was broken. Okun's law is:

where:

- Y is actual output and c is factors affecting unemployment

- ΔYis the change in actual output from one year to the next

- Δu is the change in actual unemployment from one year to the next

- k is the average annual growth rate of full-employment output

Current assumptions are we need 3% annualized GDP growth to maintain full employment. That's not reach full employment that is maintain. C in the above equation is claimed to be 2 or 3. This represents productivity factors, affecting job growth. It is in productivity where the refusal to examine offshore outsourcing really resides. Economists will blame technological advances, domestic labor arbitrage, even the lack of power of the U.S. workforce than say the O word.

Bernanke ran through the data in 2005 and claims a 2% decrease in GDP creates about a 1% increase in the unemployment rate. Yet, Robert Gordon and others have shown Okun broke about 1986 and while increases in productivity are known to be the culprits, few will dare say offshore outsourcing is the reason.

The paper suggests a set of complementary hypotheses to explain this change in behavior. The overall shift in structural responses after 1986 is linked to the increase in the inequality of the income distribution. The declining minimum wage, the decline of unionization, the increase of imported goods, and the increased immigration of unskilled labor have undermined the bargaining power of American workers. As a result, employers can reduce labor hours with impunity and without restraint in response to a decrease in the output gap, in contrast to the period before 1986 when their behavior was more constrained by the countervailing power of labor.

To wit, back to Bougearel's post noting there is nothing to substantiate claims of this magic job boom that is projected to happen. This government refuses, absolutely refuses to address global labor arbitrage. No surprise when one puts the head of globalization king G.E. CEO Immelt as the supposed jobs czar. We even have economists spinning their assumptions and even data trying to deny this is a problem, all the while corporate bias and lobbyists white papers are the ones being quoted. Yet the statistics show there is something really wrong as does the real economic theory.

Until global labor arbitrage is addressed, by the statistics and even obtaining accurate tallies of jobs created offshore....instead of the United States, and the effects thereof, expect more of the same, a permanent poverty class, record deficits due to not enough revenues from income, increasing income inequality, declining median wages and a whole lot of pain for most Americans.

Nope, outsourcing is not good for America and at this point is negatively impacting overall economic growth.

Comments

You're just now figuring this out?

I learned a while back that math is for people who wish to avoid having to think. The flaws are almost never in the math. They are virtually always in the assumptions behind the math. Does AGW ring a bell? Where is Mann now? Probably playing "hockey" . Ricardian analysis of the effect of tariffs applies the MICROeconomic definition of ceteris paribus to a MACROeconomic system, and therein lies the fundamental error, not in the math.

The folly of secular providentialism runs rampant in economic thinking. Such things as "technological advances" are taken as manna from heaven, and presumed to be providence without cause, thus allowing blindness to effect their destruction (can anybody say Henry George?). The fact that "The North was industrialized, while the South was agrarian" is likewise considered by historians to be merely "providential," as is the fact that "the population of the North was double that of the South." and on and on. **These facts all had causes.** John Chamberlain wrote that "what [Jefferson] objected to in Hamilton's position was its emphasis on tariffs, which would force an uneconomic shift of resources from farming and trade into manufacturing." How? Because without the protection of tariffs, foreign manufactures would always have the comparative advantage, and thus American manufacturing would never have developed? What else could Jefferson have been talking about? How else could the imposition of tariffs possibly force reallocation of capital from farm to factory?

The most glaring assumption of secular providentialists is the idea that it is even possible to discount political sovereigns, ignoring that they are sovereign entities, for the purpose of the analysis of international commerce (hint, it's not).

Here's one for you. If the proper MACROeconomic definition of ceteris paribus is applied to international trade models with respect to the effect of tariffs (i.e. aggregate TAXATION -- tariffs plus tax -- is held constant), then the result is that tariffs effect NO CHANGE, NONE, in import consumption. Chew on that one for a while.

Sorry for the rant dude, I'm just a little knocked over that you are just now, in 2011, coming out against outsourcing. I was a well paid software engineer for fourteen years, and have been a barely-surviving taxi driver for the last eight. Yes, I have a big ole chip on my shoulder because of that. On the other hand, if an internationalist free-trader can come out against outsourcing, there may be hope for us yet.

TD

read the site and get an account too TaxiDriver

Read the site, Google it and read especially the links in this post. When I watched the mass exodus in San Francisco of people losing their jobs, during the "dot con" crash, most were seemingly oblivious to the fact many of their jobs were offshore outsourced, that is when I pulled out my economics background and started studying.

I knew right then something was afoot and was also aware of this intense agenda by India to capture the entire STEM/IT/information services sector.

So, this is not "new" to me at all, just the latest article in many.

As far as mathematics go, math is for people who think, it is philosophies for people who are corrupt or can't "do math". If one reads these "papers" including the "math", one will see variables set to zero, you'll see assumptions that are beyond absurd, such as no Americans can code and no illegal can do a job that previously an American did...

all sorts of bias, fictional assumptions, manipulation of mathematical equations from the theory and my favorite, even cherry picking existing government statistics, which clearly show something really bad has been happening for the U.S. middle class for a while now.

This irks me and earlier it was similar, the data shows very clearly China is a huge problem for the U.S. economy, the trade deficit is a problem and the mathematics show, offshore outsourcing, labor arbitrage is a huge problem.

Why people attack mathematics, data, statistics is beyond me, that's not the problem, it shows what's going on is labor arbitrage...

Math is your friend, the data is your friend and correct statistics are your friend.

it's the people who manipulate the above to write fiction that are the problem.

Just earlier, I noticed instead of understanding what various economic indicators mean, how they are created, they are attacked as "bogus", they are not "bogus", and if one learns how to read them, they too clearly show the U.S. is in huge trouble...

the entire middle class, U.S. workforce is under enormous attack, used like disposable diapers for some multinational's quarterly profit statement.

Get an account! You comment all of the time and that way you don't have to deal with the CAPTCHA or waiting for the moderation queue to comment.

The U.S. manufacturing capacity declined, bogus press again

I just read the most bogus piece trying to claim the U.S. is #1 in manufacturing

One claim is wrong, we do not have more capacity, raw capacity has actually decreased, the first time, starting the "Great Recession".

Here is the last industrial production & capactiy utilization report overview.

Then, China exceeded the U.S. manufacturing output, this year. The reason we get so much of the trade deficit with China is China has really targeted the U.S. market.

i.e. we are their #1 export destination.

This is claiming the U.S. output if 40% larger than China, and use manufacturing in the same breath. If they are talking about GDP, that might be true, but just manufacturing, it's not from every stat am aware of.

Honestly, this isn't the first time I've seen bogus "major press" when some blogs pull out some facts they don't want people to read...kind of an "misinformation campaign" to drown out the other articles and writings.

It's just ridiculous and they refuse to acknowledge partial or semi-finished goods, global supply chains either...

trying to of course claim the entire reason the U.S. has no jobs and is in decline is because of 'technological advances', if that were true, Japan would have an unemployment crisis and a massive trade deficit, Germany would have a massive trade deficit and a job crisis...

neither of these higher wage countries do and they have some of the most advanced manufacturing processes globally.

Technology

The "technology advances" argument is always one that makes me bristle.

I have worked in the automation industry for the last 15 years. If automation were the primary culprit in the precipitous loss of plants over the last decade - 53,000+ closed plants according to a recent Ian Fletcher article, one would think the automation industry would be booming. Of course it is not, and has never fully recovered from the '01 recession. Sales of industrial robots and automated machine tools has been down in the range of 20 to 40% over the last several years according to Industry Week. Much of the lost mfg capacity has occured among small machine shops, custom machine builders, component manufacturers - all users of automation technology and of course among the largest consumers of automation techology - auto makers and auto parts suppliers.

There are two primary problems with the automation argument - the first is there have been no major advances or breakthroughs in mfg technology that can account for the job and plant losses. Robots, controls and machine tools have seen only incremental improvements over the last 20 years - these are mature technologies. And while its true that automation can eliminate some grunt labor production jobs, jobs are also created in higher skill areas programming, setting up, maintaining and operating this complex machinery

The other problem is that automation must have high volume repetitive production to justify its costs. Often the bean counters will make the determination that it is more profitable to offshore to a cheap labor, lax regulatory country than it is to invest millions in automation. High volume production indutries have been the most vulnerable to offhsoring.

I have asked proponents of the automation/technology argument to point to a single breakthrough technology that can account for the major loss of industry over the last decade - so far nothing but crickets.

Another big problem

People have been persuaded that since we are surrounded by foreign goods and services, that we should give up: that it's futile to even try to fight it. Yet, careful label reading while shopping may yield some surprises. At Walmart: two large dog dishes, one from India, one from the USA. Matches: Ohio Blue Tip at Kmart. And my first shopping choice for fashion and household goods is the thrift store: even if the item is foreign, it won't make the globalist cash registers ring twice. Even a 2% change would have business analysts screaming to corporate leaders - yes they keep track of our behavior that closely. People just need to try.

Dean Baker

Ya all, in addition to this site, I recommend reading Dean Baker. He puts posts in English but always seems to catch a critical piece on an economic report and calls out the press for their lack of accurate reporting.

He just commented that Germany's unemployment rate is down and their productivity did not soar and that's due to work sharing, they didn't lay people off, just reduced hours.

Not quite the same as this post trying to point the spotlight on offshore outsourcing, but one might note that when work sharing in Germany, that also means that job is not offshore outsourced.

He's on our list of must read sites in the column, but I'm noticing over and over again he finds the fatal factual flaw or misinformation piece and writes about it.

It's scary because I've usually already written the facts over here in an eoonomic report or whatever, and then that goes against whatever the headline buzz is...

to see that Baker caught it too.

Calculated Risk is accurate as well but Baker cuts to the chase.

75% of jobs created in the recovery have been low-wage jobs

Good discussion on this important, under-reported issue. Here is an article on the direct result of offshoring our prime jobs.

75% of jobs created so far in the recovery have been low-wage jobs

http://money.cnn.com/2011/01/31/news/economy/low_wage_job_growth/index.htm

(CNNMoney) "Growth has been concentrated in mid-wage and lower-wage industries. By contrast, higher-wage industries showed weak growth and even net losses," said Annette Bernhardt, policy co-director for the National Employment Project. She said that growth has been far more unbalanced than during previous job recoveries.

Bernhardt's analysis of the first seven months of 2010 found that 76% of jobs created were in low- to mid-wage industries -- those earning between $8.92 to $15 an hour, well below the national average hourly wage of $22.60.

But the biggest problem is continued job losses in higher-wage industries severely hit by the bursting of the housing bubble -- construction and financial services. Recoveries in those sectors helped lead the economy out of earlier downturns, but they're still suffering more than a year and a half after the official end of the Great Recession.

High-wage sectors -- made up of jobs that pay between $17.43 and $31 an hour -- accounted for nearly half the jobs lost during the recession, but have produced only 5% of the new jobs since hiring resumed, Bernhardt's study showed.

Even in some of the higher-wage industries that are hiring, it's lower-wage occupations within the sector where the jobs are being added, according to William Rodgers, chief economist for the Heldrich Center for Workforce Development at Rutgers University.

Case in point: Professional and business services sectors gained a healthy 366,000 jobs in 2010. Workers in that sector earned $27.23 an hour, on average, in 2010. But almost all of the new jobs -- 308,000 -- came in temporary help services, where the average hourly wage was only $15 an hour.

And those temporary jobs accounted for nearly one in four jobs created by all types of businesses last year.

…the Bureau of Labor Statistics has made some worrisome projections about the pay for jobs likely to be created.

The BLS's most recent job growth forecast, published back in November 2009 and projecting the job market from 2008 through 2018, identified 30 different occupations expected to experience the best growth.

The good news is that the occupation expected to add the most jobs over those 10 years -- registered nurse -- is considered "very high wage." But the six occupations with the largest gains are all classified as either "low wage" or "very low wage." Among those jobs are home health aides, retail sales people and food preparation -- including fast food workers.

Overall, 55% of the jobs growth forecasted in the 30 fastest-growing occupations identified by BLS, are considered to be low- or very low-wage......

Egypt in the US

Thank you for this labor data. I've been looking for it and I missed it.

This is to my mind is the absolutely most important and ignored statistic in all the economic ‘so-called’ news. In short, the standard of living of the American working class families is dropping precipitously and there is no end what-so-ever in sight.

There is, of course, very good reason why this type of data is not very much in the news. The implications for the 20 to 40 year old population are profound. And, the implications for the society as a whole are historic. In short, Egypt could happen here!

Cheap labor

I, too, have concerns about off-shoring our jobs, but cost of labor is the single most important factor. Cheaper labor means cheaper goods, but you're right to be worried about who's going pay for these goods, cheaper or otherwise, if the middle class keeps getting squeezed. But even if our middle class was doing great, we'd still buy cheap goods and for our domestic manufacturers to compete with goods from China and India (from whom we import those cheap goods). Domestic companies have to reduce the cost of manufacturing to compete in domestic markets and the easiest way to do that is to use cheaper labor and that means off-shoring jobs.

I am convinced that our manufacturing base -- once the bedrock of our growing economy -- is shifting to developing economies in Asia, Africa and South America. Advanced economies like ours has to shift to a technology-based economy that demands more education and skill of its labor force. In other words, this is the product of that paradoxical concept, "creative destruction."

This may not be popular but I am convinced it's reality. Fighting to hold on to a manufacturing base that has already gone will only delay the process of moving forward. Our advanced economy demands more.

gee, America disappears, oh well

Shrugs shoulders. Firstly labor advantages exclusive in China are about 10%-20%, that's not he main reason for the exodus and why currency manipulation is such an issue.

Secondly, India is cheap labor.

Thirdly, without a strong manufacturing sector, you basically do not have a 1st world economy, so "oh well", doesn't work out too well. Manufacturing spawns innovation, not the other way around and spawns all sorts of economic growth. R&D, on the other hand does not scale, it does not produce the level of jobs required for 300+ million people.

Is this coming from some corporate lobbyist white paper?

Thought Experiment

Honest question,

How are job losses due to outsourcing any different

than job losses due to technological / efficiency gains?

In either scenario,

1.)The worker is still unemployed

2a.)The consumer gets cheaper goods (and/or)

2b.)The industrialist gets a fatter profit margin

Taken to the extreme, you get the following 2 scenarios:

Scenario A)

100% of all Factory job losses are the result of outsourcing

an American Job @ a cost of $15/unit to a Chinese Worker @ a cost of

$3/unit

Scenario B)

100% of all Factory job losses are the result of outsourcing

a Human Job @ a cost of $15/unit to a Mechanized Worker @ a cost of

$3/unit

I'm new to this site and have seen a number of articles detailing the evils

of job robbing outsourcing, but nothing covering the evils of job robbing

technology.Why?

good question, thought experiment

and I guess it depends upon which circles you run in. Economists will blame technological advances for increased productivity as well as increased unemployment.

But what is the breakdown of labor arbitrage vs. technological advances? I don't know. Right now most economists will not even mention or look at what global labor arbitrage is doing to the U.S. workforce, economy, it's a real Ostrich head in the sand because it goes against their philosophies or religion.

That said, technological advances do and can displace workers, especially structural shifts. The thing is, we really have not had a major technological shock, really since 2000 when communication prices dropped and high bandwidth technology (high speed internet) became so available. We've had advances, everything from less fighting your computer and applications to smart phones, wireless and advances in robotics, advanced manufacturing.

But nothing "earth shattering" such as the car, the airplane, the computer.

Some of this has to be technological advances but the fact we have raging employment and exports in China, plus the India offshore outsourcing industry has been and is growing at double digit rates, imply direct worker labor arbitrage is taking it's toll.

The problem is this is "political" so getting real data to analyze is near impossible. You have to "assume" and estimates and unfortunately most of those assumptions are coming from "fiction land" by the forementioned groups in this post.

Usually a technological advance would do something like "wipe out 10-key data operators" or "wipe out" hand plows, i.e. certain direct occupational areas which the technology has directly replaced...

Anyway, great question.