Yesterday a hearing was held and during JP Morgan Chase Home Lending CEO Mr. David Lowman's testimony, a protester yelled out the Chase Bank representative was committing perjury.

This happened during a Senate Banking Committee Hearing on foreclosure fraud. The Banksters proclaim they are doing everything in their power to keep people in their homes, yet the stories and evidence say otherwise. Below is a paragraph of written testimony from Diane Thompson:

At every stage of the process, from modification evaluation through foreclosure, servicers have failed to serve either the interests of investors or to treat homeowners fairly and honestly. As the robo-signing scandal illustrates, servicers hold themselves above the law in ways large and small.

Bank of America recently refused to process a Chicago-area homeowner for a loan modification, saying that the investors forbid modification, but refused to provide the name of the holder of the loan—despite the fact that federal law requires servicers to provide the name of the holder upon request. In communicating with a California attorney, Bank of America representatives similarly represented that a pooling and servicing agreement forbade all modifications, when, in fact, the Pooling and Servicing Agreement specifically provided for modifications in the event of the borrower’s default. The Bank of America representative in that case went so far as to provide the homeowner’s attorney with an electronic copy of the relevant sections of the PSA from which the clause permitting modifications in default had been excised, and a comma replaced with a period. Tens of thousands of homeowners have languished in trial modifications—facing growing loan principals and increasingly damaged credit—although they have met all requirements to obtain a permanent deal. The errors by servicers are systematic and widespread. In the aggregate, they cannot be explained as good faith mistakes.

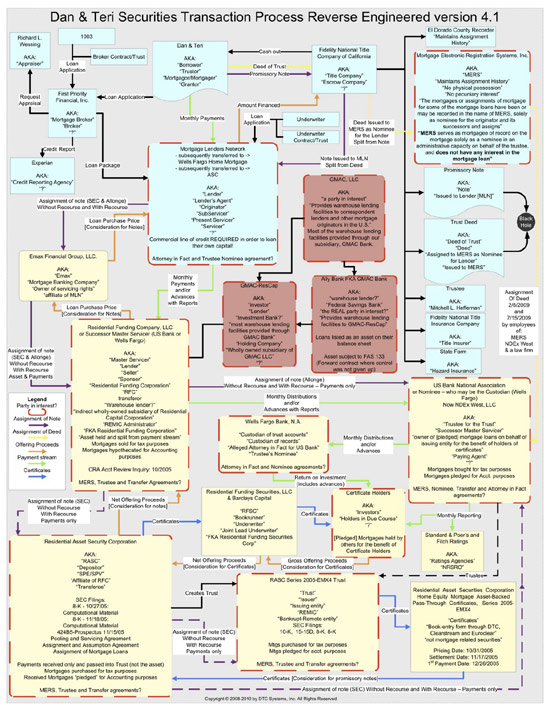

Remember Rube Goldberg? Crazy, over complex machines? Zero Hedge posted the below graph by Dan Edstrom that is a flow chart of finding who owns his mortgage. In other words, the Rube Goldberg of residential loans. This is what homeowners are dealing with. Can you follow this?

Meanwhile the Congressional Oversight Panel has come out with a damning report on mortgage and foreclosure irregularities. Here are some dire consequence warnings from the COP press release:

If documentation problems prove to be pervasive and throw into doubt the ownership of pooled mortgages, the consequences could be severe. Borrowers may be unable to determine whether they are sending their monthly payments to the right people. Judges may block any effort to foreclose, even in cases where borrowers have failed to make regular payments. Multiple banks may attempt to foreclose upon the same property. Borrowers who have already suffered foreclosure may seek to regain title to their homes and force any new owners to move out. Would-be buyers and sellers could find themselves in limbo, unable to know with any certainty whether they can safely buy or sell a home.

Further wide-scale disruptions in the housing market, if they arose, could cause significant harm to financial institutions. For example, if a Wall Street bank were to discover that, due to shoddily executed paperwork, it still owns millions of defaulted mortgages that it thought it sold off years ago, it could face billions of dollars in unexpected losses. To put in perspective the potential problem, the mortgage-backed securities market totals approximately $7.6 trillion, so irregularities that affect even a small percentage of this market could have dramatic effects on bank balance sheets - potentially posing risks to the very financial stability that the Troubled Asset Relief Program was designed to protect. The Panel urges Treasury and bank regulators to undertake new "stress tests" to gauge the ability of major financial institutions to cope with a potential documentation-related crisis.

Documentation irregularities could also disrupt Treasury's foreclosure prevention efforts. Some servicers dealing with Treasury may not be able to document a legal right to initiate foreclosures, which may call into question their ability to grant modifications or to demand payments from homeowners. The servicers' use of "robo-signing" may also have affected determinations about individual loans; servicers may have been more willing to foreclose if they were not bearing the full costs of a properly executed foreclosure. The Panel recommends that Treasury immediately undertake more active efforts to monitor the impact of documentation irregularities on its foreclosure mitigation programs.

Documentation irregularities could compound other threats to the mortgage market. In particular, allegations have surfaced that banks may have misrepresented the quality of many loans sold for securitization. Banks found to have provided misrepresentations could be required to repurchase any affected mortgages. Because millions of these mortgages are in default or foreclosure, the result could be extensive capital losses if such repurchase risk is not adequately reserved.

Now look at the Rube Goldberg who owns my mortgage road map above and see what's probable in terms of best case/worst case scenarios. Below is Senator Kaufman's video overview of the COP report, Examining the Consequences of Mortgage Irregularities for Financial Stability and Foreclosure Mitigation.

In the midst of this, foreclosure class action lawsuits are piling up against the Banksters with all 50 state attorney generals starting probes and actions.

Bank executives are swarming Capitol Hill this week to defend themselves against multiple foreclosure-related investigations, including one by all 50 state attorneys general.

Believe this or not, CNN put the protester video front and center on their site. That's a first. Letting the real people speak.

Comments

OneMacIndyWest

I want to tell you all a little story. The story begins, as all American dreams do, with unfettered hope and belief, but has, over time, become a nightmare from the darkest recesses of our national psyche. This is not a fairy tale, and I beg you to see yourself in our heroine; for you could find yourself in her shoes very soon. And I promise you that that is not a place you want to be. But read on, and judge the veracity of my words for yourself.

I have been in the mortgage industry for almost a decade, and have seen my share of the ugly side of lending: the foreclosures, the forgotten families, and the greedy, heartless, faceless “holder of the note” gone wild. I have experienced all of this more times than I care to admit, and have been ashamed of my industry more times than I care to count, but the borrower I wish to tell you of was the reason I broke into this business in the first place. People like her, hard-working, honest Americans, are the ones a broker like myself looks for day and night, and strives to take care of in whatever capacity we are capable of.

Why you ask? What makes her so special? There are many answers to these questions, and the easy answer would be that she perfectly fit the mold we in the business look for. She had been employed for 22 years with the same corporation, and had managed to pay every liability on time for her entire adult life. No late payments, no missed payments, and nothing at all to indicate that she would ever change. Her credit score was 780, and she had owned a home for 10 years in Miami Beach (an expensive place to buy). This showed unequivocally that she understood liability, and knew how to get things done in the lending market. In short, she was a lender’s dream come true. A loan you approve and forget about because the payments are always in on time, and so, as a lender, you just count money for 30 years. What could be better from our point of view than that? Every lender in the world will tell you the answer to that question is nothing; absolutely nothing.

This lady decided to move to Chicago to be closer to her corporate office, so she sold her home in Miami and took her dreams and possessions north to Chicago. This took place in 2006 while the housing bubble was still growing larger, and no one outside of the industry had any expectation that it may burst at any time. She did her due diligence while looking for a home in the Chicago area, and eventually settled on a brand new property in an area ripe for gentrification. Basically, she bought in an older neighborhood that was undergoing massive urban renewal projects that were projected to raise property values in her area significantly; as long as there was no unforeseen disaster looming. That is the danger of things unforeseen. They eventually come to pass, and no one is prepared to combat them.

She started with an Interest-Only Loan as at that time it made more sense to use her principal money on personal investments rather than giving it to a lender to make decisions with. Even though interest rates were high at the time, IO rates slightly higher than fixed, she was able to get the property for almost $75K less than it initially appraised for, so she was already ahead of the game. She maintained her perfect history, 0x30 on her mortgage, and everything else for that matter, but that was before the wise and powerful bankers in America decided to play 3-Card Monty with America’s future.

As the signs of the encroaching financial apocalypse began to show themselves, she attempted, through her lender, to pursue refinancing, but was told her case called for the loan modification process. The press was making a fuss about how these modifications were the way for borrowers to get the help they needed to stay afloat in the carnage that followed the bubble bursting, and as an intelligent and savvy borrower with a perfect history she expected the process to go smoothly for her. In that assumption, she would have been right if not for the new credit card laws passed that allowed the companies to raise their interest rates and reduce the line of credit available on any given card. These changes have had an enormous, unintended consequence in the lending world since loans are in large part based on debt-to-income (DTI) ratios.

Imagine this borrower has a credit line of $10K on a card with only a $2K balance, but is then targeted by the credit card company for a reduced credit line of say $2500, so her 20% balance has now become 80% without her actually doing anything irresponsible. Yet, when lenders looked at her DTI they would see that she is nearly maxed out on her card, and in this industry that is a major red flag. She understood DTI, and how it could affect her ability to qualify for extra money (even though she did nothing untoward or rash in terms of spending), but why should that hamper her from getting a reduced rate? It is asinine to ask a person to re-qualify for something they already have, or to tell them they must qualify to save money, but this is what is happening in America today. She signed no agreement stating she could not refinance in the future with the help of her lender, so all she is left with are questions. Questions that for her and the millions like her, unfortunately, have no good answers. The American Dream, for this model American, is quickly becoming the American Nightmare.

There are so many questions our borrower wants to ask, but there are no phone lines to call or government offices to visit with any answer other than, “talk to the lender”. This is just endless runaround from the lender, and more and more frustration for her and her family. How is it possible to be locked into a loan, with bankruptcy laws so much tougher, and have absolutely no way to refinance? More transparency in the industry is great, but how can our borrowers appease the credit companies interest hikes while losing equity in their property due to the housing catastrophe and still meet the necessary financial obligations they agreed to prior to this meltdown? This is a recipe for mass bankruptcy and foreclosure; two things that hurt us all in the long run.

It was March of 2009 when our borrower started the conversation about refinancing with her current mortgage company, Indy Mac, from the 7.625% IO-Loan to a 4.5% fixed rate. They explained to her that she would need to print out a new financial packet, and send it, along with all other pertinent information, in to be reviewed before they could proceed; she did just that. After an entire month had passed, she called in to check the status of her application, and was told that the servicing company, Indy Mac, was changing hands, but she would still be taken care of by the new investor, One West.

Just like that, she and thousands of other customers were being sold to the highest bidder, and after some research she discovered that One West actually only paid up to far less than full value for these notes. It gets better. One West actually had the federal government guarantee them anything lost over a certain percentage. What does this mean you ask? All the numbers are there in black and white on the internet for anyone to see; but no one looks. You do not have to be a rocket scientist to see that it would be more profitable to foreclose quickly and collect the guaranteed funds than to refinance the borrower’s note at a current market rate.

The changing of the servicer of her note, as unsettling as it was, would have been fine if not for the dramatic change in guidelines and customer service she experienced. This often happens after a change of this magnitude in any business field, but these differences were downright ridiculous. She was informed that the financial packet she had sent was no longer valid, so she would have to assemble another one before any process could begin. So, once again she followed procedure in hopes of capturing that elusive lower interest rate.

She waited and waited for a call to inform her of the status of her newest application, and finally tried calling herself to enquire; but to no avail. Her calls were treated as a joke. They repetitiously asked for the same documents, and even claimed after three business days that they had never received her fax, and that it took all that time to verify whether or not they had received her documentation. They have done this over 50 times from March of 2009 to the present day! That is preposterous, shameful, and ought to be criminal! But it gets better; or worse for our heroine.

After calling repeatedly for three months she finally got them to look at her application. They told our borrower that the check stubs submitted were out of date according to Fannie Mae guidelines (must be less than 90 days old), but when she remedied that they told our borrower that her check stubs were fraudulent. Check stubs from one of the three largest airlines in the world which she has worked with for more than 20 years by the way. They focused on some minutiae that they knew to be nothing, but she was forced to get a complete employment record from her employer to along with a Letter of Explanation (LOX) from her Human Resources department. This process has stretched into years with no results. She was even told that the best way to get help is to be late on her mortgage payments! Imagine that. It has become so bad that when she follows up on any fax or correspondence they claim she has never talked to anyone about her issue, and when she asked about recording the conversation she was told it was against their policy. I am not making this up. Every word is true and to the point, and the point is that One West and Indy Mac, Fannie Mae and the federal government are fleecing, and failing we the people.

This is dangerous and uncontrolled corporate behavior, and it cannot be allowed to continue. One West has become the poster child for what is wrong with this industry; what is wrong with America in fact. In my humble opinion (and that of thousands of other Americans…not to mention all the honest lenders in the industry), they have pulled out all the stops when it comes to delaying and deceiving their customers in order to get a government handout and make a dishonest buck. This must not be allowed to stand.

Help her. She has asked again and again, and researched every option. She can’t refinance due to not having value. She can’t modify because it’s not profitable to the lender to do so, and she can’t walk away as her state won’t allow this. Why I ask myself? Is it considered walking away if you have no more options? Why is it easier to profit from bad deals than good ones? There is no hope for this borrower that she can see. The only hope I can think of is a Federal Reserve for primary borrowers in America. By that, I mean the feds open the vaults to primary homeowners at a specific rate, and work directly with the borrowers from a federal standpoint. Cut the banks out. Let them focus on commercial deals and second homes where the rates are higher and people know what they are getting into from day one. I do not think these customers’ closing paperwork said anything about having to stay in one rate for thirty years. Do you know anyone on record in today’s environment that can say they stayed in their home for thirty years at the same rate? I don’t think that is even possible. Please share…

Here are some sites that clearly have people in the same situation, read, educate, follow and post, let’s start the revolt against One West/ Indy Mac and Fannie Mae.

Go to Google, You-tube or any engine for that matter and type class action Indy Mac, Type Complaints Indy Mac/ One West; you will see firsthand what we are all up against.

no justice for regular folk

Thanks for sharing this story and may the force be with you to get anywhere. It seems generally, the entire civil code is for the super rich and attorneys and regular folk just get squished, no recourse.

Request for Congressional Foreclosure Panel to Examine Foreclosu

Request for Congressional Foreclosure Panel to Examine Foreclosure Lawyers

http://www.change.org/petitions/view/request_for_congressional_foreclosu...

"Although increasing numbers of courts are continuing to reject improper and fraudulent foreclosures, the Congressional Foreclosure Panel examination of mortgage services and foreclosure practices did not include foreclosure lawyers.

Lawyers are officers of the court; knowledge of applicable laws and civil procedure is not required from mortgage lenders. In states that require judicial foreclosures, lawyers are the ones who file lawsuits to seize and sell property; and lawyers are responsible for filing and recording foreclosure property deeds.

An investigation could prove helpful to sorting out whether improper and illegal foreclosure proceedings are linked to any self-dealing conduct disadvantaging lenders, investors, homeowners, and city governments. . .”

http://www.change.org/petitions/view/request_for_congressional_foreclosu...