Q1 2010 GDP has again been revised downward to 2.7%. The 2nd GDP estimate for Q1 2010 was 3.0%. Here is the Q1 2010 advance GDP estimate, where GDP was reported 3.2%. From the 3rd revision report, as in the 2nd, consumer spending (PCE) dropped from it's initial estimate and the trade deficit widened. A whopping 0.5% reduction from the initial GDP estimate has occurred, caused by grossly overestimating consumer spending and underestimating the trade deficit. While people rail on government spending, realize State and Local Government spending subtracted almost half a percent (-0.48) off of Q1 2010 GDP.

As a reminder, GDP is made up of:

where

Y=GDP, C=Consumption, I=Investment, G=Government Spending, (X-M)=Net Exports, X=Exports, M=Imports.

So, what changed? Here are Q1 2010, 3rd estimate breakdown of GDP percentage:

- C = +2.13

- I = +1.82

- G = -0.39

- X = +1.27

- M = -2.09

Below is Q1 2010, 2nd estimate breakdown of GDP percentage:

- C = +2.42

- I = +1.66

- G = -0.40

- X = +0.82

- M = -1.48

Below is the change between the Q1 2nd and Q1 2010 3rd revisions:

- C = -0.29

- I = +0.16

- G = +0.01

- X = +0.45

- M = -0.61

In the first revision for Q1 20910, those numbers, which make up the total GDP percentage growth were:

- C = +2.55

- I = +1.67

- G = -0.37

- X = +0.66

- M = -1.28

Below is the change between the Q1 advance and Q1 2010 3rd revision:

- C = -0.42

- I = +0.15

- G = -0.02

- X = +0.61

- M = -0.81

From the report the Q1 2010 GDP component percentage changes, along with some sub-components from Q4 2009 GDP. They do not list I total, which had 16.3% growth from Q4 2009, due to inventories rate changes.

Real personal consumption expenditures (C) increased 3.0 percent in the first quarter, compared with an increase of 1.6 percent in the fourth. Real nonresidential fixed investment increased 2.2 percent, compared with an increase of 5.3 percent. Nonresidential structures decreased 15.5 percent, compared with a decrease of 18.0 percent. Equipment and software increased 11.4 percent, compared with an increase of 19.0 percent. Real residential fixed investment decreased 10.3 percent, in contrast to an increase of 3.8 percent.

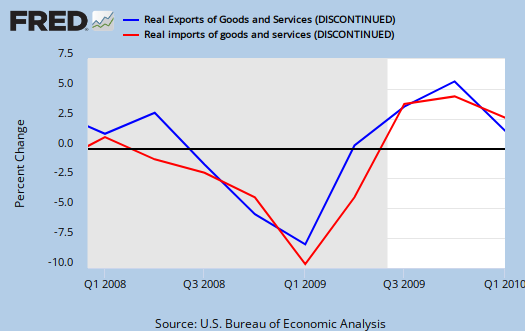

Real exports of goods and services (X) increased 11.3 percent in the first quarter, compared with an increase of 22.8 percent in the fourth. Real imports of goods and services (M) increased 14.8 percent, compared with an increase of 15.8 percent.

Real federal government consumption expenditures and gross investment (G) increased 1.2 percent in the first quarter, compared with no change in the fourth. National defense increased 1.0 percent, in contrast to a decrease of 3.6 percent. Nondefense increased 1.5 percent, compared with an increase of 8.3 percent. Real state and local government consumption expenditures and gross investment decreased 3.8 percent, compared with a decrease of 2.2 percent.

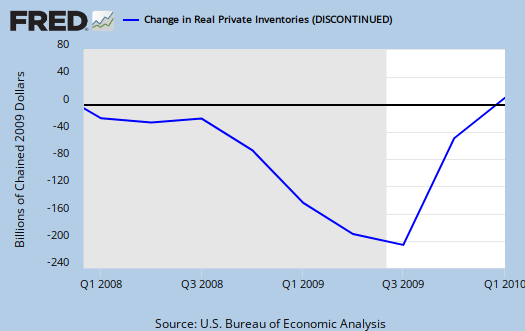

The change in real private inventories added 1.88 percentage points to the first-quarter change in real GDP, after adding 3.79 percentage points to the fourth-quarter change. Private businesses increased inventories $41.2 billion in the first quarter, following decreases of $19.7 billion in the fourth quarter and $139.2 billion in the third.

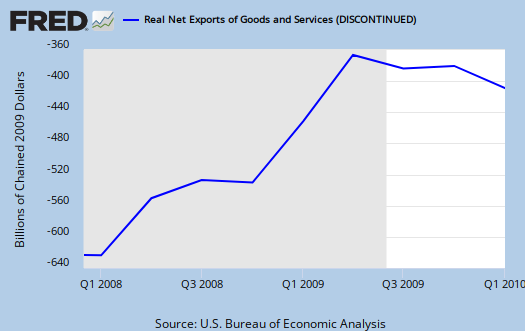

The trade deficit widened to -0.82% of the percentage contribution of GDP from -0.66% second revision and the first estimate on the trade deficit was -0.62%.

The below graph is the change, quarterly, of real imports vs. exports. As we can see, there is a sudden drop in U.S. exports that goes against the grain of recovery.

As in the advance and 2nd revision GDP report, C, or consumption (PCE), which reflects demand, dropped from the initial estimate but is still a driving force of positive GDP growth.

A main change was in investments again, attributable to changes in private inventories. Fixed non-residential investment also was negative -0.6 of the total 2.7% GDP. Residential investment was a -0.27.

Note the changes in inventories accounted for 1.88 of the 2.7% change in GDP. In the 2nd revision inventories was 1.65 of GDP, up from in 1.57 in the first estimate. Inventory changes are now 69% of GDP growth for Q1 2010!

The report gives some details on real GDP contributions.

Motor vehicle output added 0.40 percentage point to the first-quarter change in real GDP after adding 0.45 percentage point to the fourth-quarter change. Final sales of computers added 0.09 percentage point to the first-quarter change in real GDP after adding 0.01 percentage point to the fourth-quarter change.

Structures are office buildings, investment in consumer places, hotels and so on and took away -1.17 from Q1 2010 GDP. Fixed private investment declined -0.5% from last quarter.

Personal savings was revised to 3.5% of personal income.

Corporate profits were revised to 8.0%, up 34% for the year.

The price index on consumer purchases increased 1.7% for Q1 2010.

The BEA website on GDP is here. In July GDP will be revised all the way back to 2007. The BEA needs better raw data collection methods (obviously).

Contrast That to Real World State and Muni Situations

Build America Bonds May Push Cities to Bankruptcy

What Happens When Cities Go Broke?

If States Printed Their Own Money Their GDP's Would Grow Also

did you see me say those bonds were a great idea?

I don't think so. My thing has been a direct jobs program, infrastructure jobs and a host of revamping other policies to kick start start ups (and it sure isn't some absurd capital gains holiday, this is raw funds, a federal "VC" or a ramp/change of the SBA) and to give funds for new ventures in key technologies and new industries.

I said I liked the AAM plan especially because they clearly made conditions be "buy American and hire America", which is Keynesian, so it would have given much more bang for the buck.

So, borrowing more money even with a subsidy is akin to tax cuts when one has no income....

Just Contrasting GDP With Whats Happening at State & Muni Levels

Is there a chart with a correlation between deficit spending/debt levels and GDP?

Certainly whats going on at the Federal level and whats going on in states, cities and towns is dramatically different.

DC I'm certain is booming compared to the rest of the country. It has the second lowest unemployment rate among metro areas and the real estate market there while down is not bad comparatively.

Your analysis is on the money at the federal level I was just comparing the economies within the economy which can't print their own money, can't borrow what they can't repay etc etc.

If a state actually goes under will the Fed bail them out the same way they printed money to bail out other countries?

there are a host of charts on GDP vs. Debt

Here's one you can customize.

I won't touch those demographics on regional economies frankly because I just cannot locate enough statistics, evidence on what's really going on.

Good question. I think they were trying to bail out the states but the GOP blocked them and I truly believe it's due to those corporate tax code changes to remove the tax advantages to offshore outsource your job.

CA is a huge percentage of US GDP, it's like a country within a country.

Frankly I blew off tracking the real effects on "Stimulus" because the White House issues such spin. I clearly is having some effect but I frankly don't think that much in jobs. They plain did not "do it right", bottom line. They literally gave contracts to companies overseas for new "green technologies". What kind of Stimulus for a domestic economy is that? It's anti-stimulus.

Spending will be stimulative but that's not the "bang for the buck". Like Steven has his jobs guarantee idea but it's too vague for me. One could literally design such a thing to destroy what's left of the U.S. workforce. On the other hand, one could design such a thing to save the U.S. workforce too.

Same thing with "Stimulus", one can just "spend" or one can craft a truly, bang for the buck, generate the largest job growth possible plan.

Notice the government absolutely refuses to deal with canceling Federal and State contracts currently offshored. They refuse to repeal tax subsidies to companies who offshore outsource jobs, such as IBM. They refuse to put a moratorium on immigration and of course they refuse to deal with illegal workers.

None of this requires a bill through Congress. It's existing law and contract terms. Ex. IBM got a host of State, local contracts on the promise to create regional jobs. They did not. In fact they offshore outsourced more jobs. Therefore those states should demand their money back and cancel those contracts due to a major contract violation by IBM and award them to companies who will hire U.S. workers.

They don't do a damn thing on this score, that's city, county, state and federal governments.

Another example is security clearances. There are a host of U.S. tech jobs which require those but it's so much a bureaucracy, companies want people who already have them and the gov. won't speed up the process or change it to get them. It's ridiculous. They have metrics such as credit score instead of important things like, ...uh, do you sympathize with other nation's and their interests? Ever get busted for cheating in school? Cheat on your taxes, cheat on your spouse? The types of things which would imply one of low moral character and a risk to national security. It's not if someone smoked pot 20 years ago or couldn't pay their bills because they are broke.

You'll hear all sorts of spin but the reality is offshore outsourcing and use of foreigners to displace U.S. workers are duals of each other. What difference does it make if that worker is sitting in Bangalore or Cincinnati? The same U.S. worker lost their job and was displaced. Notice I'm making a differentiation between worker substitution and other forms of work. It's direct worker substitution or when wages are repressed due to oversupply that is the concern and this also is predicted by labor econ equations. Some try to make substitution coefficients zero, which is an absolute falsehood, by the statistics alone, or try to ignore, negate a host of costs and so on....

but worker substitution is going on. If the U.S. government wanted to quickly create some jobs at no cost, this is one area to act. Of course they will not due to politics and ignore the labor economics theory or statistical realities.

On the Econmy All is Disputed but One Thing: Make it Here

The Alliance for American Manufacturing has just cited a new poll showing that despite all the things that Americans disagree about, Americans agree on the 'Make It Here' mantra.

http://www.americanmanufacturing.org/newscenter

It is surprising and almost shocking the way this cuts across ideology and partisan politics. There is huge and broad agreement on the subject not seen since folks wanted to end the Vietnam War. The people, as usual, are way ahead of the Pols. That is an 86% majority

That is positive if by 'people' we include the Big Manufacturers. The 14% of diehard Globalists must include the Business Roundtable and the Washington think tanks. Globalism is on the run.

On these pages, we undertand Globalism and democracy to be on a collision course, and in the end, only one wins

Burton Leed

US Manufacturing Was Gutted

When 'Buy American' would have made a difference in the 60's, 70's and 80's people sided with 'costs less' and despite a poll that says otherwise people are voting with their wallets just the opposite way.

US Manufacturing was gutted a long time ago, except of course US Prison labor which is competitive - Unicore.

manufacturing gutted

It really escalated with the signing of the China PNTR. But it started in earnest with NAFTA. We have some great sites/groups focusing in on U.S. manufacturing and their blogs are listed on the left hand column. One of the most shocking but why I write about it now so often, was just how much China's currency manipulation has wiped out U.S. manufacturing. Basically researchers have shown, if just currency manipulation was stopped, not even all of the other trade abuses....it could correct the trade imbalance with China. That's astounding to me.

Currency Manipulation and the Trade Deficit

"if just currency manipulation was stopped, not even all of the other trade abuses....it could correct the trade imbalance with China."

Wow! I guess this shouldn't surprise any of us, but it's still shocking. So do you happen to know which of those links over on the left would be the best place to see the research supporting this?

EP on currency manipulation affecting trade deficit

U.S. trade deficit and the China currency exchange rate.

Shocked me. I cannot believe, with all of the other manipulations plus U.S. MNC's moving to China for various reasons, just one element would wipe out the trade deficit, but it's clearly a much larger variable than one would intuitively think.

Econbrowser I'd say is pretty "New World Order" in philosophy but they go deep into equations and theory, so it's a great site to read the minimal, or opposing views I think. But I also think they leave out things in some of their analysis, so it takes a lot of critical reading, con mathematicas, to parse through their analysis posts.

Then, the site has meta tags. If you click on them (it's supposed to work this way but sometimes doesn't) such as currency manipulation, you should get all of the posts marked with that tag.

It's not working exactly right, for I know there are many other posts with this meta tag. Seems the database, when you put them in, isn't entering the same tag and instead making duplicates. This is a bug I need to fix but for now, it brings up some posts.

Korean Free Trade Agreement-The Unofficial Republican President

The next big push is the Korean Free Trade Agreement. This makes the Obama Administration almost officially Republican. We have a $66 Billion Stimulus without contracts, Weak to Non-Existent Financial Reform, the HealthScare Plan which cuts Medicare in 2014.

On Immigration, Obama is a Neo-Con but not a libertarian Republican. So, Obama is a Democrat on social issues.

Burton Leed

I don't think that's a Democratic position

We have a lot of special interests saying it's so, but even in the so called Progressive wing, you have a lot of people aware of global labor arbitrage, so they have limits on things like guest worker Visas, others know one must control one's immigration policy, set limits...it ranges all over the place in position in reality.

It's more the corporate agenda, especially to "trade workers".

I think Obama is like an extension of the Bush administration too. We get a few tweaks on the side it seems only.

True

I believe Columbia and Peru(?) are also pending for free trade agreements.

All of these agreements started with Bush and Obama is following through.

I can't understand how we can have free and equitable trade with countries that have no labor standards - have little to no military expenditures because we are the worlds police force and have a much worse standard of living. Its impossible for trade to be equitable. Those agreements, especially NAFTA kill jobs here, force people into lower paying jobs and in the end game force people to shop at WalMart.

Progressive Wing of Democrat Party Not Controlling Trade Policy

Orzag, a New Democrat, quit over the absence of Stimulus, return to austerity, and KFTA. It is the Summers-Geithner axis that is in control.

The talk of Krugman for the policy role is probably wishful thinking, but a good choice.

Burton Leed

Really?

Orszag Leaving as Budget Director

Just found your blog. Liking

Just found your blog. Liking it!