The US is no longer the engine, or at least the sole engine, of global economic growth. That mantle is shared, at least, with Europe, and even moreso with emerging Asia, and nowhere so much as China, now the world's 4th largest economy and 47wallst.com/2008/07/china-a-10-gdp.html">growing at a rate of 10% a year.

That growth has run smack up against at least short term limits on the availability of resources -- metals, livestock, rice, and more than anything else, Oil.

While growth in the US peaked about two years ago and has been generally declining since, most recently measured at about 1.9% (but perhaps in a year or three retroactively to be revised into negative territory, as Q4 2007 just was), China in particular has continued to boom, as I described in China's Out of Control Inflationary Boom.

Global inflation has been driven by China and Oil, and facilitated by their links to the declining US$. China's continued growth is continuing to put pressure on commodities. Moreover, China's continued albeit reduced subsidies to the consumption of oil, continues to distort and increase global demand.

But there are strong deflationary forces at work in the industrialized world: the US is currently somewhere in the middle of what the Bank of International Settlements has bluntly called the "unwinding of a credit bubble." This unwinding is wiping out perhaps $trillions of imaginary "values" in the form of a housing and financial crash, as $4/gallon gasoline continues to destroy demand. Meanwhile, the European Central Bank seemingly determined to throw that continent into recession with a tight interest rate policy.

At the beginning of this year, I mapped out a future in which food and fuel inflation would continue to rise until a recession kicked in with sufficient force to reduce demand. At some point as demand declined, I expected inflation to subside as well. I was sufficiently confident in my prediction that I bet my friend Bonddad $50 to a favorite charity that the inflation rate by the end of 2008 would be lower than the inflation rate at the end of 2007.

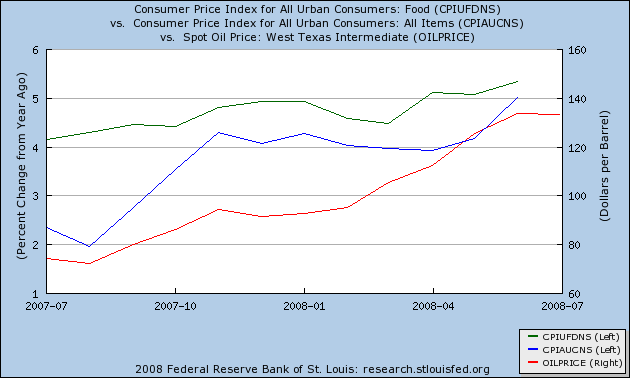

Most of that scenario is coming to pass. The outlier has been the price of oil, which drove official inflation to 5% by June, and which went ever more parabolic -- until this last month. Originally, guessing that a recession had begun in about December 2007-January 2008, and noting that in the oil-spike induced recessions of 1981 and 1990, food inflation peaked first, then oil price inflation a few months later, I believed that the inflation rate would peak during spring and then begin to decline. This obviously didn't happen as oil went parabolic, climbing to $147 by about July 4. Food and overall inflation did steady, but then peaked at 5% in June:

In July the worm may finally have begun to turn. The price of a barrel of oil broke trend and went down from $147 at its high point to $120 just before month's end, a new short term low -- the first time that has happened in 6 months.

Thus it appears that the year-over-year surge in oil price inflation may finally have peaked, heralding a respite as the inflation rate begins to decline later this summer and into autumn, and making the pattern of this recession closer to that of the 1973-4 oil-spike induced recession.

And, as I reported in Is China's Bubble Bursting?, there have been signs that China's insatiable demand for resources, and its seemingly unstoppable export machine have in fact slowed down and at least temporarily in the manufacturing sector, gone into reverse. If the growth of China and the Petrosheikhdoms goes into reverse, there is nothing holding back the deflationary deluge.

In addition to the first-order-of-magnitude economic effects of that deflation (what I have been calling "The Slow Motion Bust"), which are likely to lead to a long-term US political realignment, as the Millenial generation in particular repudiates the GOP and brings about a secular ascendancy of the Democratic party; it is also worth considering, if China's economy goes into reverse, what recourse ordinary Chinese have, as the long disinflationary economic era ends, and another begins. The American revolution, like so many others, happened after a period of growth was suddenly reversed (due to the need to pay for the French and Indian War) with costs borne by those who had no voice in the decisions.

We live in interesting times.

Comments

The US maybe ready for a political realignment

But, well, does that imply current leaders and candidates are the political realignment that is desired by the American people?

Honestly, I don't think so. I'm sorry but I have yet to see true policy directives, both parties, that are really Progressive and Populist, especially on putting Americans 1st for jobs/labor, another area being trade.

I wish I saw it, but so far, I am simply not a believer although there are a few scattered candidates running for House/Senate.

On inflation, I'd like to see some analysis on the reality that China can peg it's currency, give "tax breaks" almost immediately to their private ahem (I believe most businesses are still 50% state controlled?) and other adjustments a communist system can just throw out there on a dime.

What cannot go on forever, won't

China's currency peg won't go on much longer. And many of China's billionaires have (frequently familial) connections to important party officials. If an economy that had been booming shifts into reverse, those cronies are going to be protected. And that is a recipe for civil disorder.

not the same as the US

I mean you can say that but China is a different political system, assuredly not a market economy as much as folks like to believe it is and the people there have different attitudes and beliefs than the United States generally.

I don't know about their peg. They now hold US debt by the, well, certain hairs not on the head, so while US is pressuring them extensively on the pegging of their currency, so far it hasn't done much.

Maybe it should be those who manufacture for the world control the world.

I think that it really helps to think of this in terms of

shipping cost by volume.

So a standard 40' shipping container is 2,385 cubic feet.

Which means that each $1000 rise in shipping costs, means that it costs an additional $0.42 per cubic foot.

So at $2000 per container the cost per cubic foot is $0.84.

Now at $10000 per container, the cost is $4.20 per cubic foot.

The irony here is the the cost advantage for clothing (which takes up little space is much better than for many higher value goods. Think about something like a big screen plasma tv. It takes up 50-75 cubic feet in a container.

So at $2000 per container, it costs $42-$63 to ship that TV.

If the cost is $10000 per container then it costs $210-$315 to ship that TV.

That's just the ocean trip, not inland transport.

So the question is where's the tipping point at which wage arbitrage matters less than transport cost?

Think of it in these terms. The $167-$273 increase in transport costs is enough to pay for 6.5-9 hours of labor at $30/hr (with benefits).

If it only takes 6 hours of labor to make that plasma tv, then it doesn't make sense to ship it from China assembled.

excellent detail

What concerns me on this is while shipping costs might help enable a return to US manufacturing, on services, or things zipped around the Internets there is no real supply chain cost increases to curtail it.

But great info middle!