The December 2013 ISM Non-manufacturing report shows the overall index decreased by -0.9 percentage points, to 53.0%. The NMI is also referred to as the services index and the decrease indicates slower growth for the service sector. New orders just plunged, by -7.0 percentage points, and went into contraction. So did inventories as well as order backlogs stayed in contraction. This is the lowest new orders has been since July 2009, the height of the recession. Generally speaking it seems the service sector is truly slowing down, a negative counter to the manufacturing sector.

The comments from survey respondents quotes three as claiming their businesses are steady. One said severe weather has hampered business and another said Obamacare is probably going to slam them, but how exactly is unknown. Wholesale trade and information said business is picking up for them.

Generally speaking a value above 50 for NMI indicates growth, below 50 indicates contraction. The below table shows the ISM non-manufacturing indexes.

| ISM NON-MANUFACTURING SURVEY - December 2013 | ||||||

|---|---|---|---|---|---|---|

| Index |

Series Index December |

Series Index November |

Percent Point Change |

Direction |

Rate of Change |

Trend (Months) |

| NMI™ | 53.0 | 53.9 | -0.9 | Growing | Slower | 48 |

| Business Activity/Production | 55.2 | 55.5 | -0.3 | Growing | Slower | 53 |

| New Orders | 49.4 | 56.4 | -7.0 | Contracting | From Growing | 1 |

| Employment | 55.8 | 52.5 | +3.3 | Growing | Faster | 17 |

| Supplier Deliveries | 51.5 | 51.0 | +0.5 | Slowing | Faster | 2 |

| Inventories | 48.0 | 54.0 | -6.0 | Contracting | From Growing | 1 |

| Prices | 55.1 | 52.2 | +2.9 | Increasing | Faster | 51 |

| Backlog of Orders | 46.0 | 49.0 | -3.0 | Contracting | Faster | 2 |

| New Export Orders | 51.5 | 58.0 | -6.5 | Growing | Slower | 5 |

| Imports | 50.5 | 55.0 | -4.5 | Growing | Slower | 7 |

| Inventory Sentiment | 57.5 | 60.5 | -3.0 | Too High | Slower | 199 |

Below is the graph for the non-manufacturing ISM business activity index, or current conditions, what we're doin' now meter. Business activity declined and one survey respondent comment said customer released orders on hold, which is quite an ominous statement. One said customer spending was simply down. Here is the ISM's ordered services sector business activity list:

The industries reporting growth of business activity in December — listed in order — are: Management of Companies & Support Services; Retail Trade; Finance & Insurance; Public Administration; Utilities; Information; Construction; Accommodation & Food Services; and Professional, Scientific & Technical Services. The industries reporting decreased business activity in December — listed in order — are: Mining; Arts, Entertainment & Recreation; Transportation & Warehousing; Educational Services; Real Estate, Rental & Leasing; and Wholesale Trade.

The really bad news of this report is new orders. New orders plunged by -7.0 percentage points and went into contraction. New orders are an indicator of future business activity. Mining, which includes petroleum, was at the top of the list for new orders contraction, yet Arts, Entertainment & Recreation was a close second and generally speaking it appears bad juju is happening to this sector. Below is ISM's new order growth vs. contraction list:

The six industries reporting growth of new orders in December — listed in order — are: Management of Companies & Support Services; Retail Trade; Information; Public Administration; Construction; and Finance & Insurance. The 11 industries reporting contraction of new orders in December — listed in order — are: Mining; Arts, Entertainment & Recreation; Transportation & Warehousing; Educational Services; Real Estate, Rental & Leasing; Utilities; Wholesale Trade; Other Services; Accommodation & Food Services; Health Care & Social Assistance; and Professional, Scientific & Technical Services.

The employment index was better with a 3.3 percentage point increase to 55.8%. The below ISM services employment graph has been normalized to 50, the ISM inflection point for expansion versus contraction. Generally speaking it seems to see job growth really take off this index needs to be in the 60's range, but an uptick is still good news.

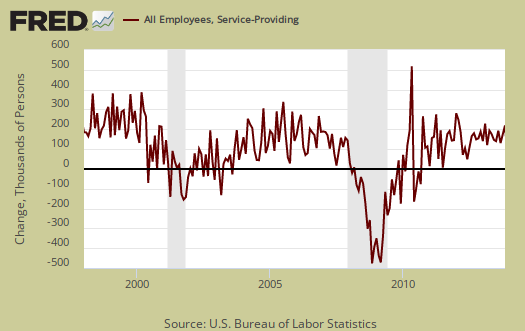

Below is all employees in services as reported by the BLS monthly level change graphed against the ISM services employment index. As we can see they match up reasonably well, although not exact on monthly figures. Yet this is yet another private indicator to use in guessing what the service sector December employment might be.

Inventories really lurched down into contraction. One commenter said they were using their inventories but not replenishing them. This bodes bad news for changes in private inventories and overall economic growth. Still a pick up in sales versus less demand as the reason inventories are declining is the best reason of the lot for contraction.

New export orders plunged as well, by -6.5 percentage points to 51.5%.. New export orders are from outside the United States, but to be performed by domestically sourced workers. Notice how U.S. citizen/perm. resident labor is not part of this definition. Arts, Entertainment & Recreation was the only contraction so their export declines must have been a doozy.

Prices paid by the services sector increased 2.9 percentage points to 55.1 % and this indicates while prices are considerably higher, they are not in the soaring 60's,which would imply raw material costs are pounding the roof.

Order backlogs really contracted by -3.0 percentage points as they did last month. This puts order backlogs at 46.0% and is a sign business is picking up yet businesses are not increasing their output just yet. Arts, Entertainment & Recreation was again at the top of the list for a decrease in order backlogs, which implies they might very well be clearing their decks as inventories plunged as well.

Below are supplier deliveries or vendor supplies and it's how fast businesses are getting their stuff to make more stuff. Above 50 is a slow down, which is opposite how many of these sub-indices are defined. Slow-downs mean more demand yet too much can also limit the ability of that business to produce, or business activity. No stuff to make more stuff and you're stuck. This month the index had little change from last month and the index is in the low 50's, which really implies supplies are getting to the these businesses at about the same rate.

The use of imported materials decreased -4.5 percentage points to 50.5%, which is still growing but at a much slower rate. Services imports includes BPO, or offshore outsourcing can sometimes be classified as indirect materials. Other Services was at the top of the list for imports, which might very well mean there was a decline in use of offshore outsourcing, always good news to America.

Overall ISM gives an order list from expansion and contraction in the services sector.

The eight non-manufacturing industries reporting growth in December — listed in order — are: Management of Companies & Support Services; Retail Trade; Other Services; Finance & Insurance; Public Administration; Construction; Information; and Health Care & Social Assistance. The eight industries reporting contraction in December — listed in order — are: Mining; Arts, Entertainment & Recreation; Educational Services; Transportation & Warehousing; Real Estate, Rental & Leasing; Utilities; Wholesale Trade; and Accommodation & Food Services.

Some in the press are trying to extrapolate GDP from the services index. Beyond large changes, such as the declines in 2009, on a quarterly basis there isn't a lot of rhyme or reason between the NMI composite index, the business activity index and real GDP. We show this in the below graph with GDP on the left, in black, graphed against NMI, in red and the business activity index in green. We're sure if there was a strong correlation, ISM would publish it as well.

The NMI is made up of: Business Activity, New Orders, Employment and Supplier Deliveries, all equally weighted. Here is our past services index, overviews. You might also want to compare the services index to the ISM Manufacturing index.

Recent comments