The Producer Price Index, or wholesale inflation, did not change, or zero for August 2011 finished goods. Food trumped gas as foods increased 1.1% while gas dropped -1.0%. Core PPI, which is finished goods minus food and energy, increased 0.1% and is the 9th month in a row for an increase. While this is wholesale, tire shoppers beware, 20% of core's increase was tires, up 1.4% from July. Core PPI is a Federal Reserve watch number for signs of future inflation. Intermediate goods prices dropped -0.5% and crude or raw materials prices increased +0.2%.

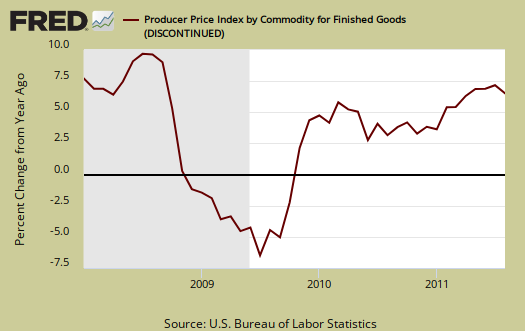

Unadjusted, finished goods have increased 6.5% for the last 12 months, which shows an overall slowing in inflation, in comparison to recent months as this is the lowest yearly advance since March. Still it's almost twice as high as August 2010's 3.3% year-over-year increase. Below is the wholesale finished goods PPI percent change for the year.

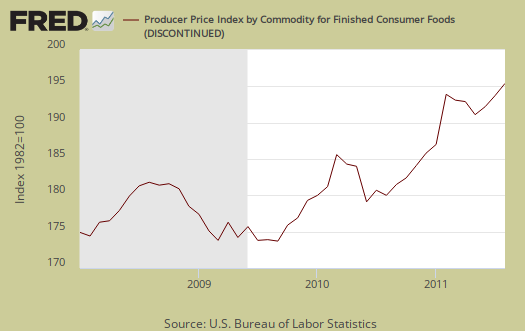

Future meat eaters beware, wholesale prices on pork increased 5.2%, eggs, which are always volatile, 10.8%, beef and veal, 1.2%, chicken, 3.8% and turkeys, 1.8%. Except for shell fish most food prices increased. Dairy was up 1.8%, fresh veggies, up 8.9%. Meat overall was up 2.4% and accounted for 30% of the increase and this is the 3rd month for finished wholesale food prices to increase overall. Considering food banks are in crisis and we are a nation of food stamps, this doesn't bode well for future retail inflation in terms of main street.

Below are Core PPI or finished goods minus food and energy, which increased 0.1% for August 2011 and is the 9th month for an increase. Capital equipment, or finished goods to make more goods, decreased -0.1%.

Below is the monthly percentage change of finished energy only, to show the decrease in prices. Liquefied petroleum gas (Propane, used in rural heating), declined -6.0% in a month. Residential gas increased +0.8%, home heating oil decreased -1.2%, electricity, -0.1% and gas, -1.0% for August.

Crude in the Producer Price Index are the items which are used for further processing, or to make other stuff. Crude PPI increased +0.2% in August 2011 and -1.6% for the last three months. Crude energy dropped -5.1% in August while foods increased +4.7% for August and is up +6.0% for the last three months. Corn increased +9.2% in August as did cattle and chickens.

Crude core or crude stuff minus food and energy, increased +1.6% for August, with gold ores jumping +9.3% and being half of the increase. Surprise, surprise.

For intermediate wholesale goods we had a -0.5% decrease for August, with energy dropped -2.3%, the largest monthly percentage drop since July 2009. Intermediate core declined -0.1%, the first drop since July 2010. From the report:

In August, about eighty-five percent of the decrease can be traced to a 2.6-percent drop in prices for thermoplastic resins and materials.

Below is the indexed price change for all commodities. Commodities are not limited to what comes from inside the United States.

Durable goods wholesalers in the trade industries just increased their profit margins by 2.3%, which resulted in a total net output PPI (or increase in prices for retailers), by 1.6% in August, the highest jump since January 2007. There also was a 3.0% increase by the airlines for passenger airfare. Insurance also increased in August.

This all implies these wholesale price increases will be passed onto consumers through retail sales price increases later down the pike.

Here is the BLS website for more details on the Producer Price Index. They list individual items and special indexes. For example, crude energy materials decreased -5.1% in a month, yet crude materials minus energy increased +3.7% for August.

Lobsters slow cooking

People don't much notice marginal wholesale price increases from month to month. Marginal increases maybe don't even occur month to month at the retail level. I remember the first time that I bought a loaf of bread for more than a dollar and pretty soon almost all the bread was more than a dollar. (Of course, there's bread and then there's bread, and it's been a while since the choice was between vanilla and chocolate.) My friend who ran a grocery explained that there had been resistance to the dollar cap for quite a while, but then it went. It would be like now, there's resistance (I hope) at the $10/loaf level.

I think what people are really noticing is tires and insurance. Especially tires. You can go a long time between purchasing a set of tires. Similarly, insurance, because of annual premiums. Another of these non-distributed-over-time things is propane. Propane vs. wood pellets vs. heating fuel vs. your local wood cutter. Summer break.

With tires, it's delayed or accumulated increases in crude oil. It's unclear why the drop in thermoplastics as tires continue up. Maybe that's a technical chemical process thing, replacing costlier materials with less expensive. Maybe that's to do with recycling. Maybe it's a fluke having to do with inventories.

With insurance including life annuities, it's much more complicated. It has to do with the global re-insurance game, I suspect. Which has a lot to do with currency exchange, liquidity crisis, equity values and everything, really. Pooling of risk ultimately reduces to pooling of the costs of recouping from disasters, such as the nuclear thing in Japan. That has to affect, for example, expected mortality rates in Japan (and elsewhere). One way or another, the big re-insurers are not going to go broke. Greece will go bankrupt first.

Of course, there may be exclusions for natural disasters, as there are for wars and insurrections, but that may reemerge in other forms of insurance. Deep pockets must be replenished. "Law of averages" rules.

this is wholesale, i.e. to businesses

At the bottom is the current "push it off to consumers implications", PPI definately foreshadows CPI, or what the inflation is to consumers, although you're right, retail can eat the increases costs and reduce their profit margins, which of course implies more firings. Seems labor is always the first squeeze.

On some of these monthlies, one time events can affect prices although with eggs, I don't get it, they bob up and down with dramatic price increases and this really does affect a lot of baked goods, products. I mean do chickens have cycles? I have no idea except there are plenty of seriously abused chickens at factory farms, (although with pigs, cows, cattle).