The Census Bureau has found State Government revenues declined nearly 31% for 2009. Guess what is causing the shortfall, unemployment. Social insurance money goes into these funds from paychecks.

Total state government revenue dropped to $1.1 trillion in 2009, a decline of 30.8 percent from $1.6 trillion in 2008, according to the latest findings from the U.S. Census Bureau. The large decrease in total revenue was mainly caused by the substantial decrease in social insurance trust revenue.

Social insurance trust revenue is made up of four categories — public employee retirement, unemployment compensation, workers compensation and other insurance trusts (i.e., Social Security, Medicare, veteran's life insurance). More details on the social insurance trust revenue will be available from the 2009 Annual Survey of State Government Employee Retirement Systems data later this winter.

State governments received nearly $1.5 trillion in general revenues in 2009, a decrease of 1.4 percent from 2008. General revenue does not include utility, liquor store or insurance trust revenue.

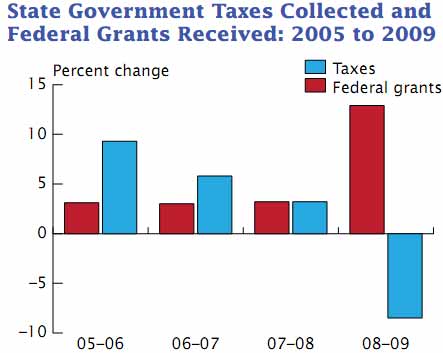

Total taxes collected in 2009 ($715.1 billion), which accounted for 47.9 percent of general revenue, fell by 8.5 percent from $781.6 billion in 2008. This is the first year-to-year decline in tax revenue since 2002. Federal grants ($477.7 billion) increased 12.9 percent from 2008 to 2009 and accounted for nearly one-third of general revenue.

According to the Census, state government revenue comes from 47.9% taxes, 30% federal grants, 10.5% from service charges and the remaining 9.6% from other sources.

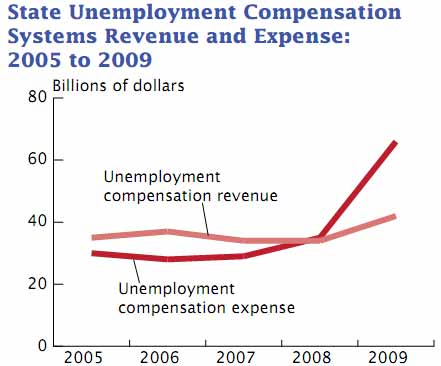

In 2009, tax revenues dropped 8.5% while federal grants increased 12.9%. States long term debt increased 4.7% from 2008. While corporate taxes are only 6.1% of states revenues, they have dropped 20.3% in 2008 and 36.4% in 2009. Income tax collections declined 13% in 2009 as did sales taxes. States spend 36.3% of funds on education and 28.2% on welfare. Look at this U.S. Census graph on the situation with unemployment compensation versus what States take in to fund it.

Here are the percentage increases in state expenditures for 2009:

- Unemployment Compensation: 86%

- Heath: 7.7%

- Welfare: 6.1%

Other spending such as infrastructure and interest on the debt remained unchanged in comparison to 2008.

Yes Virginia, in spite of the rhetoric, if people have jobs, overall tax revenues go up. You'd never get that connection from listening to the never ending sound byte nonsense rhetoric from pundits and cable noise. You want to fix the debt problem, especially with the States? Try jobs, jobs, jobs, jobs & jobs.

JP Morgan Chase predicts more Local Gov. bankruptcies

No surprise after this report overview.