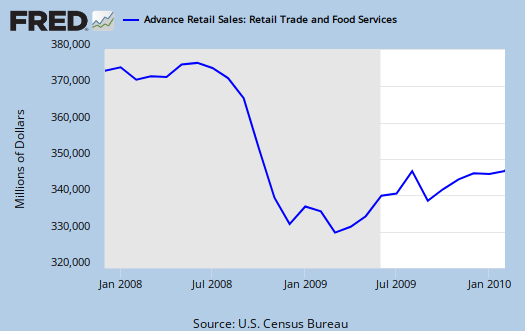

The February 2010 Retail Sales report is out. Retail Sales increased 0.3% from January 2010.

Autos down -2.4%, Electronics & Appliances up 3.7%, Gas stations up 0.3%, grocery up 1.3% and general retail stores up 2.5%, all in comparison to last month.

Here are retail sales excluding autos:

Recall auto imports had decreased from this months trade data.

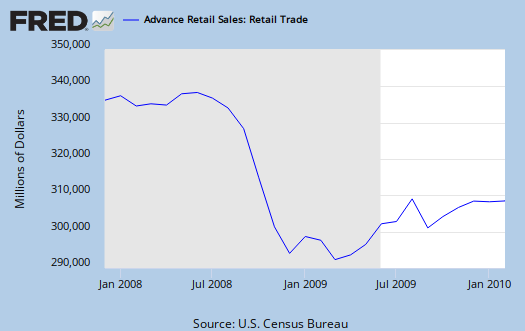

Here are retail sales, in a line graph, from the start of this recession, excluding food services (people must eat, regardless of economic conditions):

It appears our consumer society is recovering, but it also appears there is a lower trend line, as if this recession caused a structural readjustment overall.

Zero Hedge is saying retail sales are all bunk. Now they (finally) note something I see every week in the initial unemployment claims. The past week or months data is revised down to make an increase in the current report seem better. When you see this week after week, knowing it's impossible to consistently need a revision which almost always makes the current report look better...something does start to smell.

That said, retail sales does not adjust for prices, where the report from Gallup is tracking spending. Not quite the same thing.

So, what one can get in my view is the longer term slide and I think retail sales does show a structural shift at this point. People are buying less in comparison to before this financial Bankster debacle.

Subject Meta:

Forum Categories:

| Attachment | Size |

|---|---|

| 71.15 KB |

Recent comments