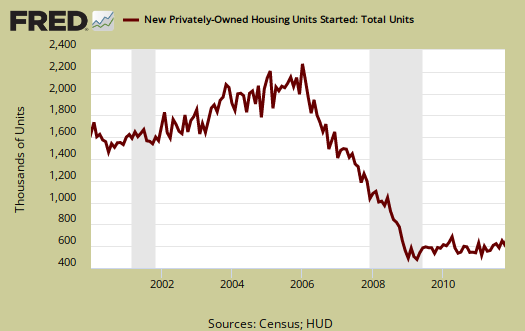

The October 2011 Residential construction report showed Housing starts decreased -0.3% from September, to a level of 628,000. This is +16.5% above October 2010, or 539,000 housing starts. New Residential Construction has a margin of error often above the monthly percentage increases, so take these monthly changes with a grain of salt. October, for example, has a error margin of ±10 9% percentage points on housing starts. The below graph shows this sector, over time, is still depressed.

Single family housing starts increased +3.9% from September. Single family housing is 75% of all residential housing starts.

Housing of 5 or more units decreased -13.3% for October and is up a whopping 96.8% for the year. Guess all of those people who were foreclosed on will need an apartment now, assuming they have any money to make rent. Although rental vacancy rates for Q3 were 9.8%, we just saw rents increase 0.4% in a month from the latest CPI report.

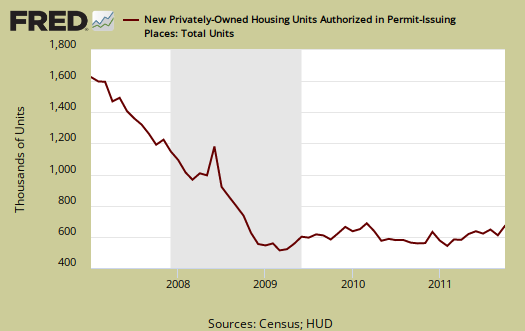

Building permits, also increased +10.9% to 589,000 and are up +17.7% from this time last year. Single family building permits increased +5.1% from September. Building permits have much less statistical error, ±1.6%, than housing starts. Below is the St. Louis Federal Reserve FRED graph for Building permits. The graph shows building permits are not always a smooth line from month to month.

Housing Completions increased by +5.7% and are now up 2.8% from October 2010. This number reflects housing starts from 2010.

This report has a large variance, so to establish a trend line one must take into account months of data. This report is also seasonally adjusted and residential real estate is highly seasonal.

One thing to take away from this report is multi-family, otherwise known as rental units, are really taking off and no surprise there since the mortgage lending standards are so tight and there are so many foreclosures. A silver lining to the destruction of the American Dream.

I recommend Calculated Risk, the uber site on housing data, for more graphs and analysis and especially this interesting correlation of the unemployment rate to housing starts graph and article.

Additionally the Q3 home and rental vacancy rate report, released by the Census November 2nd, has state by state data on their website.

another article pointing to apartments, rentals and permits

Someone else is bothering to look at the statistics, over a period on permits vs. completions as well as apartments. Worth reading here. They point out expansion occurs when permits exceed completions.

Sitting on permits

"This sector expands when more housing permits are issued than houses completed. This is the current situation. The data is not necessarily accurate in real time, however. There has been backward revision of data – and since July 2011, the data has been noisy with permits and completions almost in balance." -- from the linked Ecointersect Analysis Blog

You can see a major seasonal cycle in the first graph at the linked webpage. The second graph showing Year-over-Year Growth gives a much more meaningful picture.

I think that the sentence "this sector expands when more housing permits are issued than houses completed" should be preceded by "in times of an expansionary economy."

In the second graph, you can see clear evidence of what I have observed 'on the ground', namely, a tendency since 2009 and even continuing into 2011 for permits for major (subdivision) developments to be approved long before any construction of homes (even before any of the infrastructure) is begun.

I don't know how the Census treats these two levels of permitting, but I do know that investors are taking advantage of low impact fees, available only when governments are desperate to spur growth. This kind of permit acquisition is like rich people buying gold. They don't need it, but it looks like a shelter, a hedge at a time of great uncertainty. They have gold for the anticipated collapse of the USD, and they have land that they purchased years back for its development value. They can't sell their land scheduled for development, (unless willing to take a loss), so they might as well continue with development, locking in super deals on permits.

Sitting on permitted but essentially undeveloped land can have tax advantages, if you do it right.