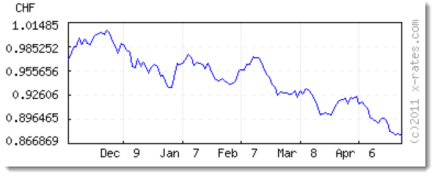

Today the Swiss franc made yet another new high against the super dollar, as it has been doing for 120 days. What you are reading in the graphs is less and less of the foreign currency that one dollar can buy. Of course, gold and silver also consistently hit new highs. Swiss franc:

As did the Australian dollar:

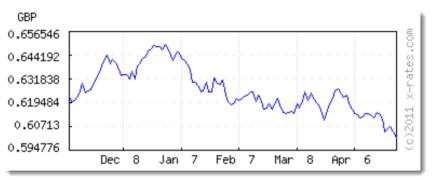

British pound:

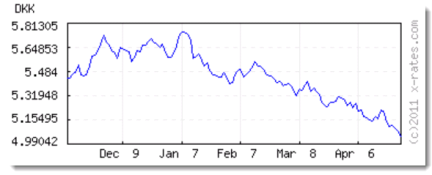

Danish krone:

Russian ruble

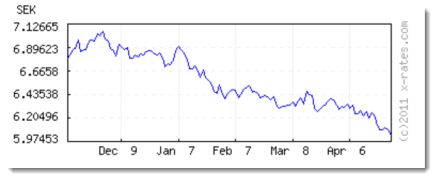

Swedish krona

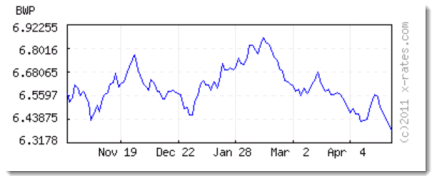

Botswana pula:

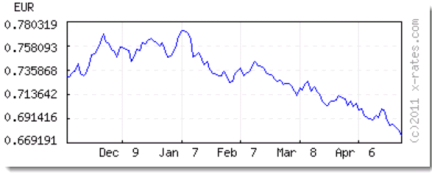

European euro (despite the "sovereign debt crisis," a product of naive European trust in Americans and the criminality of Goldman Sachs and all of Wall St.):

Other currencies, such as the Brazilian real and Canadian dollar have been consistently making new highs against the US dollar but failed by a few hundreds of a percent to do so today.

Canadian dollar:

Ben Bernacke says QE will end in June, but he is either delusional or lying. If the Fed stops monetizing Treasury debt, how will the $1.5-trillion-dollar annual operating deficit of the US government be financed? Are Americans, who are broke, suffering 22% unemployment, foreclosures on their homes and running out of money before the end of the month, as Wal-Mart's CEO recently stated, going to finance a 1.5-trillion annual government deficit? If you think so, I have a bridge to sell in Brooklyn.

The combined trade surpluses of China, OPEC, Japan and Russia are insufficient to finance more than one-third of the US budget deficit, assuming these countries are willing, in the face of the evidence, to continue to acquire US debt.

That means, even under the most optimistic scenario, that the Federal Reserve will have to purchase annually $1-trillion in Treasury debt.

In other words, the US, the great Super Power over-filled with hubris, has outdone the fiscal irresponsibility of third-world banana republics. Superpower America is financing itself by printing money.

Washington, by conducting open-ended wars of aggression against non-puppet states, by giving its approval to the off-shoring of US jobs and thereby US GDP, and by saddling bankrupt taxpayers with $1-trillion in non-recourse loans to mega-rich people in order that the richest and most favored could borrow from the Fed at nearly zero rates of interest hundreds of millions of dollars to buy under-valued student loans, credit card debt, mortgages, whatever, and have any profits from the purchase of under-valued assets put in their bank account and any losses put on the Federal Reserve's books. Obviously, the US economy is a scheme run by the rich for the rich.

In this scheme to impoverish Americans for the benefit of the mega-rich, the Federal reserve actually gave hundreds of millions of dollars to the wives of New York investment bank CEOs in non-resource loans. The already rich wives bought up under-valued debt and made a killing. The wives had no risk whatsoever, because if their investments failed, it went onto the Federal Reserve's books, not on the wives' entity. See Matt Taibbi's The Real Housewives of Wall Street in Rolling Stone magazine.

As the International Monetary Fund said, recently, "the age of America is over."

Reposted with the permission of the author. First published in OpEdNews.com

Comments

Dear Mr. Roberts devaluation of the dollar was worse in....

earlier in this decade. That said, the inane trade deficits mentioned, the never ending financialization, debt, outsourcing, sure had something to do with it!

Botswana pula

Paul Craig Roberts for President.

Botswana pula? Give me a break!

Botswana Pula

Only a pig ignorant American would not know about Botswana... It has a small population and diamond mines. Even Botswana is better run than the U.S. as you can see by the exchange rate. Adding 2 TRILLION dollars to the money supply--more than in the last 2 centuries COMBINED--is a really dumb idea. Thank Bernankenstein!

Stiglitz approves Strauss-Kahn leadership at IMF

There's interesting convergence, more of it everyday, among intelligent social and economic critics. I think EP tends also to be a part of that convergence - toward insisting on the necessity of international capital flow controls.

In May 6 article titled The IMF's Switch in Time at Project Sydicate, distributed also through truthout.org, economist Joseph Stiglitz approves leadership of Strauss-Kahn at IMF, specifically the IMF turn-around in favor of international capital flow controls and away from IMF's long-standing willy-nilly 'capital-market liberalization' policy.

1. Stiglitz uses the term "Great Recession"

2. Financial deregulation in U.S. was prime cause of 2008 global crisis, and capital-market liberalization spread the crisis outward from the U.S.

3. Thanks to the crisis, we can now state with certainty that free and unfettered markets are neither efficient nor stable. For efficiency in setting prices, look at the real-estate bubble; and, for stability, look at currency exchange. (I would example of the Flash Crash and similar little-understood instability of all financial markets. Of course, it's always about 'isolated incidents', each of them a one-time event )

)

4. Iceland helped itself out of the collapse by policies that include imposing capital controls

5. Federal Reserve policy of “quantitative easing” has assured the demise of the ideology of unfettered markets. Liquidity created by the Fed hastened the demise of the ideology of unfettered markets. With America's credit pipelines clogged and regional banks faltering, money flowed (flew?) out of the U.S. into "emerging markets".

has assured the demise of the ideology of unfettered markets. Liquidity created by the Fed hastened the demise of the ideology of unfettered markets. With America's credit pipelines clogged and regional banks faltering, money flowed (flew?) out of the U.S. into "emerging markets".

6. Stiglitz notes about capital flows that money goes where markets think returns are highest, but that may not be where returns in fact are highest

That last point reminds me of the old saw that "people vote their pocket books." No, they may think (or rationalize) that they are voting their pocket books - very different from effectively voting in you own economic or financial best interest.

My take on the growing awareness of the insanity of the faith-based ideology of global market liberalization , is that something's got to give. We cannot make the needed reforms within the WTO system, and the sooner we get real about reforming our 'fast-track' past, the better off we'll be. Our "switch in time" needs to be a turn-around in the "fast track" trade policy.

, is that something's got to give. We cannot make the needed reforms within the WTO system, and the sooner we get real about reforming our 'fast-track' past, the better off we'll be. Our "switch in time" needs to be a turn-around in the "fast track" trade policy.

A prime benefit of an across-the-board tariff policy (accompanied with an end to the U.S. system of trade preferences and patchwork subsidies) will be that it will bring about a break - a show-down - with the WTO quasi-judicial system.

If we play this right, a new U.S. could find allies everywhere. We (U.S.) have an opportunity to take the lead in global reform. Or not, in which case, we (U.S.) will be doomed to the nether end of history.

For now, my only strategy is to reject and ridicule the 'okeydoke'. That's where EP comes in, calling it like it is, including ugly naked behinds at the Imperial Court.

comes in, calling it like it is, including ugly naked behinds at the Imperial Court.