Oil continued to trade in a narrow range last week as news that OPEC had achieved 90% compliance to their agreed to production cuts offset the news that US oil supplies saw their 2nd largest weekly jump in the EIA's records. Strength in U.S. dollar, which makes internationally traded commodities cheaper, weighed on oil prices to start off the week, as US WTI oil for March delivery fell 1.5% to close at $53.01 a barrel, after closing the prior week at $53.83. Prices continued to fall on Tuesday, after the EIA forecast that US crude output would hit a fracking era high in 2018 and the American Petroleum Institute reported the 2nd largest increase in oil inventories in history, along with large increases in gasoline and distillate supplies, and again ended another 1.5% lower at $52.17 a barrel. However, prices steadied on Wednesday, despite confirmation of the large oil supply increase from the EIA, and closed up 17 cents at $52.34 a barrel, as a drop in gasoline supplies encouraged traders to think that demand for gas was returning to normal. Momentum from that rebound carried into Thursday, when prices rose to close at $53.00, after oil ministers from Iran and Qatar suggested that OPEC production cuts might be extended into the 2nd half of this year. Oil prices then rose 1.6% on Friday to close out the week 3 cents higher than last week at $53.86 a barrel, after the International Energy Agency said OPEC had achieved a record initial compliance of 90% with their planned production cuts, that global oil output had fallen by 1.5 million barrels per day, and revised upward their estimate of global oil demand growth for this year from 1.3 million barrels per day to 1.4 million barrels per day...

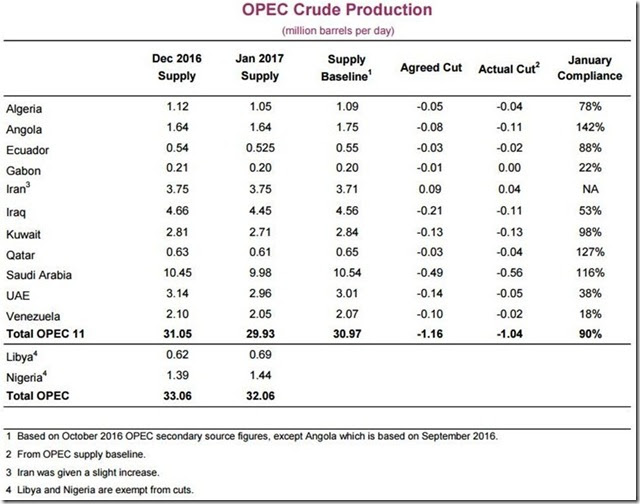

For an initial look at those OPEC compliance levels, we have a table of OPEC oil output for December and January as per the IEA (note that's the International Energy Agency, headquartered in Paris, as distinguished from the US EIA, which is the Energy Information Administration of the US Department of Energy, in case those similar acronyms have been confusing to you)

The above table comes from the IEA via Zero Hedge and it shows the IEA estimates of the December output of crude, in millions of barrels, from each of the OPEC members in the first column, estimates of OPEC’s January output of crude in the second column, and then the supply baseline for each country in the third column, also in millions of barrels. It's that supply baseline, which is approximately equal to the October production level of each member, on which the 4.5% OPEC production cuts are based, so the amount in millions of barrels of crude that each member is expected to cut is therefore shown in the 4th column, as the "agreed cut". Then, based on these estimates of January oil production, the "actual cut", or the difference between each member's baseline and their January production, is then shown in the next to last column. Finally, in the last column, the IEA computes a compliance percentage, which is simply the amount each member has cut shown as a percentage of what they agreed that they would cut. Near the bottom, they then total OPEC figures and give us the totals for all 11 members of OPEC, and conclude from those totals that they've achieved 90% compliance. While that's all pretty much self explanatory, as are the footnotes at the bottom of the table, we'd note that the Saudis by themselves cut 116% of what they'd agreed to, and thus account for more than half of the OPEC cuts so far. That means that without the Saudi cuts, OPEC compliance was at a not very spectacular 71.6%...

International Rig Counts for January

Now, those EIA estimates are for one month’s production. We can get a better gauge on the long term plans of OPEC and other producers by checking how much drilling for new oil supplies that they’re doing. On Tuesday of this past week, Baker Hughes released the international rig counts for January, which unlike the popular weekly North American count, is an average of the number of rigs that were running in each country during the month, rather than the total of those rig drilling at month end. Baker Hughes reported that an average of 1,918 rigs were drilling for oil and natural gas around the globe in January, which was up from the 1,772 rigs that were drilling around the globe in December, and up from the 1,891 rigs that were working globally in January of last year, which was the first time global drilling activity surpassed year earlier totals since December of 2014. Increased North American drilling again accounted for most of the global increase, as the average US rig count rose from 634 rigs in December to 683 rigs in January, which was also up from the average of 654 rigs that were working in the US in January a year ago, while the average Canadian rig count rose from 209 rigs in December to 302 rigs in January, which was also up from the 192 Canadian rigs that were deployed in January a year earlier. Outside of Northern America, the International rig count rose by 4 rigs to 933 rigs in January, which was still down from 1,095 rigs a year ago, as increases in drilling in the Middle East and Eastern Asia more than offset a decrease in Latin American activity..

Drilling activity in the Middle East rose for just the 5th time over the past 13 months, as the countries included in this region added a net of 6 rigs, including 3 offshore, increasing their active rig average to 382 rigs for the month, which was still down from the 407 rigs deployed in the Middle East a year earlier. OPEC member Kuwait accounted for the entire increase, as they started 8 more rigs in January and now have 54 rigs active, which was up from the 40 rigs the Kuwaitis were running a year ago. In addition, Egypt, who is not an OPEC number and who has not agreed to output cuts, added 1 rig in January and thus had 25 rigs active, which was still down from the 42 rigs they were running a year earlier. On the other hand, Oman, who is not an OPEC member but who has committed to a production cut of 45,000 barrels a day, cut back their drilling by 2 rigs, from 59 rigs in December to 57 rigs in January, which left them down from the 70 rigs they were running in January a year ago. In addition, the Saudis pulled out one rig in January, which left them with 124 rigs still active, the same number as they had running a year earlier. However, Saudi Arabia's rig count has averaged near 125 rigs weekly since early 2015, up from their average of around 105 rigs in 2014, so they've not yet even pulled back to the level of drilling they were doing before OPEC opened the spigots. Among other major OPEC producers, Iraq's drilling was unchanged at 41 rigs in January, while Abu Dhabi of the United Arab Emirates was also unchanged at 48 rigs, the same as their count a year ago, although like the Saudis, they are still doing far more drilling than their 30 rig average of early 2014.

Drilling activity in the Asia-Pacific region also increased by a net of 6 rigs to 198 rigs in January, even as their offshore deployment fell by 5 from 87 rigs to 82, which was down from the 198 rigs working the region a year earlier, which just included 75 platforms working offshore at that time. Indonesia, who was booted out of OPEC for not agreeing to the group's production cuts, added 7 rigs and thus had 23 rigs working during January, up from 20 rigs a year earlier. Australia added 5 more rigs, after adding 5 rigs in December, bringing their total to 14 rigs active nationwide, which was thus up from the 13 rigs they were running a year earlier. Brunei, who had shut down both of the rigs they had active in December, started both rigs back up in January, and the 2 rigs they're now running are the same as they had a year earlier. On the other hand, China shut down 5 more offshore rigs, after they had shut down 3 rigs in December, leaving them with 20 rigs working offshore, down from the 27 offshore rigs they were running last January. At the same time, both Papua New Guinea and Malaysia both idled one rig; that left Papua New Guinea with 2 rigs active, same as they had a year earlier, and left Malaysia with 3 rigs running, down form the 5 rigs they were running a year earlier...

Meanwhile, the Latin American region saw their active drilling rig numbers drop by a net of 8 rigs to 176 rigs, down from 243 rigs in January of last year, and down from 321 rigs as recently as September of 2015, as the region idled 92 rigs over the first 6 months of 2016. Argentina, where they had shut down 11 rigs in December, shut down another 7 in January, and now have 52 rigs active, down from 72 rigs a year ago, and also down from over the over 100 active rigs Argentina saw through most of 2015. Mexico, who has agreed to cut their oil output by 100,000 barrels a day, idled 3 rigs for the month, which left them with 16 active rigs, down from the 43 rigs they were running last January. Venezuela and Ecuador, both members of OPEC, each shut down 1 rig; that left Venezuela with 51 rigs, down from 67 last January, and left Ecuador with 6 rigs, up from the single rig they were running last January, which was during an anomalous slowdown in Ecuador's normal activity. In addition, Chile shut down 2 rigs and now have 2 remaining, down from the 3 rigs they had active last January, and Suriname shut down the only rig they had active in December, while they had two active a year ago. On the other hand, Brazilian drillers, who were not party to the OPEC production cuts, added 3 rigs during the month; which brought their active rig count back up to 16 rigs, which was still down from the 34 rigs deployed in Brazil a year earlier. Trinidad and Tobago, meanwhile, added two rigs, and now have 5 rigs working, which is still down from the 7 rigs they had running a year ago. In addition, both Columbia and Peru added a single rig; for Peru, that brought their active rig count up to 2 rigs, up from none a year earlier, while for Columbia, their count rose to 20 rigs, up from the 8 rigs they had running a year earlier...

Drilling activity also slipped a bit in Europe, falling by 1 rig to 98 rigs, which was down from the 108 rigs working in Europe a year ago at this time, as their offshore drilling activity fell from 35 rigs to 31 rigs, also down from 35 rigs offshore a year ago. 4 platforms offshore from Norway were idled, leaving 12 still active there, down from 18 a year ago, while the UK idled 3 offshore, leaving them 8 active, same as they had offshore last January. On the other hand, 2 new offshore platforms were deployed off the coast of the Netherlands, and one was set up in the Mediterranean off of Italy. Those brought the Netherlands count up to 3 offshore, from one on land and one offshore in December, but down from two on land and two offshore in January of 2016, and brought the Italian count up to 5 rigs, from 4 land based rigs in December and 3 on land last January. Elsewhere on land in Europe, Turkey added 3 rigs and now have 32 active, up from 29 rigs in December and a year ago, and France started up two rigs, up from none in in France in December and none most of last year. Meanwhile, the Germans shut down 1 rig, leaving them 3 still active, down from the 7 rigs they had deployed a year earlier...

Lastly, the African continent saw a net increase of 1 rig to 79 rigs in January, which was still down from the 94 rigs working in Africa last year at this time. OPEC member Nigeria, who is exempt from the organization's production cuts for the time being, added 2 rigs and now have 6 rigs working, which was still down from the 9 rigs they had deployed a year ago. OPEC member Angola also added a rig, and now have 5 rigs active, also down from the 10 rigs they had active a year earlier. In addition, the Congo Republic, which had shut down all 3 rigs they had active in December, added 1 rig back in January, still down from the 3 rigs they had active last January. OPEC member Algeria shut down 1 rig, leaving 51 rigs still working in Algeria, same as they had a year ago. Both Liberia and Ghana shut down the only drilling rig they had active; a year ago, Liberia had no rigs and Ghana had one. Finally, note that Iranian, Russian, and Chinese rig counts are not included in this Baker Hughes international data, although we did note that China's offshore area, with an average of 20 rigs active in January, were included in the Asian totals here...

Note: the above was excerpted from my weekly synopsis at Focus on Fracking

Recent comments