In August, New Residential Single Family Home Sales decreased -2.3%. July was revised upward slightly, from -0.7% to -0.3%. August's volume, annualized was 295,000 and July's annual sale rate was 302,000. This is a +6.1% increase from a year ago. In August 2010, new single family home sales were 278,000. The North East region of the country saw a monthly new home sales percentage change drop of -13.6%.

These numbers are seasonally adjusted, but also with large error margins, where the margin of error is outside the actual reported percentages. Weather can influence sales. For example, the error window, (90% deviation), for the monthly percentage change is ±13.9% and the yearly error margin ±18.8%.

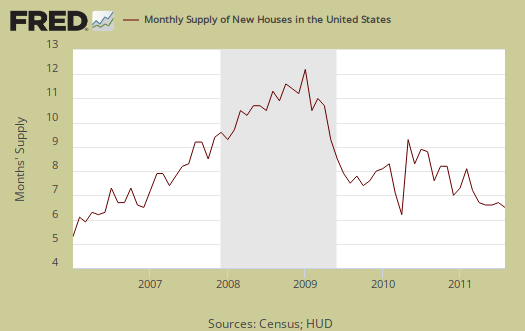

The supply of new homes is now at 6.6 months, at current sales rates, of inventory, or 162,000, a -25.8% decrease in supply from August 2010.

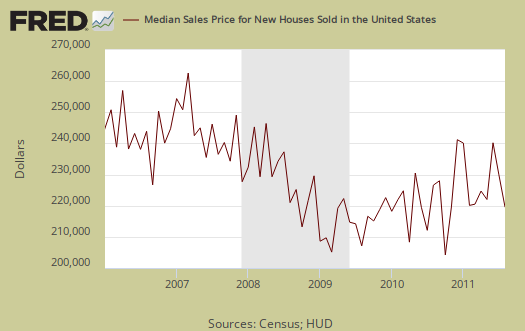

Both the median price and average new home price dropped from last month. In August, the median price was $209,100, whereas July's median price was $228,900. August's average price was $246,000, down from July's $269,500. Below is the monthly median home prices. As you can see the statistical variance is huge, but it looks like 2009 was a bottom, yet this month is approaching those 2009 levels.

If one looks at median and average sales prices, they are still way out of alignment with wages and salaries, which are flat for over a decade, even with record low mortgage rates. The median time new homes were for sale was 8.9 months; July was 9.5 months.

Basically the variance in monthly data is so large, all one can say is new home sales are rolling around in a bottom and not much is going to happen with residential real estate until the unemployment rate returns to 5% or so and demand in the economy picks up.

Calculated Risk compares new home sales to recessionary periods and goes back to 1963 in data comparisons.

July's New Home Sales Commerce Report overview is here, graphs revised, statistics as originally reported.

Recent comments