This is it. Forward month WTI has closed below $100, at $95.71. The Series is officially over.

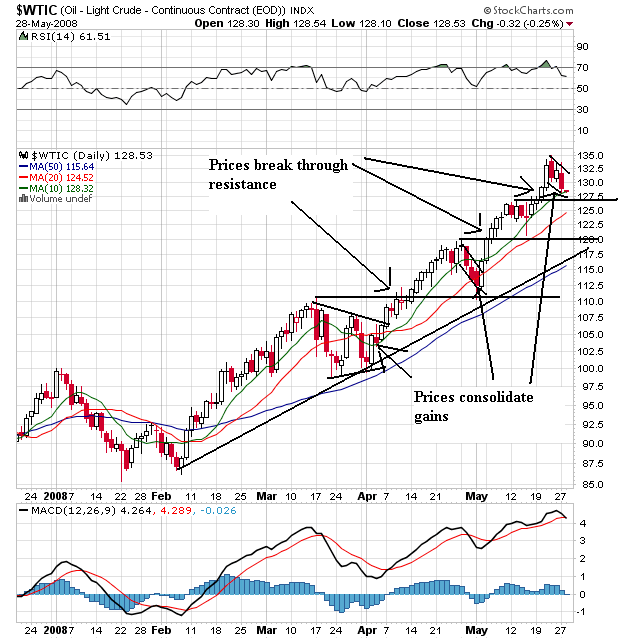

When I began this series on May 29, Oil was over $130, having gone up 30% in only 4 months! It seemed everybody was convinced that we would have $150 Oil by July 4 and $200 Oil by the end of 2008. Here's what the Oil chart looked like on the very day that I said "The Countdown to $100 Oil is on":

Courtesy bonddad

As my initial diary discussed, it appeared that sentiment was at an extreme. It was very popular to proclaim that oil would continue to head up inexorably. Asian demand was insatiable and growing. US demand was irrelevant, and speculation was a non-issue. Here's an example (not attributed so as to not make these personal attacks) of highly recommended commentary around the time I made my contrarian call:

Optimists cling to the notion that this is self-correcting, ie that the recession underway will cause oil demand to shrink and prices to recede, thus allowing all of these phenomenons to go into reverse. But this ignores the fact that demand is already shrinking in the US and Europe ....

We are no longer driving demand: beyond China, ... it is oil producers like Iran, Saudi Arabia, Russia or other Gulf countries that are ... driving demand[. T]his is unlikely to change.

- May 19, 2008

Speculators can only accelerate underlying trends, but cannot cause them....

All those that blame speculators have had to increase the "real" price at which oil should trade, according to them, if there weren't speculation....Speculation is a minor issue.

- May 19, 2008

oil has been extraordinarily cheap. Now its price is noticeable, but not yet unbearable, for the majority. It will go high enough as to be painful for large numbers of people, and we're still very far from that.

- May 21, 2008

This is no bubble, because there is a very real link to supply-demand tensions here: supply is tight, and demand is increasing, not in the West, but in Saudi Arabia, Iran, Russia and China....

- May 21, 2008

A price of $150-200 seems possible - likely even - but predicting a DECLINE to $75 after 2011?!?! Is that really possible?

.... It seems - like it or not - that supplies will be getting tighter and demand will continue to increase. The only issue is the rate of change....

- May 22, 2008

Oil prices are high today not, as in 1980, due to a temporary disruption in the global flow of petroleum but for systemic reasons that are, if anything, becoming more pronounced. This means news headlines with the phrase "record oil price" are likely to be commonplace for a long time to come

- May 22, 2008

gas will never fall below $4 a gallon

- June 4, 2008

One view that has been gaining ground in recent months is that the commodity market is caught in a speculative bubble akin to the housing or technology bubble of the late 1990s. The notion is buffered by the fact the oil prices have doubled in 12 months despite a slowing economy. ...

"I don’t know how else to say it, this is not a bubble," Jan Stuart, global oil economist at UBS, said. "I think this is real."

- June 06, 2008

This has been the story in every single paper and by almost all analysts: it's a bubble, it's not justified by fundamentals, it's speculation, driven by a few self-interested traders at Goldmans or similar places, etc...

This is denial pure and simple.

- June 06, 2008

$150 Oil... by next week. Friday the latest. And if I'm wrong...

you can have my milkshake.

- June 06, 2008

Weeks? I wish it would take that long, it'll hit 150 by next Friday

- June 06, 2008

it is just too convenient, too irresistible and, let's say it, too comfortable an excuse that speculators are to blame. It's not our fault, we have our scapegoat. Our price increases are temporary, we'll soon be back to "normal" lows, as soon as (take your pick) speculators have been punished/oil companies are taxed for their profiteering/"fundamentals" are left toset prices.

This is just denial

There are A LOT of reasons why oil prices are going up.

....

Chinese demand growth is very real, it's very large, it's highly likely to continue for a number of years

- Jun 26, 2008

we're on track to reach $200 oil by 31 December this year

- Jul 01, 2008

Oil prices have gone from ridiculously low to noticeable/annoying. They have not yet reached the pain threshhold for large parts of the population (they sure have for some, but that's not yet enough).

....

What you don't get is that prices will increase until you use less oil, because there's no longer enough of the stuff, and demand destruction is required. If, as you note, oil is vital to your current life, then prices will go up high enough to force you to change your life....

Since these suggestions are not practical, as you rightly note, prices will go up very, very, very, high.This is not gloating, or anything like it. I'm simply providing a warning, which is just an opinion, but one backed by an increasing array of facts on the ground.

- July 1, 2008 (only 10 days before Oil hit its high of $147 and started to decline).

This is exactly what a bubble looks like. After a sustained, nearly one-way move continues long enough, the opinion that the trend will continue are "backed by an increasing array of facts on the ground," and not only is the "story" compelling, but the "story" has been right for so long that almost nobody dares state a contrary opinion.

The same thing happened with the housing bubble, and the internet bubble before it, and so on ....

Opinion becomes ever more one-sided as the price moves in a "parabolic" fashion (i.e., increasing at an ever-higher rate) which is exactly what Oil did in 2007 and early 2008.

What we know now, that Oil-bubble boosters didn't know a few months ago, is that much of the demand in Asia, particularly China, wasn't "real." It was buttressed by large consumer subsidies, subsidies that started giving way in June.

And far from the assertion that "Chinese demand growth is very real, it's very large, it's highly likely to continue for a number of years", in fact Chinese demand growth was "Hoarding in Plain Sight", foisted on the private sector in the lead-up to the Olympics; and it didn't last past June. In July the Chinese government allowed private companies to stop building up their hoards, and Chinese demand for Oil promptly declined.

Once the Oil bubble began to burst, not even August Hurricanes in the Caribbean could stop the decline to $100. Just as speculators caught short on the way up got blown away, so too did speculators caught long on the way down.

The final nail in the coffin, a decline below $100, took place on the special very first NY Mercantile Exchange trading session in reaction to Hurricane Ike making a direct hit on Houston Saturday morning.

So what now? Just as in 2006, the last Congressional election year, Oil has declined going toward election day. If the same seasonality holds up, further declines for the next couple of months are in the cards.

So what is my next prediction? Well, this I can state with great certainty: Oil will hit $200 before it hits $0.

Prior installments in this series:

Countdown to $100 Oil?!? Subsidies, Hoarding, and Bailing out Billionaires

Countdown to $100 Oil?!?(2): Asian Subsidies Crumbling

Countdown to $100 Oil?!?(3): Oil under $120

Countdown to $100 Oil?!?(4): Hurricanes of the Caribbean

Comments

Update: Oil's collapse continues

Oil continued to collapse today, closing at $91.15, after falling as low as $90.51 a barrel. This means that Oil is down almost $10 in 2008, and only about 15% higher than at this point last year.

This was not a "rational" move, any more than the sudden moves from $121 to $139 a barrel were a few months ago. This move, more than anything else, probably reflects (1) margin calls, as speculators caught long when Oil fell below $100 had to liquidate; and (2) forced liquidation by those who have to sell their "winners" in order to raise funds to cover other liquidity requirements (e.g., banks, insurance companies, pensions, hedge funds).

So it would be no surprise at all to see the price of Oil "boomerang" at least temporarily back over $100.

Speculators

I'd love to see some analysis on speculators. We kind of dropped that ball and while we have claims speculators drove up the market, then the downside of this must be true for that claim to be valid.