By now most people are aware of how Dubai got itself in over its head. What exactly is the perfect metaphor for Dubai's excesses? The palm-tree shaped islands? The underwater hotel? The indoor ski resort? It all had the feel of Disneyland meeting the dot-com mania.

In the end it was all about borrowed money. Lots of it. In that context Dubai is not alone.

Dubai's default has the world's investors asking the question: Who's next?

Practically on the same day that Dubai announced their debt default, Vietnam sent out its own warning.

Among Asian stock markets, “the biggest risk now is Vietnam,” said Mobius, who oversees about $25 billion of emerging-market assets and has about $1 million invested in Vietnam. “The government is taking measures which may cancel out each other.”

“On one hand they’re devaluing the dong, on the other hand they’re increasing money supply in order to keep economic growth going, and they’re raising interest rates,” Mobius said. “When there’s confusion and uncertainty, you know what happens, people sell. They don’t want to stick around.”

Vietnam has struggled with inflation for many years now. The memories of the climatic Asian currency crisis of 1997 are still fresh in people's minds. People in the region are well aware that it all started with Thailand devaluing their currency.

The day before Dubai announced their intention to default, the Ukraine made a special effort to tell investors that they weren't about to do the same.

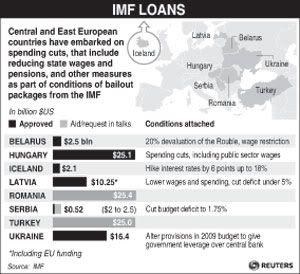

(Reuters) - Ukraine sought to calm foreign investors' fears of a sovereign default after European markets wobbled last week on the consequences of the restructuring of a syndicated loan by the state railway firm. Investors have feared a state default throughout the year as the ex-Soviet state plunged deep into recession and most recently as the International Monetary Fund suspended its $16.4 billion bailout programme.

Like Dubai, the Ukraine was in trouble because of a state-owned business. Making it a particularly difficult situation worse is a collapsing economy, which contracted at a 15.9% rate in just the last quarter, straining the ability of the government to repay its foreign debts.

The Ukraine sits near the center of most of the world's most pressing sovereign concerns - eastern Europe. Leading this group is Greece.

"As far as the bond vigilantes are concerned, the Bat-Signal is up for Greece," said Francesco Garzarelli in a Goldman Sachs client note, Tremors at the EMU Periphery.

The newly-elected Hellenic Socialists (PASOK) of George Papandreou confess that the budget deficit will be more than 12pc of GDP this year, four times the original claim of the last lot. After campaigning on extra spending, it will have to do the exact opposite. "We need to save the country from bankruptcy," he said.

Public debt in Greece is already at 100% and is expected to reach 135% by 2011. The current account deficit is over 14%. Efforts to balance this on the backs of workers has met with violent resistance.

Hungary seems to always be teetering on the edge of crisis.

With government debt totalling 80% of GDP, Hungary is most deeply in debt among the region’s countries. Therefore, it is no surprise that its 5-year CDS spread jumped 15 bp to 232 by last night, coupled with a weakening forint.

Hungary was not the only one of the region’s countries to feel the negative impact, for instance the CDS spreads of Bulgaria and Poland are the highest in 2.5 months, while Romania’s is at 3-month peak.

Hungary's economy has contracted by over 7% from last year, and is still in recession, but that is positively rosy compared to the situation in the Baltic States.

Latvia's economy contracted by 18.3 percent in the third quarter compared with the same period in 2008.

Estonia, meanwhile, posted a 2.8-percent contraction against the second quarter and 15.3 percent compared with 2008.

The price of homes in Latvia have fallen a staggering 59.7% in just the last year.

Repeated IMF bailouts in 2009 has kept many eastern European government from defaulting, but it hasn't managed to get them out of their recessions. Bulgaria's economy is shrinking at an increasing rate.

Strangely enough, the collapsing economices and falling currencies hasn't kept the stock markets of the region from booming with massive inflows of hot money.

The Ukraine's PFTS Index climbed 108 percent in the fact of a collapsing economy. Romania’s Bucharest Exchange Trading Index has risen 75 percent this year in U.S. dollar terms despite the government collapsing last month over economic concerns. Hungary’s benchmark Budapest Stock Exchange Index gained 84 percent this year.

Which, if any, of these nations will default in the coming years? It's impossible to say for certain. However, one thing is for certain, people are looking harder now and asking tougher questions.

Comments

globalization and contagion

I wrote about this quite a bit about a year ago because it disturbs me to no end to listen to these "architects" of this glorified global cheap markets/labor arbitrage and know they have absolutely no analysis, no idea, no clue....on how national economies now interact. It makes the financial sector "systemic risk" look like a minor ripple from a skipping rock during a tsunami.

Nice to write about Vietnam, which was completely overshadowed.

I think Dubai hits such a nerve because of oil and also the beyond belief, almost "tower of babel" architecture.

Lord knows the dominoes are perched.

We will see many stumbles.

Is Dubai a broken Business As Usual failure or squeezed by unexpected volatility and extreme demand?

We no longer use the term 'north vs south' but categories such as 'developed vs emerging' fail to describe 10s of 1,000s of worldwide packages that are suddenly too fragile to book, or already worthless, because too many of these are at home.

I've been thinking we must require risk and force liquidity in order to meet tremendous challenges.

what I would like to do or see

and this is beyond complex so odds are we're going to just have to overview a large analysis paper....is what are the effects globally? We know the Bank of Scotland has a lot of loans but it seems we do not know what's off the books and more odious, exactly what the total CDSes are as well as other MBS derivatives. Then, in terms of a sovereign default...I have no idea what that means and despite the claims in the major press that Abu Dhabi is just going to bail them out, then we read "case by case basis" to

more of a "kiss our ass" we're not going to do anything.

this post on The Big Picture has some information

Has some graphs and more technicals from timeline last year

First credit crisis since March Market Recovery.

Western Europe

I'm surprised that none of you guys said, "Hey, what about Britain, Ireland, and Spain?"

The reason I didn't include them in this list isn't because they are any less insolvent than Greece or the Ukraine. Within a year or two Britain's public debt levels will rivals Greece's. Spain's private debt levels are crushing. It's because they have more access to liquidity. For some reason the markets trust western Europe more.

Spain

I read something about them doing public works projects and then the claim "that won't help the 20% unemployment rate".

I'm more worried about a domino or contagion, originating from Dubai moving to Greece, Ukraine then hitting U.K and so on. I posted in that BoA warning the Bank of Scotland has a lot of exposure, but the real question to me is derivatives. Beyond basis points for CDSes, I cannot find any intel on it. MBS backed CDOs and so on.

Dubai government refuses to stand behind Dubai World

Looks like someone is going to be taking some serious losses.

The UAE central bank has stepped up and agreed to provide liquidity, which relieves short-term pressure on the markets, but that doesn't solve the problem of insolvency.

Morgan Stanley fears UK sovereign debt crisis in 2010

If this happens we could easily see a repeat of the Great Depression.

Rising interest rates on an already massive overhang of debt would cause a debt spiral, and eventual default.

uh, that would do 'er

and I was thinking of moving to the U.K. because they are so much cooler, worker friendly than the U.S....oops!

This is actually a pretty significant claim...

although JP Morgan Chase also is now fighting derivatives reforms tooth and nail because the poor darlin's are gonna lost $3B.

So, are they doing some alt. agenda or is this real? Seriously, sovereign default is pretty black swan, although obviously lately, just a wee bit more probable.

Greece is "Five minutes to Midnight"

What the future holds for the Euro and the European Union could be decided in the coming months.

This should be an Instapopulist

For this is the theory on sovereign default, first Greece, then Ukraine ( as I recall) plus Dubai is sitting around with a host of unknowns, trying to bury what's going on there to not cause global panic and then.....the domino theory is next, the U.K....at which point we assuredly would have global contagion.

Also, Gold is crashing and burning. Now you know I'm agnostic on the gold bug situation. That said, Roubini just called gold bugs financial spam and said it's just a big hype bubble because underlying conditions to justify gold inflation do not exist.

My thing on Gold is more "can I make a couple of bucks off of this" instead of believing financial Armageddon is around the corner.

But obviously the probability of global contagion changes that entire view! What is the probability here, really, let's get real on it, of a sovereign default domino happening causing global contagion?

Speaking of the Ukraine

This just came in today.

Ukraine turned to the IMF back in 2008, and recieved $11 billion of a $16 billion loan. However, the IMF suspended the rest of the loan because the Ukraine hasn't implemented its austerity programs yet.

What we are seeing is a slow-motion crisis that is gradually approaching the center. I believe it is because the dominant neoliberal economic school of thought in the world is f*cked up.

I'm trying to wrap my mind around it, but I'm not educated enough yet. I've been reading a lot of Michael Hudson recently.

As for gold, its correcting just like I expected. My target price is around $1040, although it might go a little lower.

more on gold

My target is $1034 and then I think it's going to take off. I didn't read all of Dr. Doom, but my impression was he doesn't believe inflation is an issue or the dollar to suddenly tank either, as well as debt. I see it differently. I see other nations attempting to decouple somewhat from the U.S. economy, reserve currency of the dollar. Maybe I'm wrong, hence I'm playing it fairly conservatively.

On contagion, it's quite a nasty study since seemingly no one knows but if you digest Hudson and some others, I hope you write it up.