The Federal Reserve's consumer credit report for September 2016 shows a 6.3% annualized monthly increase in consumer credit, and 7.0% for the entire third quarter. Revolving credit increased 5.2% for the month as well as Q3,. Non-revolving credit increased 7.4% for September and 7.6% for Q3. Consumer credit matters due to personal consumption being the driving force in economic growth.

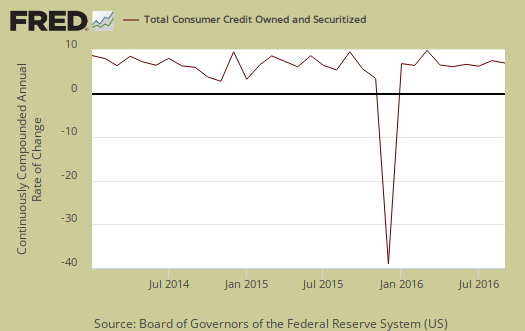

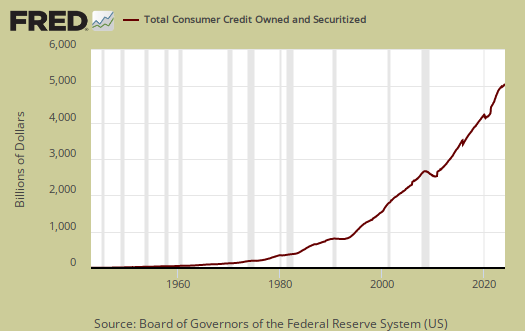

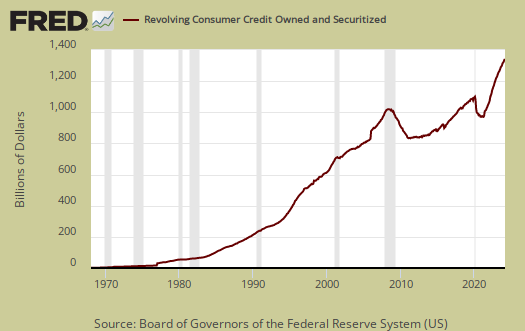

Revolving credit are things like credit cards and non-revolving are things like auto loans and student loans. Mortgages, home equity loans and other loans associated with real estate are not included in this report. Overall consumer credit increased $19.3 billion dollars to $3,706.8 billion, seasonally adjusted. Revolving credit rose by $4.2 billion to $978.8 billion while non-revolving credit jumped up by $15.1 billion to a whopping $2,728.0 billion. The report gives percent changes in simple annualized rates, also known as a continuously compounded annualized rate of change. Consumer credit contractions correlate to recessions. The consumer credit report does not include charge offs and delinquencies. Graphed below is total consumer credit.

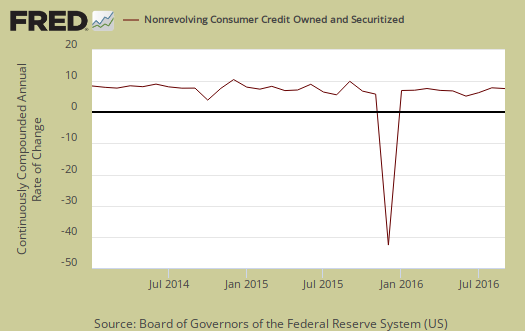

To get a feel for how much of non-revolving credit was student loans, unfortunately we must deal with not seasonally adjusted data for the report does not break down credit reported with seasonal adjustments. Not seasonally adjusted non-revolving credit increased $20.9 billion. Subtracting the not seasonally adjusted Federal Government non-revolving credit, which primarily is student loans, we get a $6.7 billion increase in non-revolving loan debt. There was a $14.2 billion increase in Federal Government non-revolving credit, so sans seasonal adjustments, once again consumer credit was driven by student loans. Below is non-revolving credit, seasonally adjusted, annualized percentage change.

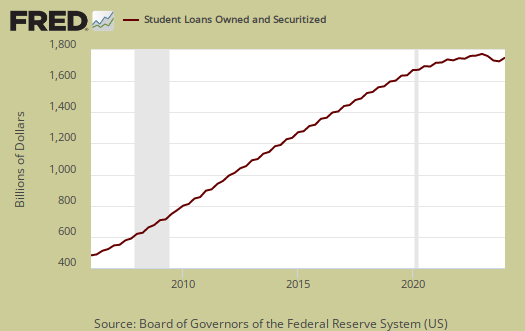

Federal government non-revolving consumer credit includes loans originated by the Department of Education under the Federal Direct Loan Program, as well as Federal Family Education Program loans that the government purchased from depository institutions and finance companies. In other words, Federal government non-resolving credit is student loans. Student loans just hit a record $1,396.3 billion.

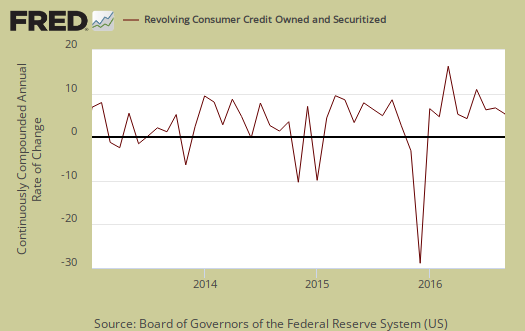

Revolving credit, which is mainly credit cards, continues to increase and is now close to levels of the great credit bubble before the financial crisis. For the month revolving credit rose by $4.2 billion. Charge offs are not included in this report.

Graphed below is the monthly revolving consumer credit annualized percentage change. Credit card use and high balances imply people are using high interest debt to make ends meet.

Student loans and auto loans together are at another all time high of $2494.4 billion and auto loans by themselves are $1.1 trillion. That's an amazing amount of debt. Since student loans are so high a primary lender is now the U.S. government. Don't expect tuition to decrease as the results of election 2016 are coming to light. Most in the press will equate the increase in consumer credit as a boon to the economy. As we can see student loans pay for tuition, which does go into personal consumption expenditures and thus GDP, yet somehow overpriced tuition and future debt slaves doesn't sound like a great trade off.

Recent comments