The Federal Reserve's consumer credit report for January 2012 shows a 8.6% monthly increase in consumer credit. Revolving credit decreased, -4.4%, and nonrevolving credit surged 14.7%. The Credit Kraken is clearly on a rampage, for the third month is a row, mainly on the backs of people going to school.

Overall consumer credit increased $17.8 billion dollars to $2512.3 billion. Revolving credit decreased $2.9 billion while non-revolving increased $20.7 billion, the largest amount since November 2001. Total consumer credit is now $2.51 trillion, seasonally adjusted. Revolving credit are things like credit cards and non-revolving are things like auto loans and student loans. Mortgages are not included in this report.

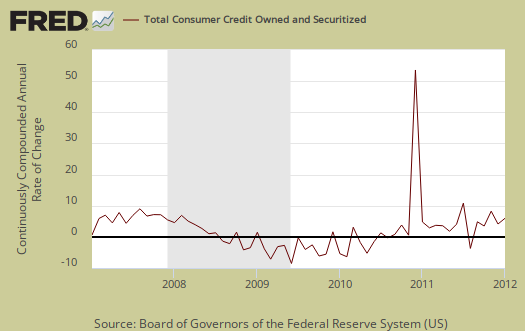

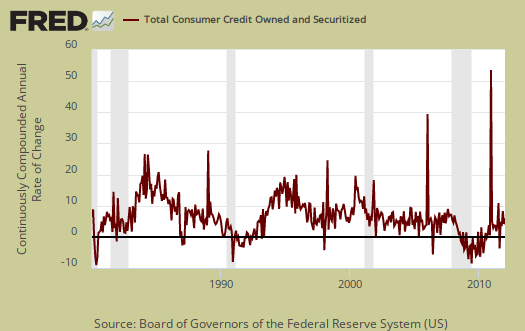

The report gives percent changes in simple annualized rates, also known as a continuously compounded annualized rate of change. To put this change in perspective, at simple annualized rates, consumer credit increased almost to this level in the last 10 years. Consumer credit, annualized, increased 9.3%, in September 2004, 9.2% in October 2004, 9.2% in February 2002 and 18.2% in November 2001. Below is the graph of the monthly annualized percentage changes in consumer credit going back to 1980.

From the above graph we can see outstanding consumer credit drops correlate to recessions. This report does not include charge offs and delinquencies, which hit another record low in January:

In January, US credit card charge-offs declined to 4.98%, the lowest level since November 2007, according to Moody's Credit Card Indices. Early-stage delinquencies also fell to new record lows, pointing to further declines in charge-offs in the months ahead.

The delinquency rate rose slightly by two basis points in January, to 2.93%, after declining to the lowest level in the 23-plus year history of Moody's Credit Card indices last month. However, early-stage delinquencies at the Big 6 trusts were flat or even lower, with the index down by three basis points from December 2011, setting another all-time low.

Below is total consumer credit.

The increase was due to student loans. Federal government nonrevolving credit, which includes student loans increased another $27.9 billion to $453.0 billion, not seasonally adjusted. Tuition has soared this fall, 8.3% at public colleges alone. The federal government started making 100% of guaranteed student loans in July 2010. People went more into debt, clearly, to pay for the soaring, absurdly high, educational costs. These are aggregates, but it's doubtful that the U.S. population entering into college is directly proportional to these monthly increases. In other words, it's because school is absurdly expensive, not because magically all decided to go back to school. Additionally, student loans do not provide much economic stimulus as most of the funds go directly to tuition.

Below is non-revolving credit, seasonally adjusted, annualized percentage change. This is the biggest monthly increase in nonrevolving credit since November 2001. Taking away the government loans, total non-revolving credit increased $5 billion, clearly not a record breaker for auto loans, boats, trailers, mobile homes and vacations.

Revolving credit, think credit cards, are down for January. Below is revolving credit, raw totals. Charge offs are not included in this report. These numbers are seasonally adjusted.

Other press claimed the increase is due to a better economy. Sorry folks, people don't go into more debt unless they have to, although offering up more debt implies banks think people can pay it back. Students who have reasonable tuition and can get part-time jobs don't go into absurdly high debt. Parents who have careers and savings to help their kids pay for college don't go into debt either.

Here is last month's consumer credit overview, unrevised. December was clearly significantly revised, overall consumer credit was revised to 7.9% from 9.3%. While annualized rates can swing dramatically, that's quite a revision.

Recent comments