Chicago Fed National Activity Index was released today and the headlines will surely blare that the economy is moving towards pre-recessionary levels.

Myself, I want to amplify there are two indexes, the first is this months national economic activity index and then the CFNAI-MA3, which is a 3 month moving average of the CFNAI. The monthly index has statistical noise, so the moving average is the number cited.

The September 2009 3 month moving average implies economic recovery. Anything above -0.70 is good.

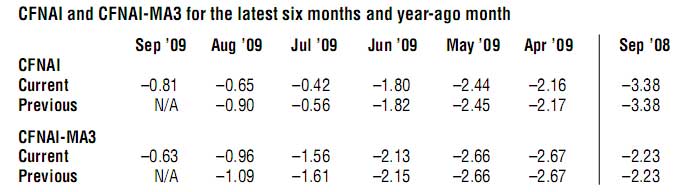

At –0.63 in September (up from –0.96 in the previous month), the index’s three-month moving average, CFNAI-MA3, suggests that growth in national economic activity was below its historical trend. However, the CFNAI-MA3 in September improved to a level greater than –0.7 for the first time since the early months of this recession. For the four previous recessions, the frst month when the CFNAI-MA3 was above –0.7 coincided closely with the end of each recession as eventually determined by the National Bureau of Economic Research.

That said, here are the actual numbers:

Notice the decrease in economic activity for both the months of August and September.

If October's CFNAI is below -65, the moving average, CFNAI-MA3, will drop below -70.0, which would indicate a recessionary economic trend.

Also note the raw numbers in the above image. While these numbers are not the rah, rah cheer lead, they no doubt will be spun into, one cannot argue we have a huge improvement from September of last year!

Recent comments